-

Zions Bancorp. appears to have found a novel approach to escape the added requirements for banks above the Dodd-Frank Act's systemic $50 billion asset threshold, but other banks in a similar position are more likely to wait for Congress to address the issue rather than following suit.

November 20 -

The $65 billion-asset company intends to shed its holding company and then will petition regulators to reconsider its designation as a systemically important financial institution.

November 20 -

Franklin Codel reportedly made “disparaging remarks” about regulators; Zions may seek to have “too big to fail” label removed.

November 20 -

The Treasury Department outlined its vision Friday for how and when federal agencies should use their powers to subject nonbanks to enhanced regulatory scrutiny, emphasizing activities over individual firms.

November 17 -

Mnuchin’s former business associate is likely to be sworn in next week; Mulvaney, as a congressman, called the CFPB a “joke” and co-sponsored a bill to kill it.

November 17 -

The differences in business model between commercial banks and universal banks should not be ignored as Congress works to recalibrate the regulatory regime.

November 16 -

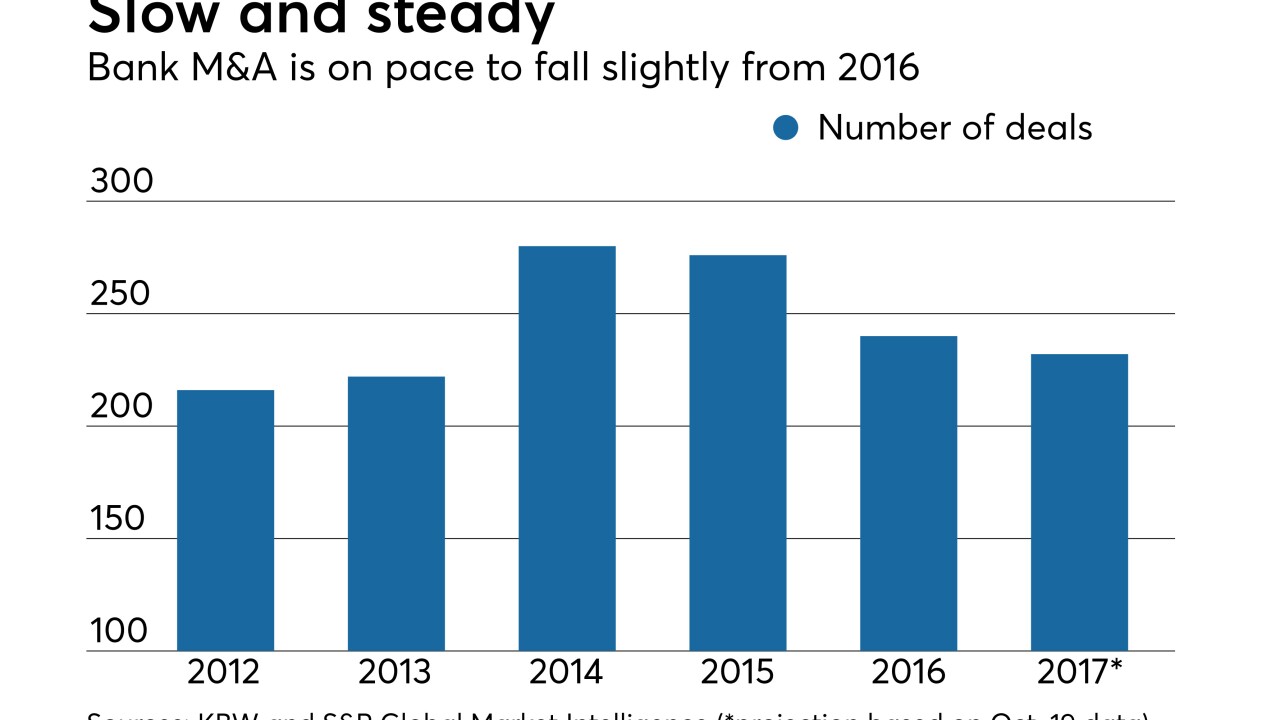

Freeing a number of big banks from enhanced oversight, including capital requirements, could motivate CEOs to pursue deals. Still, other impediments could prevent a flood of large mergers.

November 14 -

Federal Deposit Insurance Corp. Chairman Martin Gruenberg on Tuesday opposed efforts to roll back “core reforms” to bank regulation that were implemented after the 2008 financial crisis, but said some review of the Dodd-Frank law is warranted.

November 14 -

Bipartisan proposal would remove the SIFI label from more than two dozen banks; European regulator cautions investors on the risks as bitcoin price plunges.

November 14 -

The authority of the Financial Stability Oversight Council to label a firm a “systemically important financial institution” triggers duplicative regulation even if banklike rules are not appropriate to the company.

November 9 Johnson Smick International Inc.

Johnson Smick International Inc. -

Discussions on a regulatory relief package between the top Democrat and Republican on the Senate Banking Committee broke down late Tuesday, but members from both parties remain hopeful they can reach a bipartisan deal.

November 1 -

Discussions on a regulatory relief package between the top Democrat and Republican on the Senate Banking Committee broke down late Tuesday, but members from both parties remain hopeful they can reach a bipartisan deal.

November 1 -

It's been a decent year for banks, especially given the industry's return on assets hit a 10-year high. But there are signs it might not last. With Halloween near, here is a look at some potentially frightening developments that could keep bankers up at night.

October 29 -

Momentum is building to replace the hard-target $50 billion asset systemic risk threshold for banks with an indicator test, but it remains unclear whether it will be enough to get Congress to act.

October 27 -

If Congress changes the $50 billion-asset threshold for systemically important financial institutions, big banks could take it as a signal that regulators would be amenable to larger deals.

October 26 -

The Dodd-Frank Act’s $50 billion threshold for determining which banks are systemically important should be scrapped and replaced with an indicator test, according to the Office of Financial Research.

October 26 -

Top executives at nineteen regional banks sent a letter to the Senate Banking Committee endorsing a bill that would change the systemically important financial institution threshold from $50 billion in assets to an indicator test.

October 23 -

The Connecticut company, which is nearing the threshold to become a systemically important financial institution, has bought three businesses in the past year.

October 19 -

Senate lawmakers will soon introduce a bill that could more than quadruple the current $50 billion threshold to be considered a systemically important bank, National Economic Council Director Gary Cohn said Monday.

October 16 -

With issuance of marketplace securitizations now exploding — rising 300% cumulatively in the past two years — the idea of online lending as a niche is quickly deteriorating.

October 13