The San Francisco-based banking giant reported a 9% annual jump in quarterly profits. It also made official its appointment of CEO Charlie Scharf as chairman.

Regulations proposed by New York State regulators provide stricter and more specific guidance than banks have received from the federal agencies, especially in areas like data encryption and multifactor authentication.

-

The credit card company is seeing fewer customers fall behind on their payments. But with lower-income consumers still being pinched by inflation, Synchrony isn't loosening its lending standards.

-

The credit card giant says its proposed acquisition of Discover would facilitate a bevy of community development activity and philanthropy. But some public advocacy groups are skeptical.

-

CTrust is providing scores specific to the legal weed business, an industry that poses a lot of challenges and opportunities for banks and other lenders.

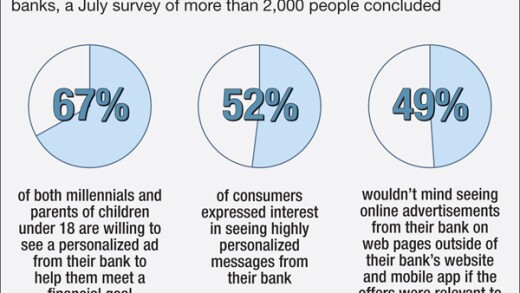

It can be difficult for financial services companies to glean customer insights from the abundance of information they have.

The Cleveland-based bank took a hit from a large bond sale, leading to a quarterly loss. But net interest income rose, and the company expects that metric to hit a key milestone in the fourth quarter.

The rebate, which would be geared toward boosting U.S. manufacturers, would be issued at the end of the year to offset the effects of retaliatory tariffs.

-

In his new book, "The Song of Significance," Seth Godin, a business management author, dives into how executives can rethink being profit driven and help create meaning in the work for employees.

-

Artificial intelligence can and should be integrated into the business of banking, but with adequate safeguards in place to mitigate the technology's potential vulnerabilities.

-

The real threat is from undercapitalized banks, and regulators must require large banks to have enough capital to eliminate that threat.

-

Within the bank's tech, operations and services organization, Brady has minimized turnover and preserved institutional knowledge.

-

In 2024, as the Alabama-based bank was facing more competition on its Southeast home turf, Danella was laser-focused on customer satisfaction.

-

Heitsenrether has been leading the charge on deployment of advanced AI throughout the bank.

-

On Beer's radar: AI, quantum computing, concentration risk

-

Piepszak kicked off the year stepping into the chief operating officer position, but she's taken herself out of the running for CEO.

-

The Most Powerful Women in Banking, No. 3, Marianne Lake, JPMorganChase

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

The Department of Government Ethics on Saturday released financial disclosures for former Federal Reserve Gov. Adriana Kugler, showing she had executed several individual stock trades in 2024, including during Fed blackout periods, an apparent violation of Fed ethics rules. The Federal Reserve Inspector General has launched an investigation.

The 23rd annual ranking of women leaders in the banking industry.