It's good to be a midsize bank these days.

Large enough to meet customer needs in their markets yet small enough to escape some of the Dodd-Frank Act's most onerous compliance expenses, banks with assets of $2 billion to $10 billion are more profitable, as a group, than their smaller and larger counterparts, according to an analysis by Capital Performance Group.

Banks in the $10 billion to $50 billion asset range are more efficient, and those with assets of less than $2 billion have slightly healthier net interest margins, when compared with the midsize group. But the midtiers are outpacing banks in both of the other size categories in areas like loan and deposit growth, and that's translating into higher returns on equity.

-

Higher loan demand is helping banks and thrifts with $2 billion to $10 billion of assets improve their profitability. Of the 191 institutions that qualified for our mid-tier ranking this year, 40% posted a three-year average return on equity in the double digits, up from 34% in our previous ranking.

May 26 -

Profitability is under a lot of pressure for small institutions. But some are handling that pressure better than others, as our annual ranking of publicly traded banks and thrifts with less than $2 billion of assets shows.

April 25 -

Several small and midsize banks generated large year-over-year loan growth despite a belief by some outsiders that a slowdown was looming. Bankers may have to spend coming months assuring investors that they can keep booking loans while adequately managing risk.

April 19

It's a relatively new trend that started to take shape after the Dodd-Frank Act passed in 2010, said Kevin Halsey, a CPG consultant who compiled the data for this ranking.

One advantage midtiers have over smaller banks is that they can spread compliance costs over a larger asset base. And unlike banks with $10 billion of assets or more, the midtiers aren't contending with stress testing or caps on interchange fees. Before Dodd-Frank introduced those changes, the larger banks were more profitable than the midtiers, Halsey said.

For three-year return on average equity — the basis for this ranking — the midsize banks posted a median of 8.79%, besting banks in the $10 billion- to $50 billion-asset range (8.03%) and those with less than $2 billion of assets (7.26%).

Midtiers generally have the scale to compete with larger banks for customers. They might never lend to multinationals, but "in our market, our lending limit is large enough that we can handle most clients that we come across," said Steve Stenehjem, chief executive of the $2.1 billion-asset Watford City Bancshares in North Dakota.

His company, the parent of First International Bank & Trust, earned the No. 1 spot in our annual ranking. It's one of 19 banks that are new to the midtier group this year, having grown above $2 billion of assets, and Halsey said he expects the ranks to continue to swell as smaller banks look to gain scale to help offset increased compliance costs.

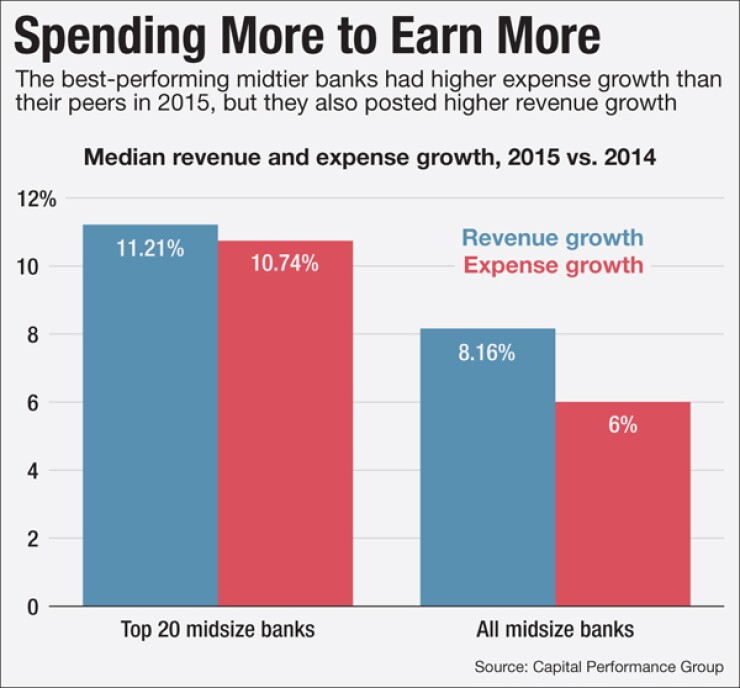

Among the midtiers, what helps separate the top 20 from the rest is efficiency. The median efficiency ratio for the standouts was 56.48% versus 62.28% for the overall peer group.

But it is not because the top 20 are penny-pinching. "The top-performing banks aren't afraid to spend," Halsey said. "They typically have much higher expense growth rates than many of their counterparts, but they also have higher revenue growth and that allows them to stay more efficient."

The high performers also generate more income from fees. For the top 20, noninterest income as a percentage of average assets was 1.29%, compared with 0.87% for the peer group.

Still, there is some cause for concern in this year's results. Nonperforming loans ticked up slightly across the board — even at Watford, which has seen delinquencies rise as energy exploration has slowed in its state. "We're chasing people around that move out of the area because they lost their oil jobs," said Stenehjem. "They don't think they have to pay us because they now live in North Carolina instead of North Dakota."

Banks and Thrifts with $2 Billion to $10 Billion of Assets | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | Institution | Location | Total Assets ($000) | 3-Year Avg. ROAE (%) | ROAE (%) | ROAA (%) | Efficiency Ratio (FTE) (%) | Net Interest Margin (FTE) (%) | Net Income ($000) | Change in Net Income, YOY (%) | Net Loan Growth, YOY (%) | Core Deposit Growth, YOY (%) |

| 1 | Watford City Bancshares* | Watford City, ND | 2,137,290 | 22.54 | 19.77 | 1.32 | 59.00 | 4.48 | 38,851 | -0.99 | 17.48 | 6.60 |

| 2 | Fremont Bancorp.* | Fremont, CA | 3,116,932 | 17.46 | 12.76 | 0.95 | 74.52 | 3.59 | 41,735 | 24.31 | 8.08 | 17.55 |

| 3 | Union Savings Bank* | Cincinnati, OH | 2,652,711 | 16.47 | 14.38 | 1.46 | 53.27 | 2.83 | 56,232 | 24.49 | 10.65 | 2.01 |

| 4 | Woodforest Financial Group* | The Woodlands, TX | 4,690,636 | 16.13 | 15.25 | 1.16 | 84.38 | 2.61 | 78,196 | -5.67 | 13.01 | 4.03 |

| 5 | State Bankshares | Fargo, ND | 3,667,296 | 15.98 | 13.20 | 1.05 | 73.07 | 3.98 | 36,404 | -21.09 | 12.68 | 18.51 |

| 6 | Bank of the Ozarks (OZRK) | Little Rock, AR | 9,879,459 | 15.38 | 14.93 | 2.11 | 34.89 | 5.19 | 182,314 | 53.74 | 63.03 | 34.04 |

| 7 | Landrum Co. | Columbia, MO | 2,417,829 | 15.19 | 13.27 | 0.84 | 67.58 | 4.00 | 19,228 | 13.28 | 9.52 | 16.56 |

| 8 | ServisFirst Bancshares (SFBS) | Birmingham, AL | 5,095,509 | 14.93 | 14.56 | 1.38 | 39.61 | 3.75 | 63,540 | 21.31 | 25.55 | 24.11 |

| 9 | First Security Bancorp | Searcy, AR | 5,050,124 | 14.27 | 12.49 | 2.15 | 40.83 | 5.55 | 105,809 | 4.21 | 8.68 | 11.52 |

| 10 | Amboy Bancorp.* | Old Bridge, NJ | 2,289,755 | 14.26 | 7.85 | 0.68 | 80.45 | 3.39 | 21,274 | -52.04 | 13.82 | 5.27 |

| 11 | First Financial Bankshares (FFIN) | Abilene, TX | 6,665,070 | 13.78 | 13.60 | 1.61 | 47.18 | 4.12 | 100,381 | 12.08 | 14.05 | 11.41 |

| 12 | USAmeriBancorp (USAB) | Clearwater, FL | 3,632,449 | 13.56 | 12.66 | 1.03 | 52.70 | 3.63 | 34,927 | 28.07 | 16.76 | 36.37 |

| 13 | Heartland Bancorp* | Bloomington, IL | 2,993,255 | 13.44 | 12.85 | 1.34 | 56.51 | 4.08 | 48,684 | 2.62 | 21.86 | 20.13 |

| 14 | Stock Yards Bancorp (SYBT) | Louisville, KY | 2,816,801 | 13.36 | 13.55 | 1.44 | 56.45 | 3.67 | 37,187 | 6.79 | 9.20 | 16.11 |

| 15 | Alpine Banks of Colo. | Glenwood Springs, CO | 2,744,250 | 13.18 | 13.75 | 1.06 | 69.76 | 4.18 | 27,625 | 8.17 | 16.19 | 17.05 |

| 16 | Stockman Financial Corp.* | Miles City, MT | 3,212,859 | 13.14 | 13.34 | 1.22 | 51.55 | 3.48 | 57,646 | 16.85 | 8.59 | 7.75 |

| 17 | City Holding Co. (CHCO) | Charleston, WV | 3,714,059 | 13.11 | 13.03 | 1.52 | 54.04 | 3.76 | 54,097 | 2.14 | 8.03 | 11.92 |

| 18 | German American Bancorp (GABC) | Jasper, IN | 2,373,701 | 13.03 | 12.47 | 1.33 | 56.28 | 3.70 | 30,064 | 6.07 | 8.43 | 5.14 |

| 19 | First Bancshares | Merrillville, IN | 3,130,772 | 12.74 | 12.21 | 1.11 | 59.43 | 3.62 | 31,656 | 4.49 | 15.55 | 16.59 |

| 20 | Fidelity Southern Corp. (LION) | Atlanta, GA | 3,849,063 | 12.71 | 13.85 | 1.16 | 70.98 | 3.24 | 39,135 | 30.29 | 25.86 | 31.28 |

| 21 | Lakeland Financial Corp. (LKFN) | Warsaw, IN | 3,766,286 | 12.51 | 12.26 | 1.29 | 48.98 | 3.20 | 46,367 | 5.85 | 11.88 | 9.16 |

| 22 | Canandaigua National Corp. (CNND) | Canandaigua, NY | 2,271,509 | 12.51 | 12.04 | 0.95 | 64.51 | 3.43 | 20,991 | 1.78 | 6.51 | 7.64 |

| 23 | Wilshire Bancorp (WIBC) | Los Angeles, CA | 4,713,468 | 12.29 | 11.84 | 1.36 | 50.40 | 3.56 | 61,405 | 4.06 | 15.93 | 21.47 |

| 24 | Inwood Bancshares* | Dallas, TX | 2,203,045 | 12.29 | 13.95 | 1.29 | 48.70 | 3.49 | 39,509 | 24.41 | 15.41 | 20.40 |

| 25 | Talmer Bancorp (TLMR) | Troy, MI | 6,595,890 | 12.26 | 8.04 | 0.95 | 65.97 | 3.74 | 60,129 | -33.82 | 12.21 | 1.23 |

| 26 | Home BancShares (HOMB) | Conway, AR | 9,289,122 | 12.13 | 12.77 | 1.68 | 39.45 | 4.98 | 138,199 | 22.23 | 31.38 | 19.94 |

| 27 | First South Bancorp* | Nashville, TN | 2,887,730 | 12.09 | 14.19 | 1.26 | 73.95 | 3.98 | 45,063 | 38.82 | 23.69 | 31.52 |

| 28 | Fishback Financial Corp. | Brookings, SD | 2,048,735 | 12.01 | 10.53 | 1.24 | 61.08 | 4.21 | 24,847 | 0.05 | 7.57 | 3.76 |

| 29 | Eagle Bancorp (EGBN) | Bethesda, MD | 6,076,649 | 11.94 | 11.40 | 1.49 | 42.00 | 4.37 | 84,167 | 55.12 | 15.83 | 22.01 |

| 30 | Arrow Financial Corp. (AROW) | Glens Falls, NY | 2,446,188 | 11.92 | 11.86 | 1.05 | 58.12 | 3.17 | 24,662 | 5.57 | 11.46 | 8.46 |

| 31 | CVB Financial Corp. (CVBF) | Ontario, CA | 7,671,200 | 11.90 | 10.87 | 1.31 | 42.64 | 3.62 | 99,145 | -4.69 | 5.34 | 7.84 |

| 32 | Park National Corp. (PRK) | Newark, OH | 7,311,354 | 11.90 | 11.40 | 1.11 | 60.78 | 3.39 | 81,012 | -3.51 | 4.95 | 9.12 |

| 33 | Hometown Community Bancorp* | Morton, IL | 3,062,072 | 11.89 | 11.40 | 1.04 | 51.30 | 3.14 | 42,900 | 5.08 | 5.24 | 8.17 |

| 34 | Washington Trust Bancorp (WASH) | Westerly, RI | 3,771,604 | 11.84 | 12.00 | 1.19 | 57.48 | 3.12 | 43,465 | 6.47 | 5.13 | 11.68 |

| 35 | CNB Financial Corp. (CCNE) | Clearfield, PA | 2,285,136 | 11.79 | 11.23 | 0.99 | 59.92 | 3.65 | 22,197 | -3.80 | 16.70 | -2.36 |

| 36 | Westamerica Bancorp. (WABC) | San Rafael, CA | 5,168,875 | 11.79 | 11.32 | 1.16 | 51.34 | 3.36 | 58,753 | -3.12 | -9.90 | 7.30 |

| 37 | Educational Services of America | Farragut, TN | 3,572,047 | 11.65 | 10.84 | 1.05 | 61.10 | 3.02 | 35,279 | -6.92 | 9.36 | 32.78 |

| 38 | Institution for Savings | Newburyport, MA | 2,492,076 | 11.53 | 9.66 | 1.06 | 72.82 | 2.26 | 23,474 | -16.45 | 32.61 | 9.40 |

| 39 | Century Bancorp (CNBKA) | Medford, MA | 3,947,441 | 11.47 | 11.26 | 0.59 | 64.51 | 2.18 | 23,021 | 5.31 | 30.51 | 10.49 |

| 40 | Farmers & Merchants Bancorp (FMCB) | Lodi, CA | 2,615,345 | 11.39 | 11.21 | 1.12 | 55.08 | 3.87 | 27,392 | 7.83 | 16.58 | 12.52 |

| 41 | Exchange Bank (EXSR) | Santa Rosa, CA | 2,062,508 | 11.39 | 12.59 | 1.08 | 65.48 | 3.53 | 21,028 | 18.74 | 4.79 | 12.80 |

| 42 | Amarillo National Bancorp* | Amarillo, TX | 3,838,126 | 11.38 | 9.65 | 1.15 | 50.26 | 3.48 | 67,997 | -13.41 | -3.51 | 0.27 |

| 43 | WSFS Financial Corp. (WSFS) | Wilmington, DE | 5,585,962 | 11.35 | 10.24 | 1.05 | 57.79 | 3.82 | 53,533 | -0.42 | 18.06 | 9.36 |

| 44 | First American Bank Corp.* | Elk Grove Village, IL | 3,458,074 | 11.32 | 9.31 | 0.68 | 74.53 | 2.65 | 29,398 | -3.05 | 2.92 | 9.18 |

| 45 | American Chartered Bancorp | Schaumburg, IL | 2,828,114 | 11.28 | 17.75 | 1.14 | 53.79 | 3.49 | 31,989 | 86.09 | 7.35 | 6.12 |

| 46 | Tompkins Financial Corp. (TMP) | Ithaca, NY | 5,689,995 | 11.27 | 11.53 | 1.07 | 63.29 | 3.38 | 58,552 | 12.23 | 11.17 | 8.23 |

| 47 | Durant Bancorp* | Durant, OK | 3,161,259 | 11.21 | 11.17 | 0.97 | 71.35 | 3.74 | 42,727 | 20.80 | 28.06 | 23.76 |

| 48 | Burke & Herbert Bank & Trust (BHRB) | Alexandria, VA | 2,665,190 | 11.10 | 10.00 | 1.18 | 63.19 | 3.68 | 30,875 | -8.25 | 10.80 | 6.30 |

| 49 | North American Bancshares | Sherman, TX | 2,349,444 | 11.09 | 11.81 | 1.36 | 51.50 | 3.88 | 30,066 | 15.60 | 2.37 | 10.37 |

| 50 | Enterprise Financial Services (EFSC) | Clayton, MO | 3,608,483 | 11.09 | 11.47 | 1.14 | 55.07 | 3.86 | 38,450 | 41.50 | 11.92 | 22.22 |

| 51 | Hanmi Financial Corp. (HAFC) | Los Angeles, CA | 4,234,521 | 11.04 | 11.30 | 1.32 | 62.17 | 3.90 | 53,823 | 8.16 | 14.66 | 9.38 |

| 52 | TrustCo Bank Corp NY (TRST) | Glenville, NY | 4,734,992 | 11.04 | 10.41 | 0.89 | 55.06 | 3.09 | 42,238 | -4.42 | 4.39 | 4.30 |

| 53 | Pinnacle Bancorp* | Omaha, NE | 9,337,686 | 10.93 | 11.13 | 1.14 | 56.18 | 3.48 | 146,021 | 15.92 | 16.63 | 19.61 |

| 54 | Hills Bancorp. (HBIA) | Hills, IA | 2,493,607 | 10.92 | 10.79 | 1.19 | 54.98 | 3.46 | 28,418 | 5.35 | 7.06 | 8.16 |

| 55 | Boston Private Financial (BPFH) | Boston, MA | 7,542,508 | 10.88 | 9.50 | 0.98 | 68.46 | 2.92 | 69,332 | -5.75 | 8.61 | 12.34 |

| 56 | Preferred Bank (PFBC) | Los Angeles, CA | 2,598,846 | 10.86 | 11.81 | 1.35 | 39.74 | 3.92 | 29,743 | 20.95 | 28.79 | 35.02 |

| 57 | Merchants Bancshares (MBVT) | South Burlington, VT | 2,021,237 | 10.83 | 9.69 | 0.71 | 67.75 | 2.94 | 12,618 | 4.07 | 19.80 | 18.21 |

| 58 | INTRUST Financial Corp.* | Wichita, KS | 4,431,618 | 10.81 | 12.13 | 0.74 | 68.83 | 2.64 | 48,573 | 15.53 | 6.58 | -0.59 |

| 59 | American National Corp.* | Omaha, NE | 2,962,197 | 10.81 | 10.71 | 0.98 | 61.28 | 3.70 | 38,107 | -3.32 | 17.19 | 14.96 |

| 60 | Glacier Bancorp (GBCI) | Kalispell, MT | 9,089,232 | 10.72 | 10.84 | 1.36 | 54.47 | 4.00 | 116,127 | 2.99 | 13.63 | 13.95 |

| 61 | Longview Financial Corp. | Longview, TX | 2,205,257 | 10.47 | 10.18 | 1.03 | 59.66 | 3.45 | 21,363 | 9.78 | 15.48 | 10.74 |

| 62 | Horizon Bancorp (HBNC) | Michigan City, IN | 2,652,401 | 10.47 | 9.36 | 0.87 | 65.03 | 3.45 | 20,549 | 13.52 | 27.36 | 26.32 |

| 63 | BancFirst Corp. (BANF) | Oklahoma City, OK | 6,692,829 | 10.46 | 10.38 | 1.01 | 63.60 | 3.12 | 66,170 | 3.57 | 10.06 | 1.74 |

| 64 | Customers Bancorp (CUBI) | Wyomissing, PA | 8,401,313 | 10.46 | 11.51 | 0.81 | 50.61 | 2.81 | 58,583 | 35.56 | 26.21 | 26.30 |

| 65 | First of Long Island Corp. (FLIC) | Glen Head, NY | 3,130,343 | 10.46 | 10.64 | 0.89 | 50.56 | 2.94 | 25,890 | 12.50 | 24.67 | 19.19 |

| 66 | Wilson Bank Holding Co. (WBHC) | Lebanon, TN | 2,021,604 | 10.44 | 11.17 | 1.23 | 59.41 | 3.80 | 23,863 | 14.85 | 8.51 | 14.28 |

| 67 | First State Bancshares | Farmington, MO | 2,074,439 | 10.35 | 10.85 | 1.10 | 67.12 | 3.73 | 19,906 | 14.77 | 23.17 | 25.07 |

| 68 | Community Trust Bancorp (CTBI) | Pikeville, KY | 3,903,934 | 10.32 | 9.97 | 1.23 | 56.20 | 3.81 | 46,432 | 7.35 | 5.09 | 9.55 |

| 69 | BBCN Bancorp (BBCN) | Los Angeles, CA | 7,912,648 | 10.31 | 10.11 | 1.25 | 47.63 | 3.88 | 92,258 | 4.11 | 11.84 | 14.05 |

| 70 | Financial Institutions (FISI) | Warsaw, NY | 3,381,024 | 10.23 | 9.78 | 0.87 | 61.49 | 3.28 | 28,337 | -3.47 | 9.18 | 12.65 |

| 71 | MidWestOne Financial (MOFG) | Iowa City, IA | 2,979,975 | 10.12 | 9.84 | 0.91 | 58.54 | 3.71 | 25,118 | 35.61 | 87.95 | 93.84 |

| 72 | Great Southern Bancorp (GSBC) | Springfield, MO | 4,104,189 | 10.11 | 10.60 | 1.14 | 60.34 | 4.53 | 46,502 | 6.83 | 9.80 | 4.58 |

| 73 | First Interstate BancSystem (FIBK) | Billings, MT | 8,728,196 | 10.09 | 9.37 | 1.02 | 61.61 | 3.46 | 86,795 | 2.84 | 7.18 | 2.88 |

| 74 | TriCo Bancshares (TCBK) | Chico, CA | 4,220,722 | 10.02 | 10.04 | 1.11 | 63.70 | 4.32 | 43,818 | 67.83 | 10.64 | 8.89 |

| 75 | Dime Community Bancshares (DCOM) | Brooklyn, NY | 5,032,872 | 9.94 | 9.40 | 0.96 | 48.52 | 2.89 | 44,772 | 1.19 | 14.08 | 31.62 |

| 76 | W.T.B. Financial Corp. (WTBFB) | Spokane, WA | 5,305,272 | 9.93 | 10.21 | 0.94 | 65.75 | 3.42 | 46,360 | 10.74 | 6.17 | 13.74 |

| 77 | QCR Holdings (QCRH) | Moline, IL | 2,593,198 | 9.84 | 8.79 | 0.66 | 63.12 | 3.37 | 16,928 | 13.21 | 10.27 | 16.29 |

| 78 | RCB Holding Co.* | Claremore, OK | 2,494,884 | 9.67 | 9.34 | 0.91 | 62.06 | 3.46 | 30,462 | 2.63 | 5.66 | 8.11 |

| 79 | CoBiz Financial Inc. (COBZ) | Denver, CO | 3,351,767 | 9.63 | 8.77 | 0.83 | 68.12 | 3.86 | 26,069 | -10.13 | 12.04 | 13.48 |

| 80 | Farmers & Merchants | Lincoln, NE | 3,397,868 | 9.56 | 8.71 | 0.91 | 65.28 | 3.12 | 29,548 | 5.38 | 9.65 | 7.94 |

| 81 | Cardinal Financial Corp. (CFNL) | McLean, VA | 4,029,921 | 9.51 | 11.76 | 1.29 | 56.66 | 3.37 | 47,334 | 44.83 | 18.83 | 14.04 |

| 82 | Flushing Financial Corp. (FFIC) | Uniondale, NY | 5,704,634 | 9.50 | 9.93 | 0.86 | 59.21 | 3.04 | 46,209 | 4.45 | 15.35 | 13.00 |

| 83 | Heartland Financial USA (HTLF) | Dubuque, IA | 7,694,754 | 9.43 | 10.38 | 0.89 | 72.01 | 3.94 | 60,042 | 43.30 | 28.68 | 32.61 |

| 84 | 1st Source Corp. (SRCE) | South Bend, IN | 5,187,916 | 9.41 | 9.05 | 1.15 | 62.98 | 3.60 | 57,486 | -1.00 | 8.27 | 6.16 |

| 85 | First Mid-Illinois Bancshares (FMBH) | Mattoon, IL | 2,114,499 | 9.39 | 8.83 | 0.91 | 60.45 | 3.38 | 16,512 | 6.80 | 20.84 | 41.31 |

| 86 | Community Bank (CYHT) | Pasadena, CA | 3,550,255 | 9.38 | 9.13 | 0.79 | 58.84 | 3.30 | 27,765 | 7.59 | 6.53 | 7.91 |

| 87 | Bank of Marin Bancorp (BMRC) | Novato, CA | 2,031,134 | 9.34 | 8.84 | 0.98 | 59.30 | 3.89 | 18,441 | -6.73 | 6.53 | 11.74 |

| 88 | S&T Bancorp (STBA) | Indiana, PA | 6,318,354 | 9.29 | 8.94 | 1.13 | 53.83 | 3.56 | 67,081 | 15.84 | 31.15 | 24.36 |

| 89 | Enterprise Bancorp (EBTC) | Lowell, MA | 2,285,531 | 9.27 | 9.29 | 0.76 | 70.17 | 3.97 | 16,148 | 10.22 | 11.22 | 15.88 |

| 90 | ANB Corp. | Terrell, TX | 2,748,548 | 9.27 | 9.05 | 0.81 | 68.94 | 3.49 | 20,750 | 7.78 | 7.20 | 7.34 |

| 91 | Ameris Bancorp (ABCB) | Moultrie, GA | 5,588,940 | 9.25 | 8.30 | 0.85 | 60.88 | 4.12 | 40,847 | 5.49 | 37.47 | 52.44 |

| 92 | Camden National Corp. (CAC) | Camden, ME | 3,709,871 | 9.22 | 7.54 | 0.70 | 59.69 | 3.19 | 20,952 | -14.73 | 41.59 | 39.49 |

| 93 | Bryn Mawr Bank Corp. (BMTC) | Bryn Mawr, PA | 3,030,997 | 9.19 | 4.49 | 0.57 | 62.28 | 3.75 | 16,754 | -39.83 | 37.80 | 31.69 |

| 94 | Community Bank System (CBU) | De Witt, NY | 8,552,669 | 9.19 | 8.87 | 1.17 | 57.89 | 3.73 | 91,230 | -0.13 | 13.48 | 17.56 |

| 95 | Independent Bank Corp. (INDB) | Rockland, MA | 7,210,038 | 9.18 | 8.79 | 0.93 | 62.66 | 3.40 | 64,960 | 8.55 | 11.69 | 16.34 |

| 96 | First Foundation Inc. (FFWM) | Irvine, CA | 2,592,579 | 9.17 | 8.09 | 0.77 | 70.12 | 3.39 | 13,378 | 59.38 | 51.77 | 48.42 |

| 97 | Pinnacle Financial Partners (PNFP) | Nashville, TN | 8,715,414 | 9.15 | 10.06 | 1.34 | 54.28 | 3.64 | 95,509 | 35.53 | 43.84 | 41.26 |

| 98 | Meta Financial Group (CASH) | Sioux Falls, SD | 2,960,234 | 9.11 | 8.10 | 0.75 | 76.73 | 2.79 | 18,518 | 20.99 | 24.84 | 47.77 |

| 99 | South Plains Financial* | Lubbock, TX | 2,536,865 | 9.04 | 9.64 | 0.71 | 78.43 | 3.76 | 22,932 | 17.23 | 10.51 | 9.71 |

| 100 | ConnectOne Bancorp (CNOB) | Englewood Cliffs, NJ | 4,016,721 | 8.95 | 8.84 | 1.13 | 40.90 | 3.55 | 41,311 | 122.52 | 21.71 | 12.21 |

| 101 | Chemical Financial Corp. (CHFC) | Midland, MI | 9,188,797 | 8.92 | 9.44 | 1.02 | 59.03 | 3.58 | 86,830 | 39.78 | 28.22 | 22.54 |

| 102 | MainSource Financial (MSFG) | Greensburg, IN | 3,385,408 | 8.90 | 9.56 | 1.10 | 64.45 | 3.74 | 35,542 | 22.58 | 10.20 | 9.31 |

| 103 | First Defiance Financial (FDEF) | Defiance, OH | 2,297,676 | 8.90 | 9.52 | 1.19 | 61.37 | 3.80 | 26,423 | 8.77 | 9.58 | 7.38 |

| 104 | HomeStreet (HMST) | Seattle, WA | 4,894,495 | 8.87 | 9.35 | 0.91 | 82.89 | 3.62 | 41,319 | 85.63 | 41.26 | 27.97 |

| 105 | Dacotah Banks (DBIN) | Aberdeen, SD | 2,235,201 | 8.85 | 9.10 | 0.98 | 62.18 | 4.10 | 21,244 | 14.27 | 3.98 | 3.68 |

| 106 | Mercantile Bank Corp. (MBWM) | Grand Rapids, MI | 2,903,556 | 8.82 | 8.19 | 0.94 | 64.27 | 3.83 | 27,020 | 55.91 | 9.32 | 9.55 |

| 107 | Oritani Financial Corp. (ORIT) | Township of Washington, NJ | 3,512,991 | 8.81 | 10.56 | 1.64 | 42.58 | 3.08 | 54,728 | 33.78 | 11.24 | 14.48 |

| 108 | Commerce Bancshares | Worcester, MA | 2,014,295 | 8.80 | 7.35 | 0.61 | 59.62 | 2.93 | 10,846 | -6.20 | 10.43 | -3.09 |

| 109 | Franklin Financial Network (FSB) | Franklin, TN | 2,167,792 | 8.79 | 9.52 | 0.92 | 56.40 | 3.62 | 16,080 | 91.11 | 63.50 | 24.86 |

| 110 | First Merchants Corp. (FRME) | Muncie, IN | 6,761,003 | 8.61 | 8.67 | 1.07 | 59.23 | 3.79 | 65,384 | 8.68 | 19.99 | 16.25 |

| 111 | NBT Bancorp Inc. (NBTB) | Norwich, NY | 8,262,646 | 8.54 | 8.70 | 0.96 | 62.34 | 3.50 | 76,425 | 1.80 | 5.27 | 8.38 |

| 112 | Suffolk Bancorp (SCNB) | Riverhead, NY | 2,168,592 | 8.54 | 9.27 | 0.89 | 64.54 | 3.98 | 17,687 | 15.64 | 20.89 | 16.35 |

| 113 | OceanFirst Financial Corp. (OCFC) | Toms River, NJ | 2,593,068 | 8.54 | 8.92 | 0.82 | 63.27 | 3.25 | 20,322 | 2.02 | 16.56 | 9.68 |

| 114 | Bridge Bancorp (BDGE) | Bridgehampton, NY | 3,781,959 | 8.52 | 7.91 | 0.71 | 56.00 | 3.55 | 21,111 | 53.39 | 80.97 | 50.72 |

| 115 | WesBanco (WSBC) | Wheeling, WV | 8,470,298 | 8.44 | 7.62 | 0.99 | 56.47 | 3.41 | 80,762 | 15.42 | 24.31 | 20.44 |

| 116 | Carter Bank & Trust (CARE) | Martinsville, VA | 4,893,968 | 8.43 | 9.52 | 0.82 | 52.14 | 2.39 | 39,158 | 17.03 | 13.73 | 5.43 |

| 117 | Sandy Spring Bancorp (SASR) | Olney, MD | 4,655,380 | 8.42 | 8.73 | 1.01 | 61.05 | 3.44 | 45,355 | 18.73 | 11.93 | 5.10 |

| 118 | First Financial Bancorp. (FFBC) | Cincinnati, OH | 8,147,411 | 8.39 | 9.33 | 1.00 | 59.36 | 3.66 | 75,063 | 15.48 | 13.11 | 8.45 |

| 119 | BNC Bancorp (BNCN) | High Point, NC | 5,668,183 | 8.34 | 9.52 | 0.94 | 55.34 | 4.16 | 44,450 | 51.24 | 36.53 | 43.37 |

| 120 | New York Private Bank & Trust | New York, NY | 6,791,245 | 8.27 | 9.33 | 1.27 | 64.58 | 3.59 | 80,130 | 80.12 | -1.74 | 24.21 |

| 121 | Lakeland Bancorp (LBAI) | Oak Ridge, NJ | 3,869,550 | 8.18 | 8.28 | 0.89 | 62.02 | 3.47 | 32,481 | 4.34 | 11.88 | 5.64 |

| 122 | Guaranty Bancorp (GBNK) | Denver, CO | 2,368,525 | 8.18 | 10.42 | 1.01 | 61.85 | 3.67 | 22,454 | 66.18 | 17.95 | 3.31 |

| 123 | Broadway Bancshares* | San Antonio, TX | 3,263,535 | 8.13 | 8.54 | 0.99 | 62.39 | 3.52 | 36,568 | 12.26 | 9.93 | 4.71 |

| 124 | South State Corp. (SSB) | Columbia, SC | 8,557,348 | 8.12 | 9.67 | 1.21 | 59.42 | 4.54 | 99,473 | 31.86 | 4.69 | 15.00 |

| 125 | Happy Bancshares | Canyon, TX | 2,857,018 | 8.12 | 8.84 | 0.92 | 69.74 | 3.95 | 24,660 | 31.25 | 8.18 | 9.33 |

| 126 | First Financial Corp. (THFF) | Terre Haute, IN | 2,979,585 | 8.06 | 7.46 | 1.01 | 65.11 | 4.04 | 30,196 | -10.59 | -1.06 | 2.31 |

| 127 | Luther Burbank Corp.* | Santa Rosa, CA | 4,363,234 | 8.05 | 6.63 | 0.59 | 68.12 | 2.17 | 35,391 | 2.27 | 11.77 | 94.07 |

| 128 | Farmers & Merchants Bank (FMBL) | Long Beach, CA | 6,153,600 | 8.04 | 7.79 | 1.12 | 59.32 | 3.63 | 64,948 | 4.07 | 8.90 | 14.89 |

| 129 | Banner Corp. (BANR) | Walla Walla, WA | 9,796,298 | 7.98 | 5.56 | 0.72 | 68.00 | 4.10 | 45,222 | -16.36 | 93.76 | 114.20 |

| 130 | Independent Bank Group* (IBTX) | McKinney, TX | 5,055,000 | 7.92 | 6.85 | 0.88 | 57.29 | 4.05 | 38,786 | 33.85 | 24.69 | 31.17 |

| 131 | Pacific Premier Bancorp (PPBI) | Irvine, CA | 2,790,646 | 7.89 | 9.31 | 0.97 | 55.78 | 4.25 | 25,515 | 53.56 | 38.92 | 40.72 |

| 132 | Community Bancshares of Miss. | Brandon, MS | 2,702,036 | 7.87 | 6.97 | 0.66 | 72.16 | 3.95 | 17,100 | -12.55 | 4.07 | 10.42 |

| 133 | First Busey Corp. (BUSE) | Champaign, IL | 3,998,976 | 7.87 | 8.91 | 0.99 | 61.50 | 3.10 | 39,006 | 19.02 | 9.35 | 17.73 |

| 134 | Metro Bancorp ‡ | Harrisburg, PA | 2,905,373 | 7.76 | 7.41 | 0.68 | 66.15 | 3.68 | 20,215 | -4.13 | 1.42 | -0.63 |

| 135 | TowneBank (TOWN) | Portsmouth, VA | 6,296,574 | 7.76 | 8.16 | 1.09 | 64.10 | 3.45 | 65,665 | 46.15 | 27.32 | 19.38 |

| 136 | National Penn Bancshares | Allentown, PA | 9,598,902 | 7.76 | 9.68 | 1.16 | 55.07 | 3.25 | 110,691 | 12.14 | 1.16 | 1.13 |

| 137 | BancPlus Corp. | Ridgeland, MS | 2,598,079 | 7.73 | 7.96 | 0.83 | 75.61 | 3.51 | 21,309 | 7.73 | 15.17 | 9.55 |

| 138 | Stonegate Bank (SGBK) | Pompano Beach, FL | 2,380,438 | 7.71 | 9.19 | 1.10 | 50.94 | 4.21 | 25,159 | 96.83 | 42.29 | 43.94 |

| 139 | Peapack-Gladstone Financial (PGC) | Bedminster, NJ | 3,364,659 | 7.68 | 7.71 | 0.64 | 61.06 | 2.80 | 19,972 | 34.13 | 33.14 | 22.31 |

| 140 | Univest Corp. of Pa. (UVSP) | Souderton, PA | 2,879,451 | 7.62 | 7.58 | 0.98 | 65.87 | 3.96 | 27,268 | 22.66 | 34.60 | 20.56 |

| 141 | Central Bancshares | Lexington, KY | 2,192,412 | 7.48 | 7.99 | 0.80 | 78.38 | 3.72 | 17,138 | 7.44 | 2.23 | 10.82 |

| 142 | Renasant Corp. (RNST) | Tupelo, MS | 7,926,496 | 7.46 | 7.76 | 0.99 | 62.84 | 4.16 | 68,014 | 14.15 | 40.92 | 33.72 |

| 143 | Heritage Commerce Corp (HTBK) | San Jose, CA | 2,361,579 | 7.42 | 8.04 | 0.86 | 63.12 | 4.41 | 16,497 | 22.86 | 25.73 | 60.57 |

| 144 | First Midwest Bancorp (FMBI) | Itasca, IL | 9,732,676 | 7.35 | 7.25 | 0.85 | 63.14 | 3.68 | 82,064 | 18.41 | 6.43 | 4.96 |

| 145 | First National Bank Alaska (FBAK) | Anchorage, AK | 3,569,426 | 7.27 | 7.57 | 1.04 | 60.24 | 3.38 | 36,125 | 10.83 | 12.33 | 10.93 |

| 146 | Columbia Banking System (COLB) | Tacoma, WA | 8,951,697 | 7.14 | 7.93 | 1.14 | 59.45 | 4.35 | 98,827 | 21.15 | 6.96 | 8.80 |

| 147 | Salem Five Bancorp | Salem, MA | 3,845,568 | 7.13 | 6.72 | 0.72 | 67.46 | 2.72 | 26,686 | 2.61 | 9.96 | 12.47 |

| 148 | Sturm Financial Group* | Denver, CO | 2,466,551 | 7.06 | 9.91 | 0.68 | 70.58 | 3.13 | 24,485 | 48.10 | 13.07 | 6.45 |

| 149 | Simmons First National Corp. (SFNC) | Pine Bluff, AR | 7,559,658 | 7.05 | 7.71 | 1.04 | 59.07 | 4.55 | 74,364 | 108.37 | 80.23 | 64.60 |

| 150 | Brookline Bancorp (BRKL) | Boston, MA | 6,042,338 | 7.04 | 7.90 | 0.90 | 56.82 | 3.54 | 52,368 | 15.54 | 3.81 | 7.21 |

| 151 | First Community Bancshares (FCBC) | Bluefield, VA | 2,462,276 | 7.01 | 7.05 | 0.97 | 62.92 | 3.93 | 24,540 | -3.73 | 0.92 | 2.52 |

| 152 | Southwest Bancorp (OKSB) | Stillwater, OK | 2,357,022 | 6.98 | 6.23 | 0.84 | 68.34 | 3.35 | 17,407 | -17.23 | 27.84 | 20.24 |

| 153 | Provident Financial Services (PFS) | Iselin, NJ | 8,911,657 | 6.98 | 7.12 | 0.96 | 57.90 | 3.17 | 83,722 | 13.70 | 7.51 | 4.39 |

| 154 | LegacyTexas Financial Group (LTXB) | Plano, TX | 7,691,940 | 6.88 | 9.12 | 1.10 | 52.15 | 4.00 | 70,916 | 126.73 | 79.38 | 93.77 |

| 155 | CU Bancorp (CUNB) | Los Angeles, CA | 2,634,642 | 6.85 | 7.26 | 0.85 | 57.90 | 3.83 | 21,236 | 138.39 | 12.74 | 18.35 |

| 156 | 1867 Western Financial Corp. (WFCL) | Stockton, CA | 2,615,778 | 6.85 | 8.78 | 1.30 | 53.23 | 3.81 | 30,443 | 55.31 | 16.40 | 13.17 |

| 157 | OFG Bancorp (OFG) | San Juan, PR | 7,099,149 | 6.78 | -0.27 | -0.03 | 61.90 | 5.13 | -2,504 | NM | -8.13 | -10.11 |

| 158 | Union Bankshares Corp. (UBSH) | Richmond, VA | 7,693,291 | 6.65 | 6.76 | 0.90 | 62.25 | 3.89 | 67,079 | 28.59 | 5.92 | 10.10 |

| 159 | CBFH | Beaumont, TX | 2,883,546 | 6.62 | 7.16 | 0.84 | 61.30 | 3.78 | 24,136 | 5.67 | 11.66 | 10.14 |

| 160 | Bangor Bancorp, MHC | Bangor, ME | 3,306,891 | 6.61 | 6.48 | 0.71 | 75.62 | 3.18 | 22,531 | 3.09 | 6.93 | 5.11 |

| 161 | First Bancorp (FBNC) | Southern Pines, NC | 3,362,065 | 6.47 | 7.18 | 0.84 | 68.78 | 4.13 | 27,034 | 8.15 | 5.64 | 12.57 |

| 162 | West Suburban Bancorp (WNRP) | Lombard, IL | 2,172,276 | 6.47 | 7.40 | 0.68 | 72.32 | 3.11 | 14,704 | 7.10 | 0.91 | 5.00 |

| 163 | Columbia Bank MHC | Fair Lawn, NJ | 4,815,697 | 6.33 | 7.33 | 0.64 | 65.26 | 2.63 | 30,621 | 27.38 | 7.10 | 7.47 |

| 164 | First Commonwealth Financial (FCF) | Indiana, PA | 6,566,890 | 6.29 | 6.98 | 0.78 | 62.60 | 3.28 | 50,143 | 12.80 | 5.24 | 3.47 |

| 165 | Origin Bancorp | Ruston, LA | 3,971,343 | 6.21 | 7.48 | 0.76 | 67.63 | 3.43 | 29,078 | 68.49 | 3.67 | 11.21 |

| 166 | Heritage Financial Corp. (HFWA) | Olympia, WA | 3,650,792 | 6.09 | 8.08 | 1.06 | 65.51 | 4.08 | 37,489 | 78.40 | 6.78 | 12.82 |

| 167 | El Dorado Savings Bank | Placerville, CA | 2,028,660 | 6.04 | 6.18 | 0.62 | 63.92 | 2.23 | 12,044 | 1.45 | 7.15 | 12.53 |

| 168 | Cambridge Financial Group | Cambridge, MA | 3,184,365 | 5.88 | 6.14 | 0.62 | 69.45 | 2.99 | 17,873 | 13.77 | 13.21 | 21.12 |

| 169 | Green Bancorp (GNBC) | Houston, TX | 3,786,157 | 5.85 | 4.68 | 0.58 | 54.46 | 3.84 | 15,439 | 4.73 | 73.65 | 44.40 |

| 170 | Middlesex Bancorp MHC | Natick, MA | 4,286,554 | 5.83 | 5.42 | 0.67 | 66.45 | 2.79 | 28,543 | -4.31 | 8.77 | 4.93 |

| 171 | Berkshire Hills Bancorp (BHLB) | Pittsfield, MA | 7,831,915 | 5.70 | 6.14 | 0.68 | 64.70 | 3.30 | 49,518 | 46.75 | 22.18 | 12.61 |

| 172 | Northwest Bancshares (NWBI) | Warren, PA | 8,951,899 | 5.68 | 5.49 | 0.73 | 65.53 | 3.49 | 60,540 | -2.29 | 20.89 | 18.48 |

| 173 | Peoples Bancorp Inc. (PEBO) | Marietta, OH | 3,258,970 | 5.59 | 2.69 | 0.35 | 69.16 | 3.51 | 10,941 | -34.42 | 28.01 | 41.35 |

| 174 | Standard Bancshares | Hickory Hills, IL | 2,444,533 | 5.58 | 7.84 | 0.83 | 64.58 | 3.51 | 20,454 | 43.10 | 5.39 | 16.17 |

| 175 | Dollar Bank | Pittsburgh, PA | 7,347,353 | 5.49 | 5.37 | 0.59 | 71.38 | 2.83 | 41,849 | 14.11 | 7.01 | 7.11 |

| 176 | Cape Cod Five Mutual Co. | Orleans, MA | 2,892,683 | 5.44 | 5.59 | 0.51 | 77.87 | 2.96 | 14,214 | 16.44 | 8.17 | 9.42 |

| 177 | Meridian Bancorp (EBSB) | Peabody, MA | 3,524,509 | 5.42 | 4.19 | 0.74 | 61.69 | 3.31 | 24,607 | 10.21 | 15.10 | 3.24 |

| 178 | Park Sterling Corp. (PSTB) | Charlotte, NC | 2,514,264 | 5.41 | 5.90 | 0.68 | 69.89 | 3.70 | 16,606 | 28.84 | 9.70 | 7.30 |

| 179 | Mutual of Omaha Bank | Omaha, NE | 7,025,122 | 5.41 | 5.61 | 0.62 | 69.51 | 3.33 | 42,632 | 21.29 | 6.99 | 15.71 |

| 180 | Grandpoint Capital (GPNC) | Los Angeles, CA | 3,196,988 | 5.40 | 8.64 | 1.00 | 54.25 | 3.90 | 29,744 | 73.23 | 14.97 | 10.22 |

| 181 | Yadkin Financial Corp. (YDKN) | Raleigh, NC | 4,474,144 | 5.39 | 7.98 | 1.04 | 56.63 | 4.28 | 44,627 | 105.61 | 6.99 | 6.37 |

| 182 | CenterState Banks (CSFL) | Davenport, FL | 4,022,717 | 5.38 | 8.35 | 1.00 | 61.86 | 4.51 | 39,338 | 203.44 | 6.73 | 7.24 |

| 183 | Lone Star National | McAllen, TX | 2,203,708 | 5.34 | 4.35 | 0.49 | 84.03 | 3.45 | 10,627 | -9.52 | -6.66 | 9.93 |

| 184 | Republic Bancorp (RBCAA) | Louisville, KY | 4,230,289 | 5.31 | 6.12 | 0.88 | 65.39 | 3.27 | 35,166 | 22.16 | 9.31 | 24.74 |

| 185 | Eastern Bank Corp. | Boston, MA | 9,589,013 | 5.29 | 5.33 | 0.65 | 76.17 | 3.18 | 62,563 | 13.65 | 5.46 | 8.02 |

| 186 | Liberty Bank | Middletown, CT | 3,989,410 | 5.22 | 4.52 | 0.71 | 77.38 | 3.17 | 27,294 | -16.02 | 2.82 | 8.90 |

| 187 | State Bank Financial Corp. (STBZ) | Atlanta, GA | 3,470,067 | 5.08 | 5.38 | 0.84 | 64.62 | 4.78 | 28,423 | -8.07 | 35.86 | 22.73 |

| 188 | Capitol Federal Financial (CFFN) | Topeka, KS | 9,133,422 | 4.98 | 5.41 | 0.70 | 44.90 | 1.73 | 78,339 | -2.51 | 6.44 | 6.19 |

| 189 | Parkway Bancorp | Harwood Heights, IL | 2,305,148 | 4.94 | 7.65 | 0.71 | 53.69 | 2.70 | 15,800 | 68.12 | 14.97 | 7.12 |

| 190 | Firstrust Savings Bank* | Conshohocken, PA | 2,755,212 | 4.93 | 4.47 | 0.59 | 83.48 | 4.26 | 22,187 | -6.01 | 7.58 | -1.47 |

| 191 | Valley View Bancshares | Overland Park, KS | 3,194,727 | 4.90 | 5.35 | 0.88 | 58.30 | 3.37 | 28,392 | 20.73 | 6.36 | 7.11 |

| 192 | Southern BancShares (SBNC) | Mount Olive, NC | 2,155,893 | 4.79 | 3.69 | 0.36 | 83.91 | 3.58 | 7,856 | 25.08 | 4.49 | 1.94 |

| 193 | Bank Mutual Corp. (BKMU) | Milwaukee, WI | 2,502,167 | 4.70 | 5.07 | 0.59 | 77.53 | 3.12 | 14,177 | -3.26 | 6.62 | 4.42 |

| 194 | Capital Bank Financial (CBF) | Charlotte, NC | 7,449,479 | 4.46 | 5.25 | 0.78 | 62.37 | 3.85 | 54,721 | 7.47 | 12.88 | 7.21 |

| 195 | Union Savings Bank | Danbury, CT | 2,198,946 | 4.13 | 5.73 | 0.54 | 75.29 | 3.20 | 12,039 | 24.40 | -1.56 | 2.49 |

| 196 | Spencer Savings Bank | Elmwood Park, NJ | 2,540,709 | 4.07 | 4.75 | 0.53 | 67.27 | 2.73 | 13,210 | 34.51 | 4.42 | -0.41 |

| 197 | Carlile Bancshares | Fort Worth, TX | 2,343,262 | 3.91 | 5.60 | 0.94 | 67.38 | 4.08 | 21,660 | 64.03 | -3.83 | -0.30 |

| 198 | FCB Financial Holdings (FCB) | Weston, FL | 7,331,486 | 3.81 | 6.21 | 0.82 | 46.21 | 3.65 | 53,391 | 138.65 | 32.22 | 23.12 |

| 199 | Discount Bancorp | New York, NY | 9,321,896 | 3.73 | 7.33 | 0.62 | 56.36 | 2.15 | 60,055 | 167.74 | 5.40 | 20.68 |

| 200 | Home Federal Bank of Tenn. | Knoxville, TN | 2,169,293 | 3.61 | 3.48 | 0.59 | 68.27 | 2.67 | 12,537 | 0.14 | -0.24 | 6.77 |

| 201 | First Connecticut Bancorp (FBNK) | Farmington, CT | 2,708,546 | 3.58 | 5.20 | 0.48 | 75.53 | 2.81 | 12,579 | 34.75 | 10.79 | 13.23 |

| 202 | Manufacturers Bank | Los Angeles, CA | 2,586,927 | 3.46 | 4.34 | 0.52 | 64.47 | 2.53 | 13,164 | 38.92 | 7.88 | 5.69 |

| 203 | Santander BanCorp | San Juan, PR | 5,537,749 | 3.41 | 0.77 | 0.15 | 74.33 | 4.35 | 8,596 | -84.78 | -8.26 | -8.21 |

| 204 | Mercantil Commercebank | Coral Gables, FL | 8,163,493 | 3.29 | 2.19 | 0.19 | 84.75 | 2.25 | 15,045 | -31.90 | 6.17 | -5.13 |

| 205 | Northfield Bancorp (NFBK) | Woodbridge, NJ | 3,202,584 | 3.06 | 3.41 | 0.63 | 63.53 | 2.83 | 19,531 | -3.63 | 22.55 | 22.63 |

| 206 | Capital City Bank Group (CCBG) | Tallahassee, FL | 2,797,860 | 3.00 | 3.31 | 0.34 | 85.00 | 3.31 | 9,116 | -1.56 | 4.59 | 8.82 |

| 207 | TotalBank | Miami, FL | 2,761,804 | 2.98 | 3.51 | 0.58 | 71.81 | 3.05 | 15,836 | 49.59 | 7.31 | 11.28 |

| 208 | Atlantic Capital Bancshares (ACBI) | Atlanta, GA | 2,638,780 | 2.91 | -0.77 | -0.08 | 69.18 | 2.98 | -1,319 | NM | 81.59 | 77.78 |

| 209 | Brand Group Holdings | Lawrenceville, GA | 2,240,297 | 2.85 | 6.19 | 0.53 | 82.20 | 3.68 | 10,783 | 45.97 | 18.73 | 46.60 |

| 210 | Ridgewood Savings Bank | Ridgewood, NY | 5,206,994 | 2.65 | 2.27 | 0.30 | 88.24 | 2.12 | 15,209 | 4.93 | 8.87 | 1.57 |

| 211 | HomeTrust Bancshares (HTBI) | Asheville, NC | 2,728,552 | 2.61 | 2.34 | 0.32 | 77.24 | 3.40 | 8,733 | 3.42 | 6.31 | 2.54 |

| 212 | Beneficial Bancorp (BNCL) | Philadelphia, PA | 4,826,695 | 2.37 | 2.15 | 0.48 | 77.63 | 2.82 | 22,893 | 26.95 | 22.14 | -11.97 |

| 213 | Kearny Financial Corp. (KRNY) | Fairfield, NJ | 4,405,046 | 1.58 | 0.80 | 0.18 | 73.36 | 2.31 | 7,310 | -24.69 | 43.28 | -0.27 |

| 214 | Bank Leumi Le-Israel Corp. | New York, NY | 6,073,477 | 1.31 | 9.41 | 1.09 | 58.38 | 2.83 | 61,822 | NM | 6.74 | 18.60 |

| 215 | National Bank Holdings (NBHC) | Greenwood Village, CO | 4,683,908 | 0.81 | 0.70 | 0.10 | 81.95 | 3.60 | 4,881 | -46.81 | 19.72 | 9.86 |

| 216 | Sun Bancorp (SNBC) | Mount Laurel, NJ | 2,210,584 | -3.91 | 4.03 | 0.42 | 100.10 | 2.74 | 10,220 | NM | 2.65 | -21.35 |

| 217 | Strategic Growth Bancorp | El Paso, TX | 2,214,138 | -6.54 | 0.07 | 0.01 | 113.07 | 3.67 | 235 | NM | 7.77 | 14.96 |

| Median for all 217 institutions | 3,524,509 | 8.79 | 8.84 | 0.94 | 62.28 | 3.53 | 30,621 | 11.46 | 11.17 | 11.28 | ||

| Median for the top 20 institutions | 3,171,816 | 14.02 | 13.31 | 1.27 | 56.48 | 3.72 | 40,435 | 7.48 | 13.41 | 16.33 | ||

| Average for all institutions | 4,355,957 | 8.55 | 8.64 | 0.92 | 63.01 | 3.52 | 40,072 | 19.3 | 16.11 | 16.09 | ||

| Average for the top 20 institutions | 3,806,491 | 14.73 | 13.49 | 1.30 | 59.12 | 3.84 | 55,249 | 8.96 | 16.35 | 15.7 | ||

Notes: Ranking is of top consolidated bank holding companies, banks, and thrifts with total assets of between $2 billion and $10 billion as of 12/31/15 and is based on three-year average return on equity for 2013 to 2015. Additional data is for the year ended 12/31/15; year-over-year changes compare 2015 to 2014. Financials are from SEC filings. If unavailable, regulatory financials were used.

Excludes industrial banks, nondepository trusts, foreign-owned banks and bankers' banks, as well as institutions with credit cards to total loans of more than 25%, loans to total assets of less than 20% or loans to total deposits of less than 20%. Excludes institutions with a leverage ratio of less than 5%, a Tier 1 risk-based capital ratio of less than 6%, or a total risk-based capital ratio of less than 10% during any quarter in the ranking period. Excludes institutions that received a tax benefit of greater than 10% of net income or that did not report data for any year in the ranking period. Also excludes institutions that have fewer than five depository branches and are owned by a company not primarily focused on commercial or retail banking. Based on the preceding criteria, 60 institutions in this asset size range were excluded from the ranking. Ties broken using first the 2015 ROAE and subsequently the 2014 ROAE.

* Denotes institutions that operated as a subchapter S corporation for at least one quarter between 2013 and 2015. Their profitability ratios were calculated from regulatory financials and adjusted using an assumed tax rate.

‡ Metro Bancorp was acquired in February 2016.

Source:

© 2016 American Banker Magazine