-

As financial institutions struggle to regain public trust, they need to find more systematic ways to gauge how their work impacts consumers and communities.

October 16

-

The central bank’s top regulatory official discussed how the Fed is using listening sessions in isolated communities to understand the effect of losing the one bank in town.

October 4 -

Truebill, which started as a subscription management app and grew into one targeting bank fees, is now offering automated savings and financial management.

October 3 -

The firm hopes to distinguish itself from other lenders by analyzing customer cash flow to determine the likelihood that borrowers will repay.

October 2 -

Bruce Cahan, a lecturer at Stanford University who teaches ethics, explains the link between ethical principles and profitability for financial services firms.

September 20 -

The nation's largest bank said Wednesday it is seeking proposals on ways to address economic inequality in local neighborhoods across the country.

September 12 -

The Office of the Comptroller of the Currency’s questions for the public to comment on the decades-old law could illuminate a path forward as regulators struggle to agree on an updated policy.

August 30 -

The National Credit Union Administration’s only newly chartered credit union so far this year hopes to reach a highly unique target membership.

August 29 -

Legislation allowing regular bill payments to count toward credit history would solve more problems than some critics fear it would create.

August 27

-

The agency says it will act independently of other regulators to release a notice asking for public input on revamping the decades-old law.

August 24 -

After the National Credit Union Administration asked for comments on proposed revisions and expansions to its Payday Alternative Loan program, credit unions offered their suggestions for how to fix it.

August 20 -

Helping the underserved, especially abroad, can help banks retain top workers and boost profits.

August 13 IBM Global Business Services

IBM Global Business Services -

Forty credit unions participated in the study, which led to nearly $85 million in loans over the course of 18 months.

August 8 -

Allowing alternative data such as rent and utility payments has bipartisan support, but some say it could create more problems than it solves.

July 30 -

Whether you're lounging on the beach sipping mojitos, hiking the Smoky Mountains, or, like many of us, taking a breather from household chores on your staycation, you still need an escape from time to time.

July 24 -

Consumer advocates are urging local governments and courts to consider a person’s ability to pay before assessing fines and fees for such infractions as unpaid traffic tickets. Such changes could help low-income households avoid bankruptcy — and perhaps even make them more bankable.

July 5 -

Credit unions can apply for their share of approximately $2 million in Community Development Revolving Loan Fund grants between July 1 and Aug. 18.

June 26 -

Startups such as BREAUX Capital are trying to reach consumers historically underserved and underrepresented in financial services.

June 25 -

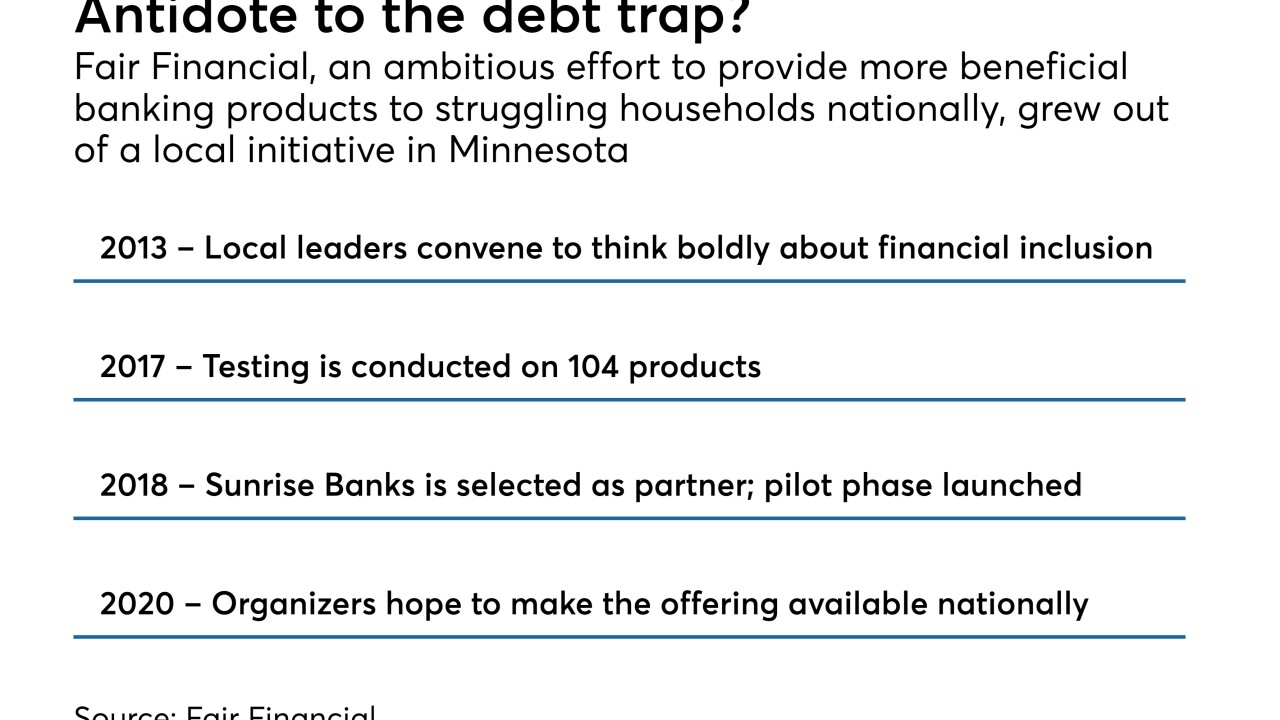

Fair Financial, a digital banking platform developed by a Twin Cities nonprofit in partnership with a local bank, launched a pilot program this week. By 2020, it plans to serve 5,000 customers across the country.

June 22 -

MyBucks plans to give away entry-level smartphones, loaded with the company's financial technology, to encourage mobile payments, mobile banking and broader access to digital services in Africa, where financial innovation often moves quickly.

June 13