-

Citigroup issued quarterly results that pleased the market by simply not being as bad as they could have been. Yes, Citi spent $7 billion to settle a mortgage securities probe, and there are still more legal costs coming. But some segments strengthened, suggesting Citi may have hit bottom and has nowhere to go but up.

July 14 -

The San Francisco bank posted strong growth in commercial loans in the second quarter, which may bode well for other banks that concentrate on business lending, but it wasn't enough to prevent questions about how Wells will be able to maintain its performance in the face of stepped-up competition from other lenders.

July 11 -

Add JPMorgan Chase CEO Jamie Dimon as a member of the league of extraordinarily optimistic bank executives, but a figure deep in his bank's quarterly report a high utilization rate for commercial lines of credit gives his predictions more credibility than his rivals'.

July 15

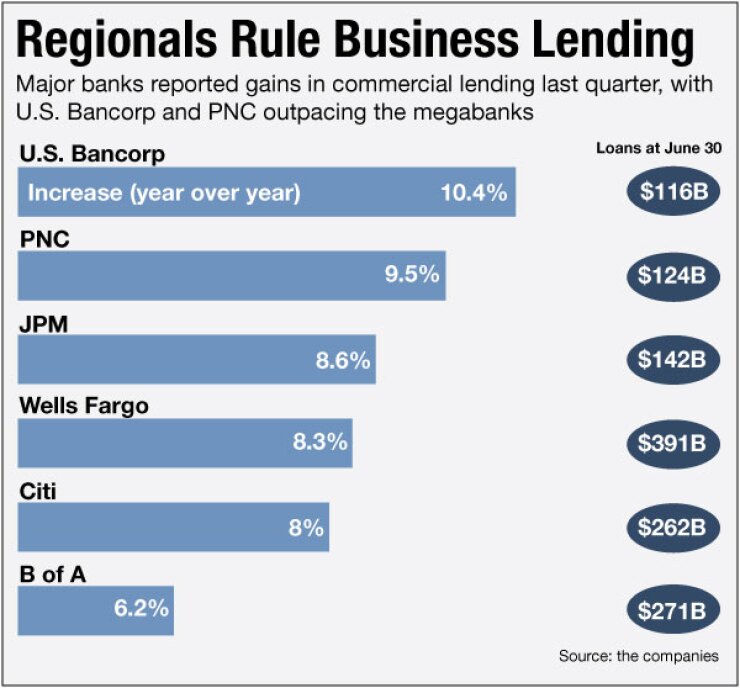

Top executives at two major banks Bank of America (BAC) and U.S. Bancorp (USB) could not have clashed more in their outlooks for commercial lending Wednesday even if they had tried.

B of A officials downplayed expectations and vowed not to lower prices to chase market share, while the head of U.S. Bancorp reported double-digit growth in the category and pledged to stay aggressive.

The conversation is important because commercial lending which includes commercial and industrial loans, real estate loans backed by commercial properties and other business credits has been one of the few bright spots for banks in the past year amid a declining mortgage market, multibillion-dollar government settlements and extreme cost-cutting.

Moreover, the opposing views suggest that, even after six years of abnormally low borrowing costs, some bankers are far more optimistic about commercial loan growth than others. And it shows that some banks are moving ahead while others are still mired in the disastrous legacy of the financial crisis.

"The battle lines are drawn," says Mike Mayo, a bank analyst at CLSA. "There are some investors and banks like JPMorgan Chase (JPM) and U.S. Bancorp that think this is an inflection point for loan growth, and others [like B of A] say this is not the sign of an acceleration."

Bruce Thompson, B of A's chief financial officer, was decidedly restrained in forecasting whether commercial loan growth is going to gain more steam in the second half of 2014.

"You're not going to see loan growth that is dramatically higher than the rate that the economy is growing," Thompson said on a conference call with analysts. "Our loan growth is going to mirror, or be a little above, the macro economy. We're seeing signs of improvement, but I'm not sure I'd go so far as saying it's an inflection point."

By contrast, Richard Davis, the chief executive of U.S. Bancorp, says two things his bank's cachet with borrowers and its lower cost of funds thanks to a strong debt rating allow it to aggressively drive down pricing.

"We beat them every time," Davis said on a conference call Wednesday, referring to competitors as everyone from "the large money center banks to community banks to foreign banks."

Davis makes it sound simple: the $389 billion-asset bank uses its good reputation and pricing advantage to attract high-quality credits. Bending on underwriting terms could hurt the bank's reputation and the company wants to avoid that.

"We can have high quality, have growth and have it on the low-risk side and use some of [that funding] advantage," Davis says. "There's no magic here, and there's no sustainability risk of this going away unless we were to harm our own ratings and we're not planning to do that either."

B of A's commercial loan portfolio grew 6.2% in the second quarter from a year earlier, to $271.4 billion, but was virtually flat compared with the first quarter.

U.S. Bancorp reported commercial loans of $116 billion, or 4% higher than the previous quarter and 10.4% from a year earlier. The growth rates were even better 5.9% and 10.5%, respectively for non-CRE business loans.

It's too early to tell which camp is right about the direction of commercial lending in the coming months, Mayo says.

"We've seen signs of optimism in the past, and it didn't materialize," he says. "The banks have been wrong before. It seems to be a little bit better but not enough to call this a turning point with a breakout for loan growth."

Bank chiefs generally speaking have leaned toward optimism in the first week of reports on second-quarter results.

Bank of America executives made their more cautious comments on the same day that they turned in another messy quarter. It included $4 billion in litigation expenses, including a $650 million settlement with American International Group. B of A's second quarter profit fell 43% to $2.3 billion, or 19 cents a share, on revenue of $22 billion.

The Charlotte, N.C., bank still has to resolve pending litigation with the Justice Department for selling faulty loans to investors. B of A also is in the final innings of a major restructuring and cost-cutting project known as New BAC, and its returns "are still subpar," Mayo says.

Brian Moynihan, B of A's CEO, says the bank had made huge progress cutting expenses but still has more work to do.

"The question is how do you hold [down expenses] in an economic environment that is lower growth than traditionally in the U.S.," he says.

Excluding litigation, B of A's noninterest expense declined to $1.4 billion in the second quarter from $2.3 billion a year ago as it continued to focus on reducing delinquent loans in its portfolio.

U.S. Bancorp's steady performance through the downturn has afforded it a high level of attention.

"They have such a strong credit reputation they can compete on price and still maintain an overall cost advantage because of their aggregate efficiency," says R. Scott Siefers, an analyst with Sandler O'Neill.

The Minneapolis bank's earnings rose less than 1% in the second quarter to $1.5 billion, or 78 cents per share, from a year earlier on revenue of $5.2 billion. Its total average loans rose 2% in the quarter and told analysts it is expecting that figure to be in the "1.5% range" in the third quarter, although it could adjust that as the quarter progresses. It is expecting commercial loans (excluding CRE) to grow 3% to 5% in the quarter.

U.S. Bancorp executives have said for several quarters that they have no qualms about competing on price for loans and reiterated that philosophy Wednesday.

"We are not at all altering our structure, we are not loosening that," says Andrew Cecere, U.S. Bancorp's chief financial officer. The company has a funding advantage, "and we use it and will continue to use it. We don't lose on price."

Pricing for middle-market loans has become much more aggressive, which could be good news for the economy, Davis says.

"We do see a pricing compression both in the middle market and the leveraged space," Davis says. "But particularly I see that as a good sign of some forms of green shoots and growth."

B of A's Thompson says that with rates so low, some corporations are tapping the capital markets rather than bank credit lines. That resulted in sizable paydowns in the second quarter.

"We are being sensitive with respect to pricing of commercial loans as we are not going to chase pricing," Thompson says. "We're being disciplined in how we approach the market."