-

NorthOne's U.S. launch joins other app providers hoping to attract entrepreneurs and freelancers with features such as real-time insights into cash flow.

August 30 -

Lawmakers and others faulted the agency's foot-dragging on approving licenses and funding requests for small-business investment companies, whose owners include banks.

August 7 -

A fight between Democrats and Republicans over a proposal to let the SBA’s Office of Advocacy challenge rulings made by other government agencies is threatening to hold up funding for small-business loan guarantees.

August 2 -

The new accounting standard meant for publicly traded firms creates greater headaches for privately held community banks.

July 29 Bank of St. Elizabeth

Bank of St. Elizabeth -

Finding a fast and easy way to receive payments remains a top priority for these businesses. And yet, they are frequently left out of the industry’s faster payments conversation, writes Steve Robert, co-founder and CEO of Autobooks.

July 11 Autobooks

Autobooks -

U.K.-based small business lender Capital on Tap has partnered with small business software provider Receipt Bank to launch a new credit card with access to credit lines.

July 8 -

The $2.1 billion-asset CU is working with Local First Arizona and State Forty Eight to encourage consumers to patronize area businesses.

June 27 -

Fears are growing that the rapid rise in fee-charging ATMs could have catastrophic consequences for the U.K.’s fragile SME market, with major supermarkets and card networks predicted to be the biggest beneficiaries.

May 21 -

Azlo will offer customers the ability to apply for a Kabbage loan through a new program called Mission Street Capital.

May 16 -

Once banks offer digital invoice processing and order approvals, small businesses would no longer need to manage the risk and hassle of paper-based transactions, argues Erik De Kroon, CEO and co-founder of Yordex.

May 15 Yordex

Yordex -

Banks are not providing enough visibility into payments and cash flow to aid small businesses' decision-making, writes Erik De Kroon, CEO and co-founder of Yordex.

May 9 Yordex

Yordex -

There are emerging payment innovations and strategies, such as card controls and online payment technology and analysis, that can help banks and other financial institutions connect with small businesses, writes Erik De Kroon, CEO and co-founder of Yordex.

May 6 Yordex

Yordex -

Here are seven startups that received multimillion-dollar venture capital investments in recent weeks to accelerate the development of banking products and services.

May 1 -

Payments platform BizPayO is launching an online cash flow tool it says will help small and medium-size business owners tackle what amounts to a $3 trillion late-payment problem annually that undermines operations.

May 1 -

Alternative providers like courting new banks. De novos like the modern features many alternative providers offer upfront.

April 18 -

Gail Jansen, who oversees member business lending at Kinecta Federal Credit Union, warned that increasing fees for Small Business Administration loans would hurt borrowers.

April 11 -

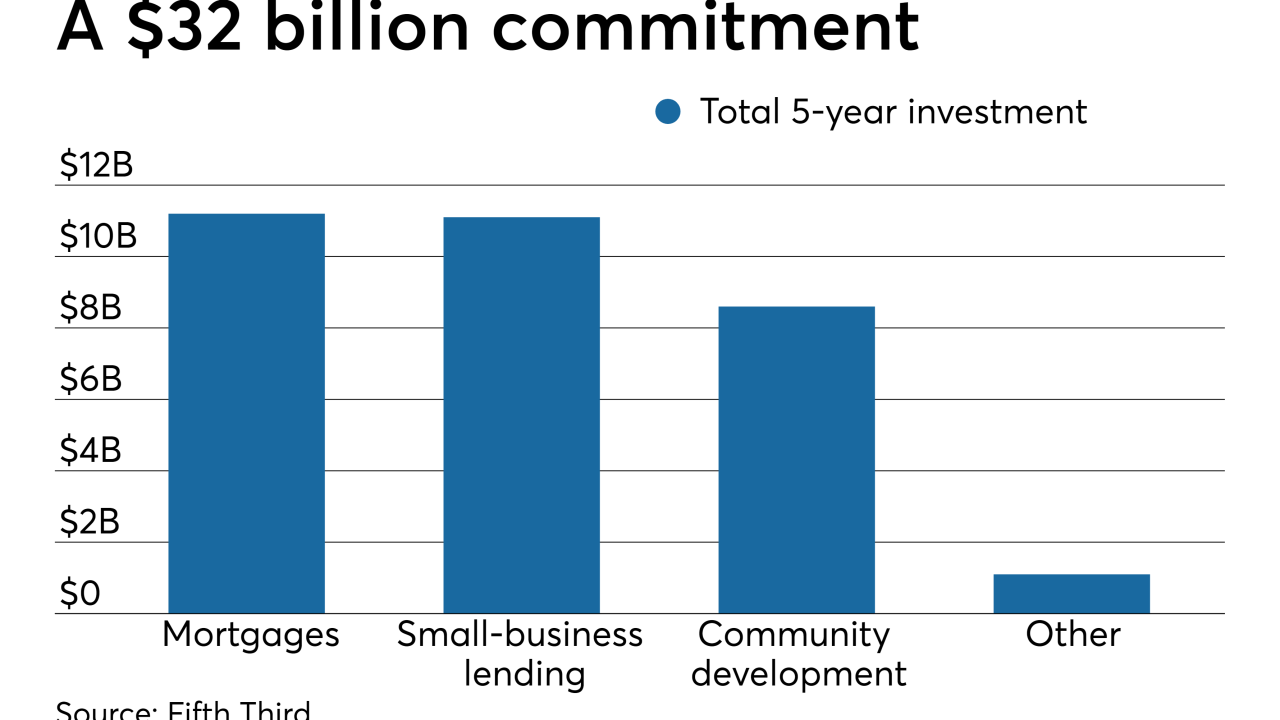

The bank is pledging to lend another $2 billion in a market where it has invested $3.6 billion in various community development initiatives since 2016. Most of the new funds will be used to make loans to small businesses that operate in low- and moderate-income neighborhoods.

April 5 -

Lenders argue that the move is premature, citing record-low charge-offs in the agency's 7(a) program.

April 3 -

Linda McMahon is planning to step down from leading the Small Business Administration to help raise money for President Donald Trump’s re-election campaign, according to people familiar with the matter.

March 29 -

As more national banks leave smaller communities and focus on large customers, fintechs are creating an "Uber effect" with an easier experience. Small businesses are increasingly looking to borrow money and fund their growth initiatives, and need a partner who can deliver, argues William Phelan, president of PayNet.

March 28 PayNet, an Equifax company

PayNet, an Equifax company