-

Credit card balances declined most sharply as consumers cut back their spending due to the coronavirus pandemic and associated shutdown orders, the New York Fed said Thursday. But delinquencies also fell across all debt categories, thanks to government and lender relief efforts.

August 6 -

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23 -

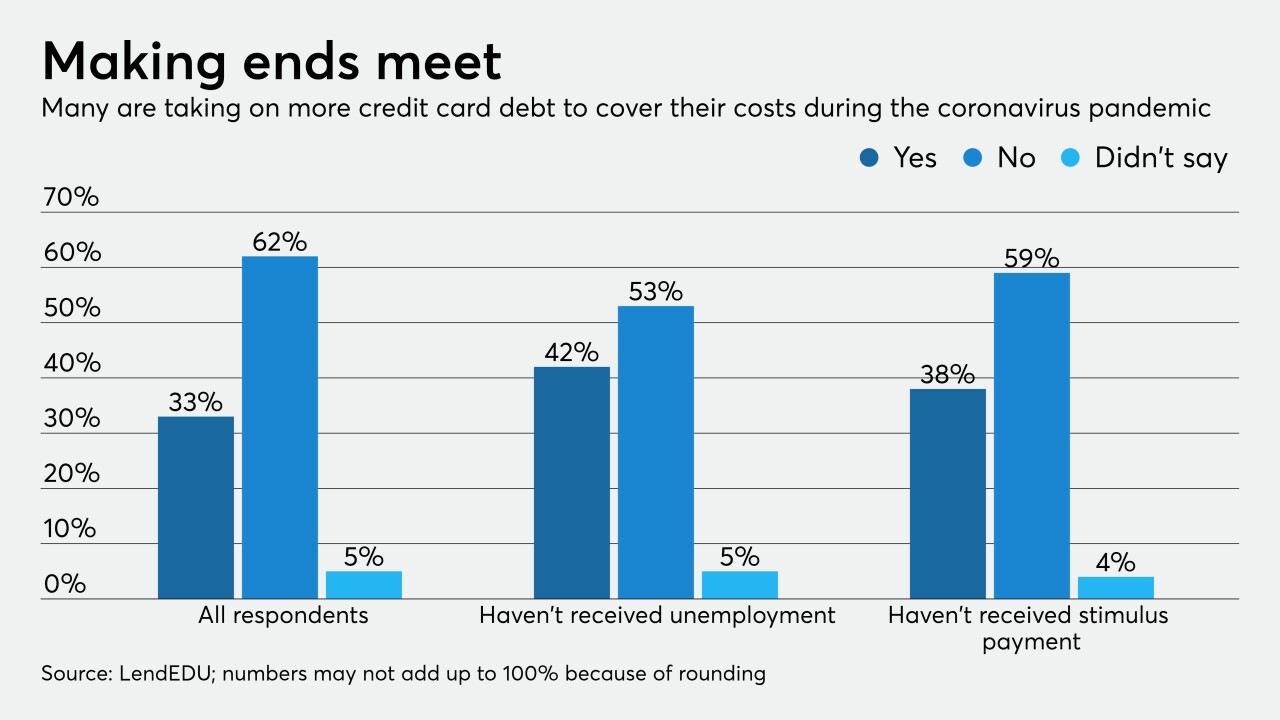

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

As universities move classes online, there are signs enrollment could be down in the coming academic year. That could have a major impact on credit unions’ private student loan portfolios.

April 15 -

Proposed reforms to the Community Reinvestment Act focus on everything but bank products that promote higher education. It’s time to change that.

February 12 Community Bank Consulting Services

Community Bank Consulting Services -

Bankers groups are keeping close tabs on a host of legislative and gubernatorial proposals, from prize-linked savings accounts in Iowa to rent control in Massachusetts to a slew of bills modeled after California's recently passed data privacy law.

February 11 -

Depending on one's perspective, the surge in consumer borrowing is either a normal byproduct of a booming economy or a worrisome trend that portends a wave of delinquencies when the next downturn hits.

February 11 -

The two agencies said they will exchange student loan complaint data after their information-sharing efforts had been in limbo for over two years.

February 3 -

The proposal announced Tuesday is aimed at attracting younger voters.

January 14 -

Democracy Forward filed the lawsuit Monday against the consumer bureau, Director Kathy Kraninger, the U.S. Department of Education and Education Secretary Betsy DeVos.

November 25 -

Several proposals in Congress requiring clear disclosures on student loans could help lower defaults.

November 20 College Ave Student Loans

College Ave Student Loans -

Politicians' grand plans to reform the college funding process won't come to fruition anytime soon, so credit unions shouldn't ignore the opportunties presented by student lending.

November 8

-

Digit is applying its automated-savings techniques to the growing problem of student loan debt.

October 31 -

A poll from AmOne indicates consumers aren't optimistic about their prospects for retirement.

October 23 -

In her second day of congressional testimony, Kathy Kraninger took heat from Senate Democrats for weighing in on constitutional questions about her agency and for her enforcement track record.

October 17 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 2 -

Readers react to plans by Democratic presidential candidates to reform college tuition, credit unions buying more banks, whether the next president could fire the CFPB head and more.

September 19 -

The CEOs of Sallie Mae and Discover Financial Services were largely dismissive this week of the threat posed by the two Democratic presidential candidates, though their optimism seemed to be rooted in an assumption that the more sweeping proposals will never become law.

September 12 -

The proposal's aim is to ensure borrowers are treated fairly and would require companies, including CUSOs, to submit licensing applications.

August 30