Technology

Technology

-

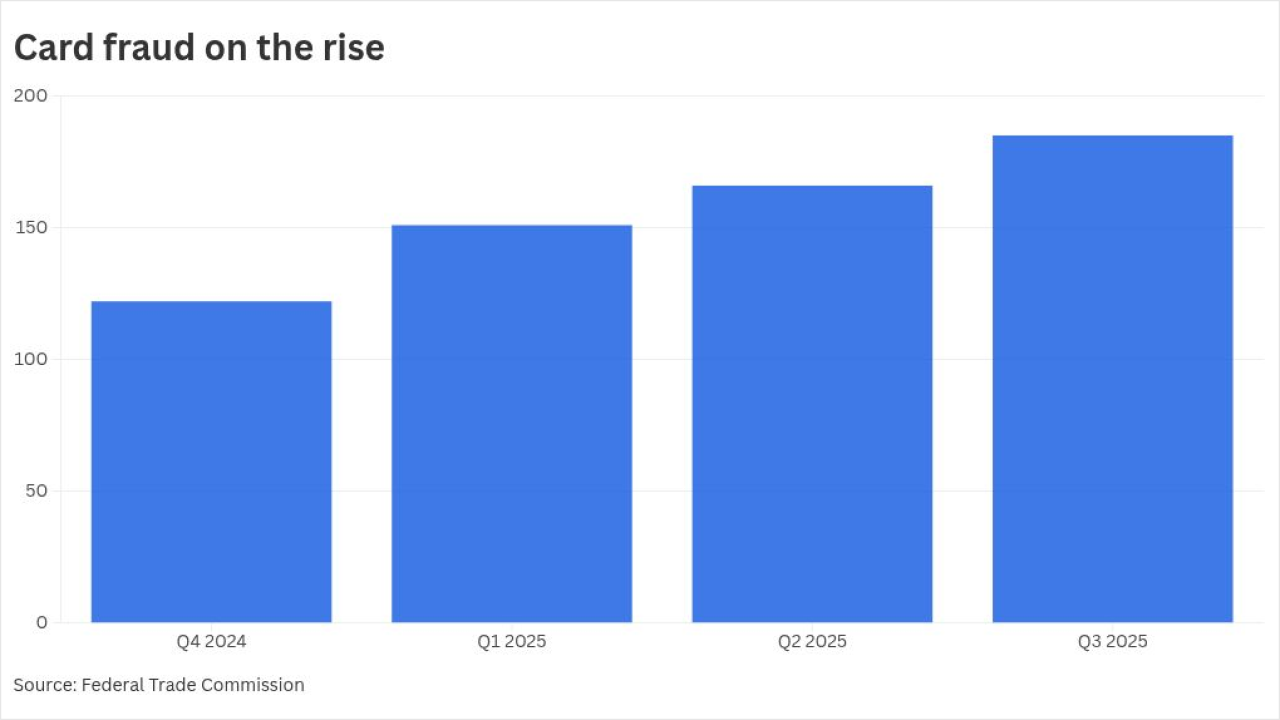

Defenses against financial schemes, both physical and digital, could leave executives scrambling to keep up with the pace of bad actors over the coming months.

January 14 -

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

January 13 -

The Securities and Exchange Commission appears to have finally acknowledged that tokenized securities are still … securities. For broker-dealers seeking to offer tokenized securities custody, the path forward is now visible.

January 13 -

Coastal Financial in Washington State has acquired GreenFi, one of its fintech partners. The move is designed to buy time in order to figure out the best long-term strategy for the struggling neobank.

January 12 -

The U.K. payments processor announced its acquisition of an alternative merchant acquirer license from the state of Georgia as part of its U.S. expansion.

January 12 -

Despite attracting $2 billion in deposits, the cloud-native unit proved too expensive to maintain, prompting a strategic retreat by parent company SMBC.

January 12 -

Research from American Banker finds that bankers are still extremely worried about fraud, but hope that raising budgets for artificial intelligence could help.

January 12 -

-

New research from American Banker details how the 50 largest U.S. banks by U.S. assets are using stablecoins, cryptocurrencies and other distributed ledger technology.

January 12 -

Universal Commerce Protocol is an open standard that establishes a common language for AI agents and systems to work together, and will allow consumers to purchase products from retailers directly through Google's AI Mode in the browser or the Gemini app.

January 11 -

Jelena McWilliams, former chair of the FDIC, is joining data sharing fintech Plaid as its new president of corporate and external affairs.

January 9 -

A recent fraud case shines a spotlight on the many communication disconnects caused by disjointed software systems common at larger banks. Here's what happened to one American Banker editor.

January 9 -

The bank fired a manager for originating suspicious loans but later asked the SBA to forgive them, prosecutors say. The case ended in a $7.7 million settlement.

January 8 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

Investors in alternative assets like private equity, private capital and venture capital often lock their money in for years, but Pluto's founders say its marketplace matches these wealthy investors who need cash with banks and investment firms willing to lend against those illiquid assets.

January 8 -

The bank is investing in Ubyx to help traditional financial institutions settle stablecoin payments and compete with nonbank fintechs.

January 7 -

-

PicPay is making a second attempt at entering the U.S. market as a profitable digital bank and a competitor to fellow Brazilian fintech Nubank.

January 6 -

Attackers stole over $340,000 in stablecoin from the Venezuela-focused app. The incident adds to recent troubles including frozen accounts at JPMorganChase.

January 6 -

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5