-

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

The student loan company had said a three-year-old lawsuit alleging consumer abuses was superseded by a similar CFPB suit. Here’s why the 3rd U.S. Circuit Court of Appeals disagreed.

July 27 -

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

Wells Fargo is pulling back from student lending as the surge in coronavirus cases threatens to further disrupt higher education and the broader U.S. economy.

July 2 -

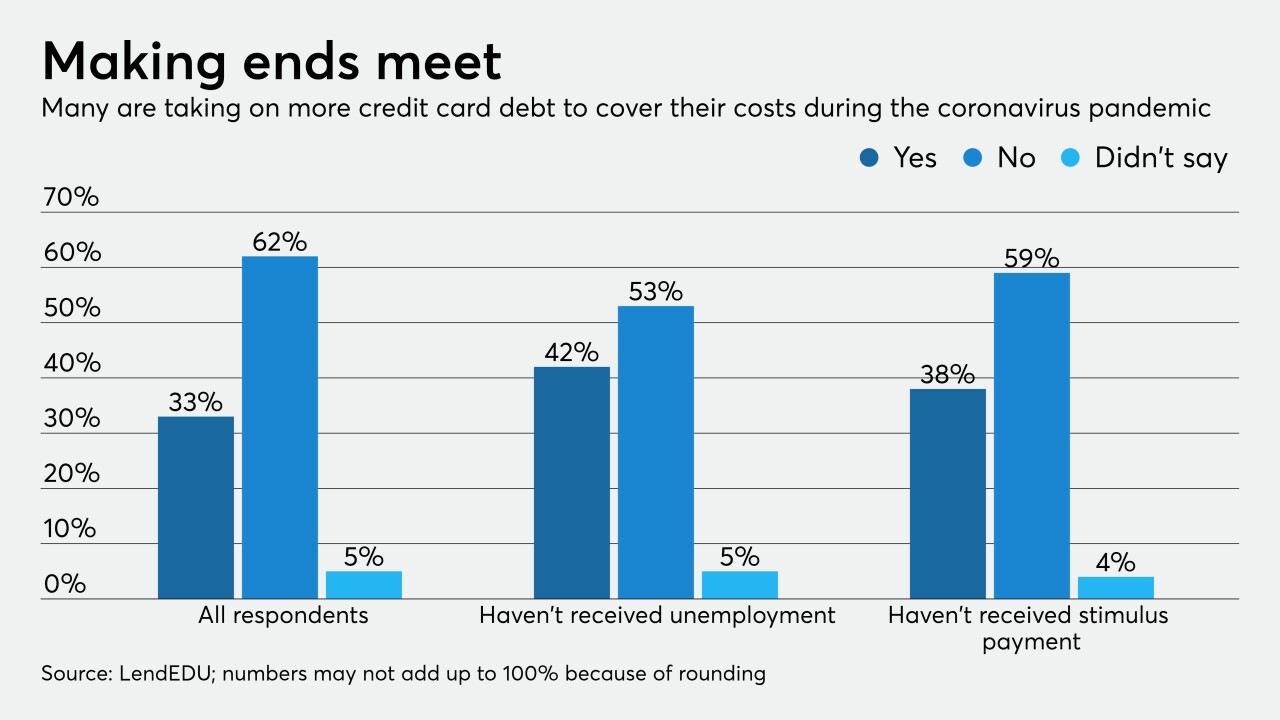

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5 -

U.S. banks under $10 billion in assets made 60% of the loans in the first round of the Paycheck Protection Program; things go relatively smoothly in the U.K. as 110,000 small businesses apply for low-cost loans.

May 5 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

Discover and Sallie Mae are the latest to report a surge in forbearance requests as households struggle with job loss and other hardships resulting from the coronavirus pandemic.

April 23