Small business banking

Small business banking

-

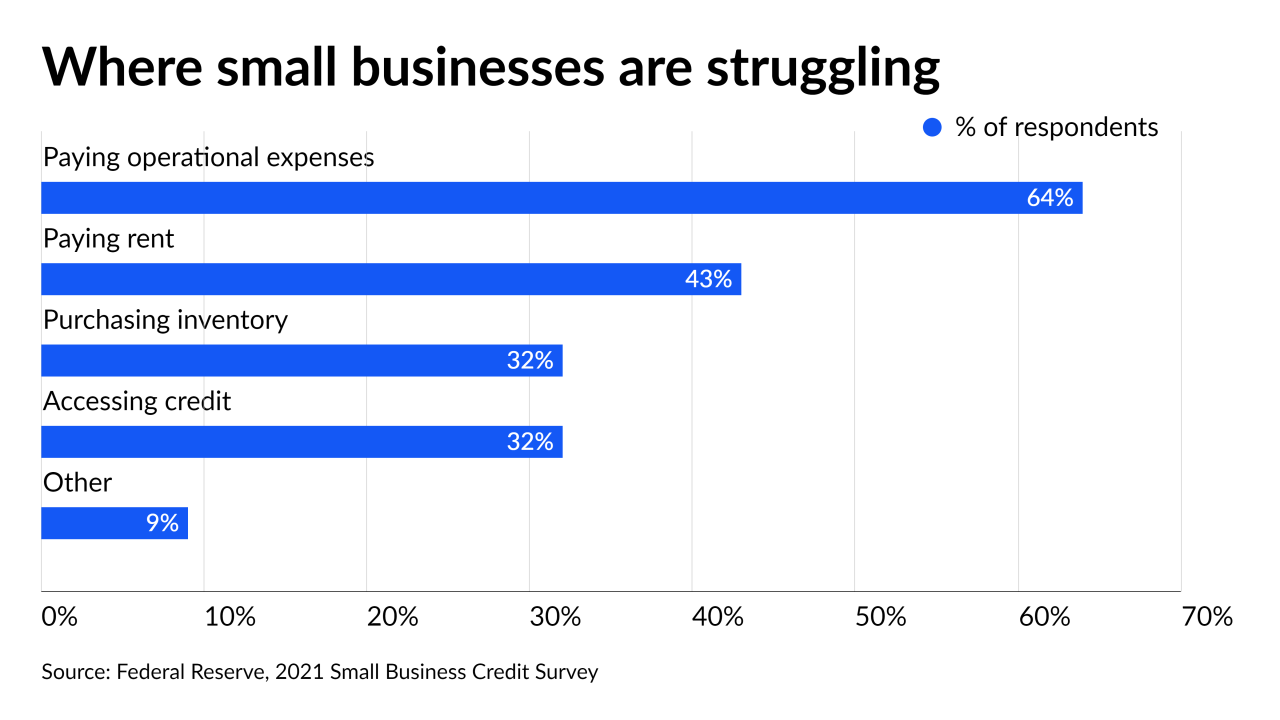

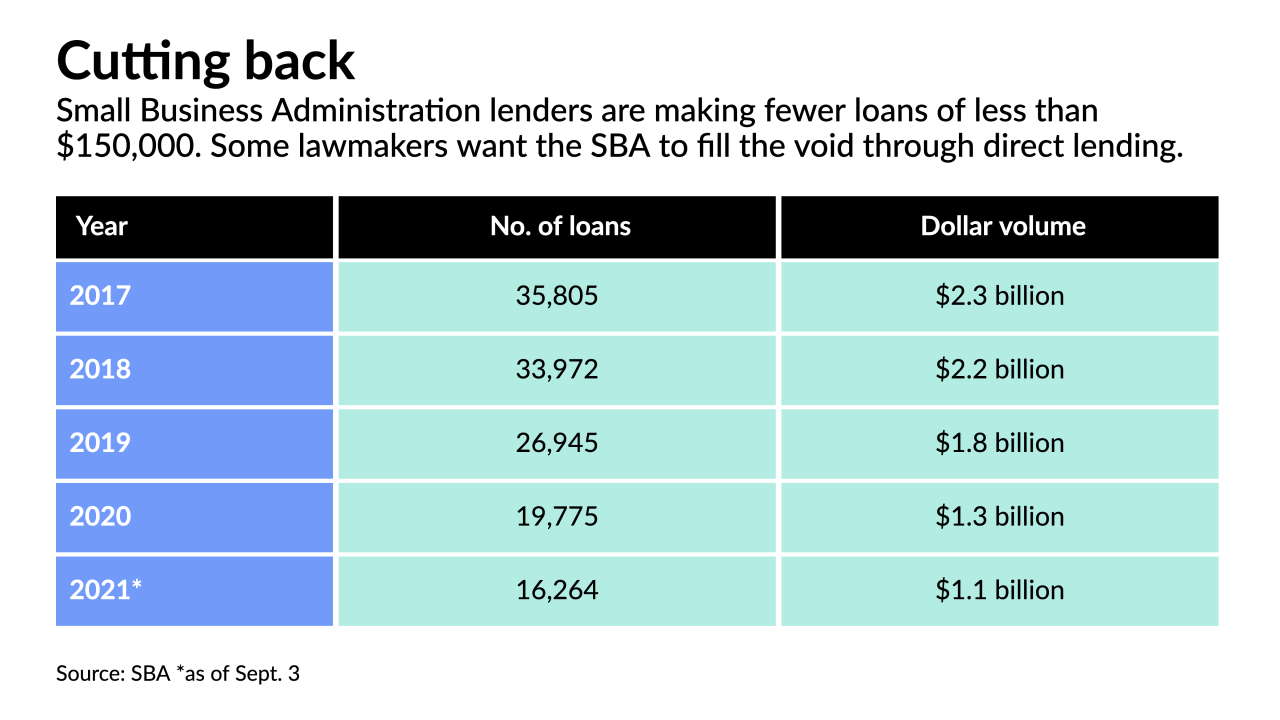

A new proposal to allow the Small Business Administration to offer credit directly would pull customers away from community lenders, writes the head of a credit union trade group.

November 5 -

Despite some bumps in the early days of the Paycheck Protection Program, small businesses report that they had positive experiences with lenders. Savvy banks are channeling the good vibes to generate more revenue from a sector that has sometimes been overlooked.

November 4 -

Digital upstarts like Square, Stripe and PayPal are invading community banks' turf by appealing to local merchants with a mix of electronic payments and lending. Small banks are fighting back by leaning into digital services while maintaining their personal touch.

November 3 -

Collaborations among rival banks and fintechs can be mutually beneficial, Vanessa Colella says. A recent example is a small-business loan portal Citi created that other banks can use.

October 27 -

The head of personal and business banking is on a mission to help Americans become better savers.

October 6 -

The White House and key lawmakers want to allocate $4.5 billion for smaller 7(a) loans that would be made by the Small Business Administration. The financial services industry says the government should collaborate with the private sector rather than compete with it.

September 15 -

Bankers worry the proposed reporting requirements on small-business loans will be used to shame lenders for neglecting minority-owned firms. Community groups are already preparing to use the data to point out racial disparities.

September 12 -

A new service offered by the company helps clients automatically capture payment and invoice information as well as make sure the data matches.

September 8 -

The North Carolina bank says the new system, which took one year to implement, will make it easier to compete with challenger banks and customize digital banking services for doctors' offices, dental practices and other small businesses.

September 7