-

The demonstrations following George Floyd's death in police custody are forcing the industry to grapple with how it can — or if it should —advocate for equality and better race relations.

June 4 -

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

Bankers spent Monday cleaning up damaged branches, wondering if their small-business clients will need more emergency aid and contemplating how the racial and economic inequalities highlighted by days of violent protests nationwide can be corrected.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

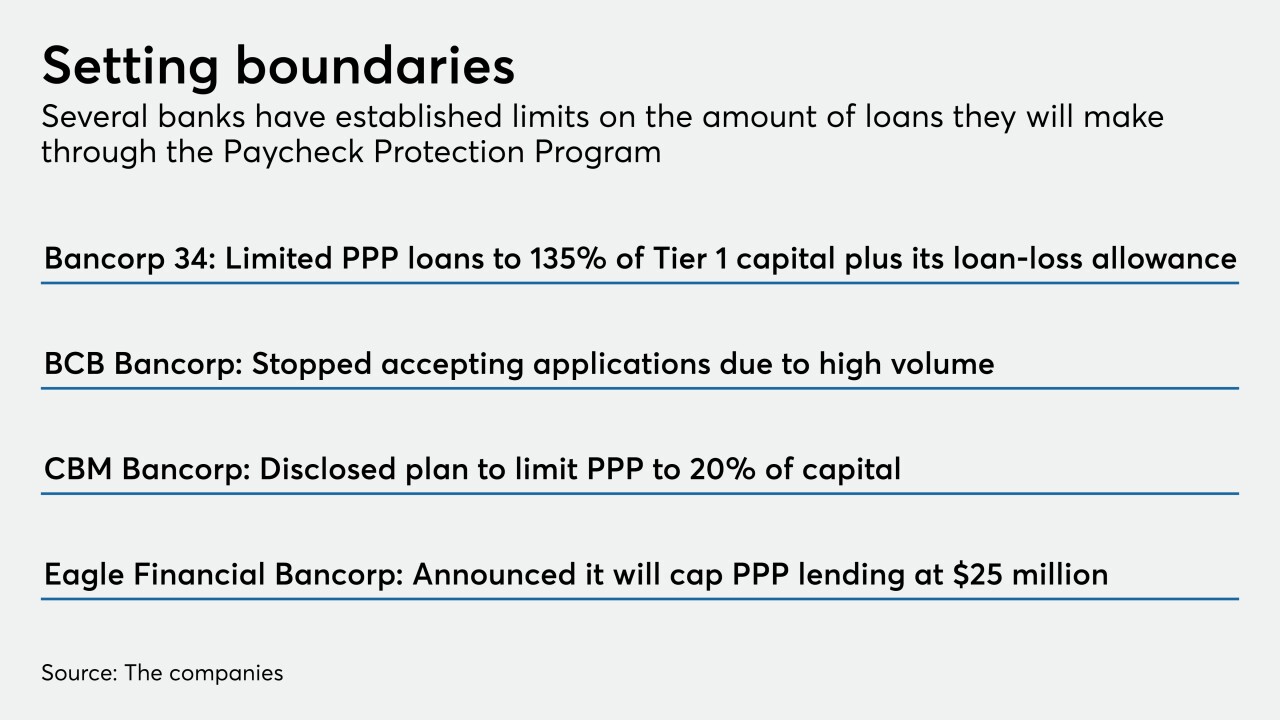

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

The website, ppp.bank, will help borrowers in the Paycheck Protection Program apply for loan forgiveness.

May 28 -

The Federal Reserve Bank of Boston published details on the terms for lenders and borrowers to participate in the facility intended to provide coronavirus relief funds to middle-market firms.

May 28 -

The measure, which garnered near-unanimous support, would triple the period during which businesses can spend their coronavirus relief funds and make it easier for loans to be forgiven.

May 28 -

Expenses soared in the rush to deploy emergency loans to small businesses, and now Bank of America may need to delay some investments if it hopes to meet cost targets, CEO Brian Moynihan said.

May 27 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

May 27 FS Vector

FS Vector -

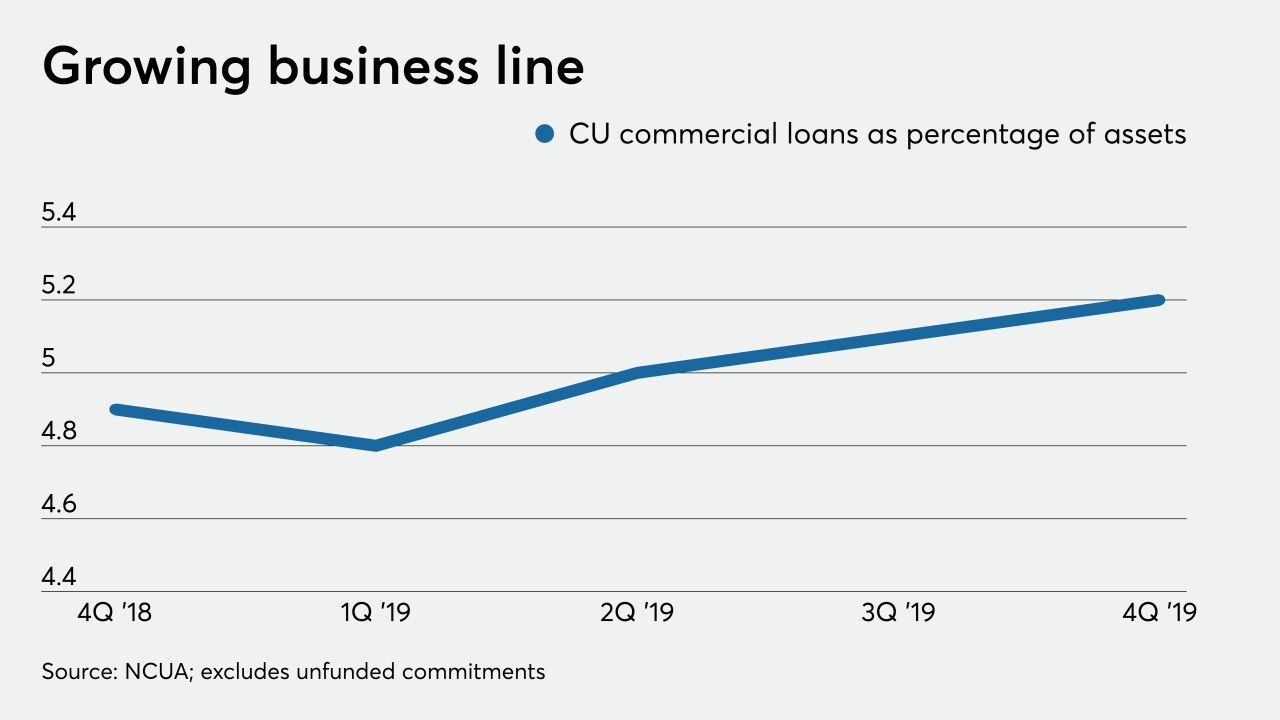

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Federal Reserve Bank of Boston President Eric Rosengren said he expects companies to begin receiving money through the central bank's long-awaited Main Street Lending Program within two weeks.

May 24 -

The new Paycheck Protection Program rules, which created a review process and timeline for paying lenders, did not extend the time borrowers have to comply or increase how much money can be spent nonpayroll expenses.

May 24 -

Companies that received funding from the Paycheck Protection Program in early April can start to submit forgiveness applications at the end of May.

May 22 -

A Manhattan man was charged by federal prosecutors with fraudulently trying to obtain more than $20 million in government loans intended to aid small businesses affected by the coronavirus pandemic.

May 21 -

The Federal Reserve received a bipartisan critique Wednesday from members of a congressional oversight panel who said the central bank has been slow to launch a key emergency lending program for midsize companies.

May 21 -

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

May 21 JPMorgan Chase & Co.

JPMorgan Chase & Co. -

The sellers will continue to service the loans and retain the fees they receive from the Small Business Administration.

May 20