-

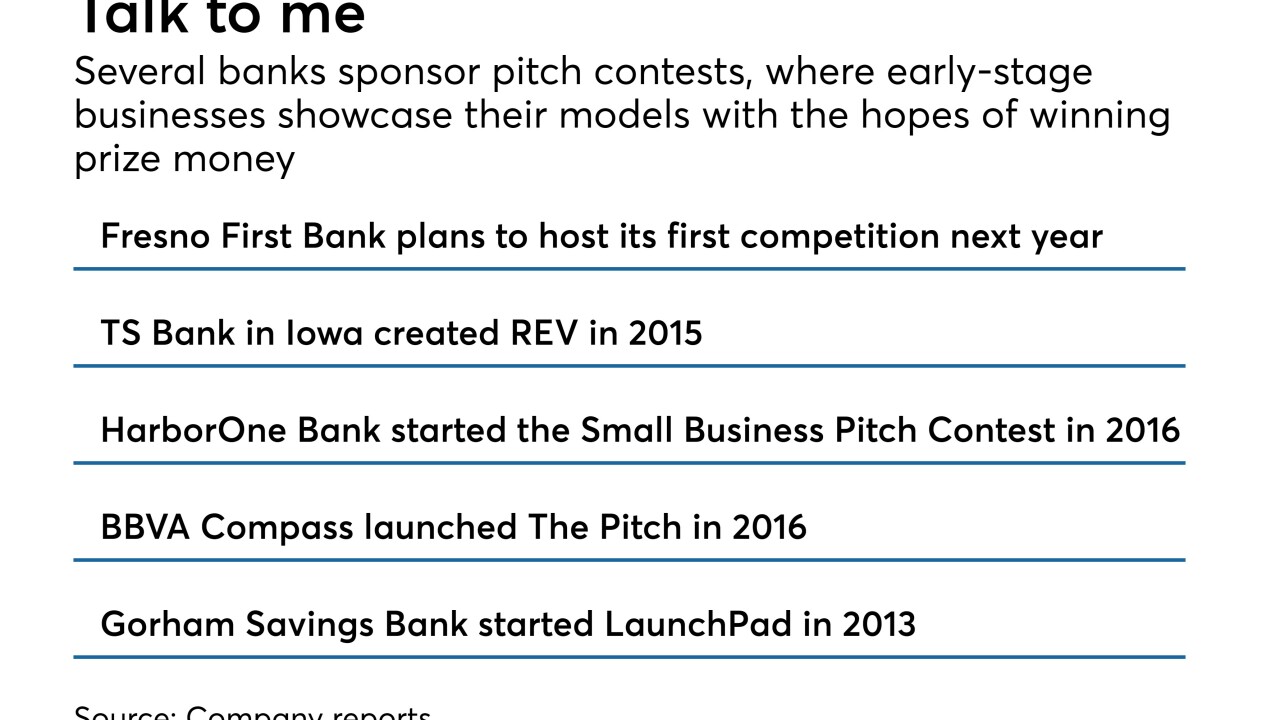

Sponsoring so-called pitch competitions helps lenders gain Community Reinvestment Act credit and gather deposits.

June 28 -

A number of banks are upgrading technology and hiring more lenders to better reach small-business owners, who are becoming more confident in their outlooks.

June 27 -

Denver-based P2Binvestor plans to use the new funds to expand its bank partnership program.

June 21 -

The explosion in construction of self-storage facilities is being backed by banks hungry for commercial loans. Some market participants fear a glut is in the making and the credits could sour.

June 20 -

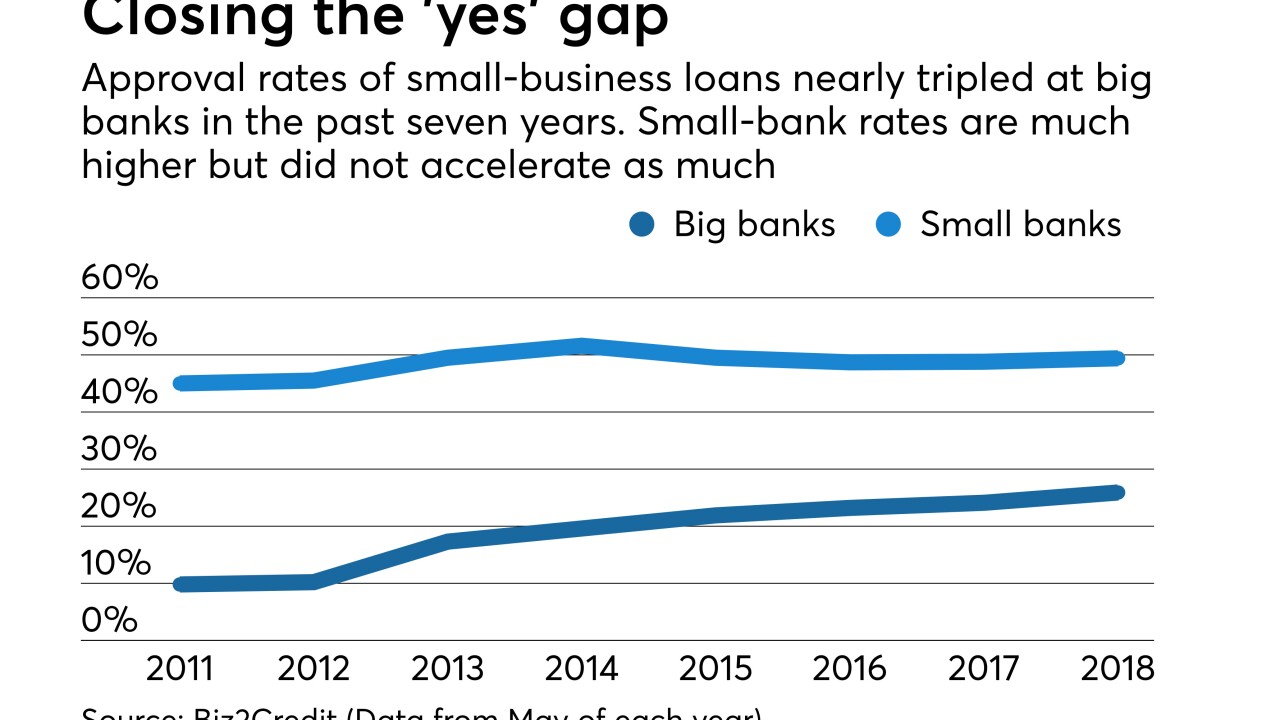

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

A bill moving through the California Legislature seeks to tame the largely unregulated world of online small-business lending. If passed, it would be the first of its kind nationally, but so far it has failed to satisfy either the industry or its critics.

June 12 -

Live Oak is the latest bank to jump into this niche lending area. But some warn they are beginning to see cracks in credit quality.

June 7 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

The bill is one of two SBA-related measures the Senate approved late Tuesday and sent to President Trump to sign into law.

June 6 -

Credit unions in Tennessee and Ohio were singled out by the U.S. Small Business Association.

June 4 -

The numbers are better but still disappointing for such a healthy economy, lamented executives from large U.S. banks. Some are scratching their heads, some are remaining upbeat about the second half of the year, and others are focusing on Plan B.

May 30 -

For many borrowers, near-guaranteed approvals and faster turnaround times are more important than the lower rates offered by banks and credit unions.

May 22 -

Seacoast in Florida slashed the time it took to make 7(a) loans within months after establishing a partnership with an online lending startup.

May 22 -

Acting CFPB Director Mick Mulvaney has dropped agency plans to crack down on overdraft programs and large marketplace lenders. Here's what else he's changing.

May 16 -

The legislation, which still needs Senate approval, would let the head of the Small Business Administration raise the program's cap in periods of heavy demand.

May 8 -

The online business lender would have reported its second straight quarterly profit if not for one-time costs tied to layoffs and lease terminations.

May 8 -

Using Orchard’s data science smarts, Kabbage intends to offer new payment products to small businesses and loan portfolio insights to financial institution partners.

April 26 -

An SBA watchdog's investigation into chicken farms may ensnare other small businesses.

April 18 -

New Resource Bank and P2Bi are splitting the risk and revenue associated with asset-based loans.

April 16 -

Expanding SBA funding and providing additional Community Reinvestment Act credit could help boost female entrepreneurs.

April 16 Invest in Women Entrepreneurs Initiative

Invest in Women Entrepreneurs Initiative