-

Student CU Connect CUSO, which had made high-risk loans to students of the now-bankrupt ITT Technical Institute, agreed to a settlement resulting in an estimated $168 million of loan forgiveness.

June 14 -

Even relatively wealthy Americans are so worried about their finances that it's affecting their mental and physical health. That's one of the findings in a Bank of America survey of more than 1,000 people in the U.S. who have enough investable money to qualify as "mass affluent."

June 14 -

The CEO of the digital-only bank Chime says it has quadrupled its membership in a year. So why doesn't his counterpart at Varo believe him?

June 13 -

To make a credit card top of wallet and build interchange income, credit unions must develop trust, provide great service and ensure the card works every time.

June 13 Member Access Processing

Member Access Processing -

Highland Associates has $26 billion in assets under management on behalf of not-for-profit medical endowments and foundations. Regions Financial is following the lead of other regionals, which have been scooping up investment firms that specialize in health care.

June 7 -

For First Republic Bank in San Francisco, “the pain index is likely somewhere between excruciating and traumatic,” says one expert. But few realize how much the bank got for its money.

June 6 -

Provident Bancorp, one of the nation's oldest active banks, is setting the stage to become a fully stock-owned company.

June 6 -

Sandler and his wife, Marion, built a small California thrift into a powerhouse before selling it to Wachovia prior to the housing collapse, but were heavily criticized for engaging in some of the same practices that caused the financial crisis.

June 5 -

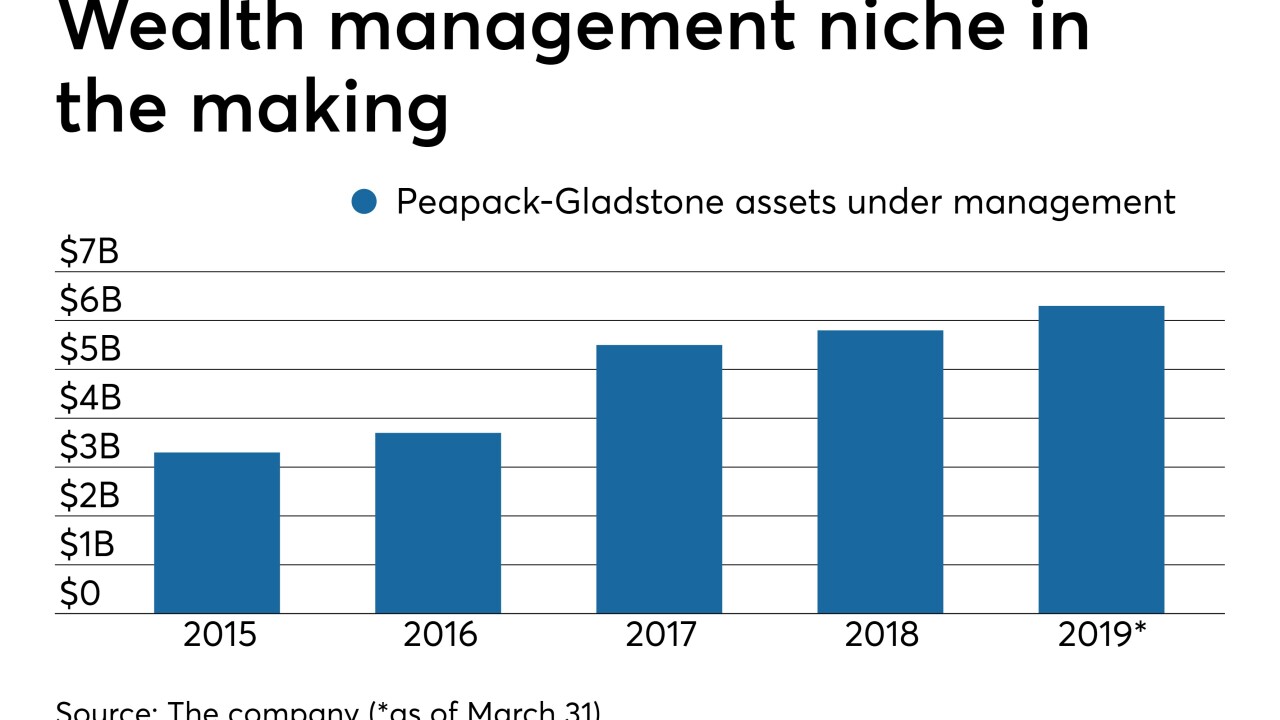

The New Jersey bank is entering a business dominated by larger players. In doing so, it could create a blueprint for other small banks.

June 5 -

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

Northpointe Bancshares sold stock to an affiliate of Castle Creek Capital.

June 4 -

The former Barclays CEO turned bank investor said he sees more opportunity in smaller, newer banks.

June 4 -

Providing workers with funds on their own terms with added features can do more than just keep up with modern technology, contends Brian Radin, president of Comdata's prepaid and payroll card business.

June 4 Comdata

Comdata -

SunTrust CEO Bill Rogers on Thursday explained the direction he and BB&T chief Kelly King are going with the new name, but gave no hints on what it is or when it will be unveiled.

May 30 -

Payment industry mega-mergers continue with $21.5B deal; the cryptocurrency is up 140% this year, including 70% this month.

May 28 -

Credit unions are doing good in their hometowns in a variety of ways, including giving one middle school student an award for her business plan for a food truck.

May 24 -

Anthony DeChellis’ strategy for staying relevant in a competitive metro market is a little odd — rebuild the private banking business his predecessor shrank — but observers say he might be the executive who can pull it off.

May 22 -

Galileo Processing has created a digital banking product that seeks to provide wealth managers with the offering they generally lack: an in-house savings account that pays competitive rates.

May 21 -

New president suggests less regulation and meets with bank leaders; state and city check for illegal lending activity.

May 21