The bank's Kinexys blockchain unit processes a fraction of the institution's overall payment volume. It's betting that an appetite for the technology's promise of speedy processing and liquidity will make that larger.

The Michigan bank hopes conversational technology can get customers to talk more freely about their financial health.

-

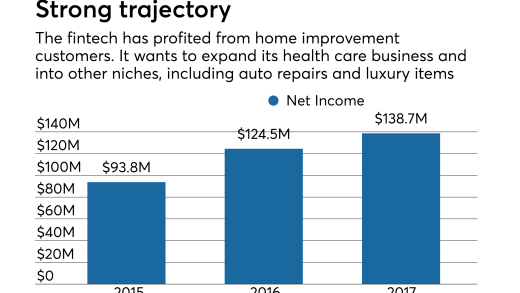

Financial technology veteran Steven Pinado, who assumed the fintech's top role this week, says the demand for an easy checkout experience will drive growth.

-

BNPL lender Klarna officially revived its highly anticipated IPO, and cryptocurrency exchange Gemini also announced plans for a public offering. The offerings follow Chime and Circle's blockbuster IPOs in June.

-

The Cleveland-based credit union recently launched a fractional stock rewards program for members ages 18 to 28 through a partnership with Bits of Stock.

Items include estimations of President-elect Donald Trump's impact on fintech funding, the fallout from VyStar Credit Union's tech moves and more.

As the holiday shopping season approaches, retailers are grappling with how to optimize their inventory and set prices amid higher tariffs. A new Wells Fargo report sheds light on how businesses are adapting.

A proposal from the Office of the Comptroller of the Currency would roll back Biden-era recovery planning rules for banks, leaving them with broad discretion to determine their own recovery protocols.

-

For fintech to achieve its true potential of democratizing financial access for all, we need diverse viewpoints among fintech founders, board members and advisors.

-

With vast amounts of capital locked in privately held companies, both employees of those companies and average investors would benefit from a loosening of the rules restricting private investment.

-

The decision to stop requiring U.S. companies to report beneficial ownership information is misguided. The compliance burden could be substantially eased by collecting the data at the state level.

-

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

-

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

-

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

-

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

-

It's not just Capital One Cafés; banks all over the country are repurposing branches and offices. Marketing experts call it innovative, but critics say some lenders are crossing a legal boundary between banking and commerce.

-

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Tom McFarland leads Novidea's UK product roadmap and business analysis function. Through his industry expertise, close relationship with existing clients and engagement with prospects, Tom ensures the delivery and ongoing enhancement of Novidea's platform provides added value to brokers and MGAs. Tom holds strong partnerships within the insurtech community, enabling practitioners to benefit from a connected insurance ecosystem. Having spent time in operations roles within Specialty Broking and Delegated Authority, Tom's comprehensive understanding of the challenges at each stage of the insurance value chain ensures that the Novidea platform solves the challenges of today and prevents the problems of tomorrow. Tom is keen to drive transformation across the industry, particularly within the Specialty and Lloyd's markets, where there is enormous opportunity for technological modernisation and adoption.

The bank, which has ties to prominent right-wing political figures, is touting its intention to embed cryptocurrency into loans, deposits and investment offerings.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsored by S&P Global

- Sponsor Content from Chargebacks911

-

- Sponsor Content from Finzly