-

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

As branches in remote areas disappear, banks run the risk of losing business to fintechs.

August 27 CCG Catalyst

CCG Catalyst -

North Side Community FCU served the underbanked before it joined Great Lakes earlier this month.

August 16 -

Offering 3% on purchases through its App Store, Apple hopes to make its competitors' phones a less-appealing option; a call for speeding up FedNow.

August 14 -

From housing finance to Facebook’s crypto plans, moderators questioning the presidential candidates in Texas next month would have no shortage of financial policy topics from which to pick.

August 11 -

Anticipating recession, banks start scrubbing loan books; how Trump's political appointees thwarted tougher settlements with two big banks; the Fed's plans on its real-time payment service; and more from this week's most-read stories.

August 9 -

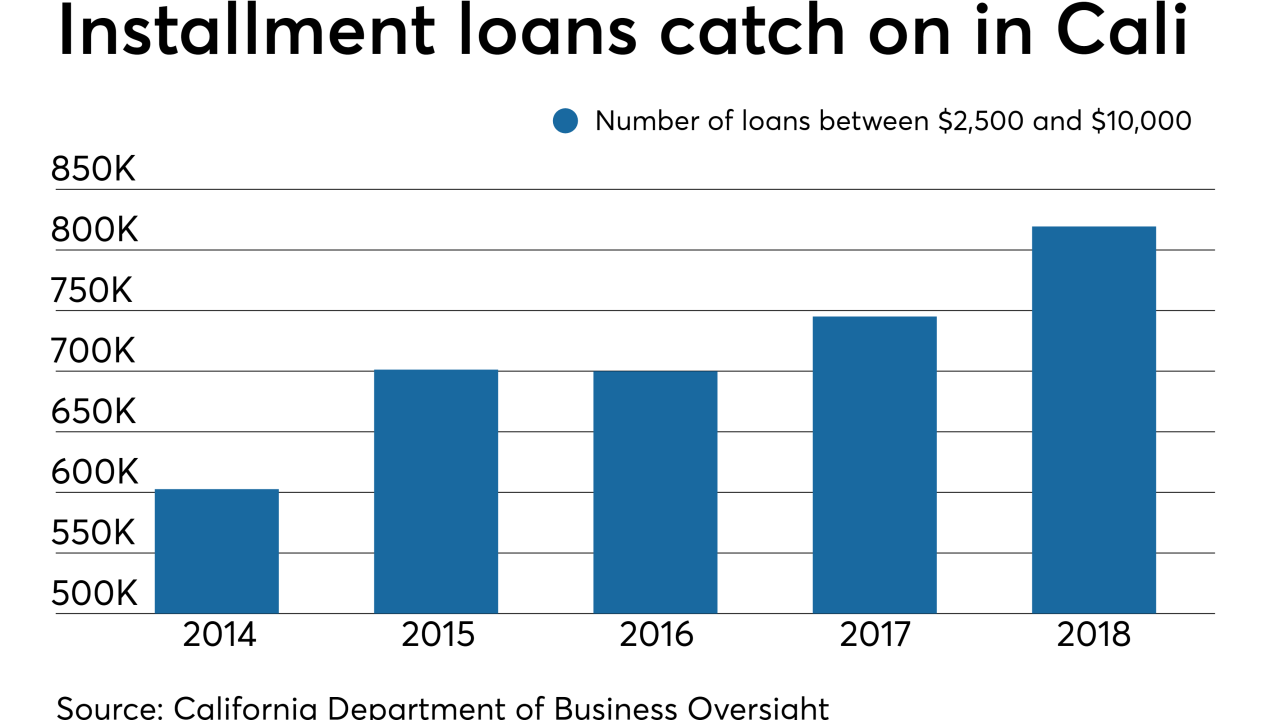

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

Two weeks after lawmakers grilled a Facebook exec over its crypto plans, they acknowledged there are benefits from digital currency technology and urged U.S. companies to take the lead.

July 30 -

In a registration statement filed with the SEC, the company revealed new details about its financial performance and its growth plans.

July 18 -

Many people still distrust banks, but many also look askance at the social media giant, making it an unlikely savior of the unbanked.

June 25 American Banker and Financial Planning

American Banker and Financial Planning -

Companies that offer early access to earned wages want a regulatory framework for their fast-growing industry. But the bill under consideration in Sacramento is exposing big divisions in the sector.

June 24 -

Intern programs are just one example of an activity that should count for CRA credit and meet Dodd-Frank requirements, says Comptroller of the Currency Joseph Otting.

June 24 Office of the Comptroller of the Currency

Office of the Comptroller of the Currency -

Many people still distrust banks, but many also look askance at the social media giant, making it an unlikely savior of the unbanked.

June 18 American Banker and Financial Planning

American Banker and Financial Planning -

Despite renewed calls from Democrats looking to USPS to offer banking services, policymakers should instead consider reforms that would permit private-sector firms like Walmart and Amazon to offer a wider array of financial products.

June 13

-

The credit union movement is uniquely positioned to partner with the U.S. Postal Service as a way to increase consumers' access to affordable financial services.

June 3

-

A former Wall Street lawyer who worked on bank bailouts is behind the idea; threatened tariffs are only one of the country’s problems, Citi CEO says.

June 3 -

BB&T’s chief executive has not prioritized meeting with local leaders and consumer advocates to discuss its merger plans, missing a valuable opportunity to create a new kind of large bank.

May 21National Diversity Coalition -

Mariel Beasley, co-director of Duke University’s Common Cents Lab, who studies consumers’ financial behavior, says savings "nudges" in apps often fall flat. Here's why.

May 7 -

The two banks’ CEOs used a public hearing to argue their merger will be a boon for underserved markets. But other speakers warned that bank consolidation hurts communities.

April 25