The Brazil-based neobank has 122.7 million customers in three countries and is focused on international expansion.

Airbnb, the company that disrupted the hospitality industry as Uber did to taxis, is sidling up to the fintech space.

-

Ambitious women who feel trapped in their roles sometimes find themselves competing against others with the same goals. An effective way to advance may require stepping off the most obvious path, according to executives sharing their personal experiences at American Banker's Payments Forum.

-

A federal appeals court is putting the transfer of a lawsuit challenging the Consumer Financial Protection Bureau on hold pending the outcome of a hearing on the suit's appropriate venue.

-

Judge Mark T. Pittman sided with the Consumer Financial Protection Bureau in ordering the case be moved from Texas to the District of Columbia due to "forum shopping."

The services that Kasisto, Personetics, North Side and Teller offer banks to automate interactions vary in their levels of personality and the workload they can handle.

The top five banks and thrifts had combined assets of more than $13 trillion as of March 31, 2024.

The Treasury will no longer enforce Corporate Transparency Act reporting rules for U.S. businesses, a move critics say weakens anti-money-laundering efforts.

-

Federal banking regulators should allow banks to receive Community Reinvestment Act credit for making loans to community news organizations.

-

A new study finds that in the six months after a rate cap was imposed in Illinois, the number of subprime loans being made declined, and subprime borrowers reported a decline in their financial well-being.

-

The Supreme Court's insistence that Congress expressly authorize regulatory action on 'major questions' is destined to run afoul of the administration's efforts to set rules of the road for cryptocurrency.

-

Leslie's mandate spans the entire investment banking and trading apparatus at Goldman.

-

In addition to overseeing wholesale banking, LoCascio is managing dozens of the bank's technology projects.

-

In a still challenging CRE market, McShane emphasizes careful underwriting and sticking to fundamentals.

-

Following the bank's acquisition of Heartland Financial, Wilson and her team have been in "extremely heavy lifting" mode.

-

Last year, Wolverton implemented a new AI fraud detection technology that helped to reduce fraud and operational losses by $3.2 million.

-

During the past three years, Menelik has launched CSG services for eight new verticals including one for Native American tribal and corporate banking.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The credit union fintech and core provider partnered to launch three new agentic AI-powered tools for credit unions that work with existing systems.

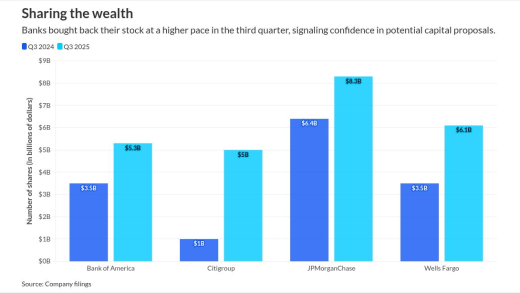

Large banks seem comfortable paring back their capital positions while they await an updated proposal on the so-called Basel III endgame. The rules are widely expected to be more lax than what was proposed during the Biden administration.

The 23rd annual ranking of women leaders in the banking industry.

-

- Sponsor Content from Fiserv

- Sponsor Content from IBM

- Sponsor Content from IBM