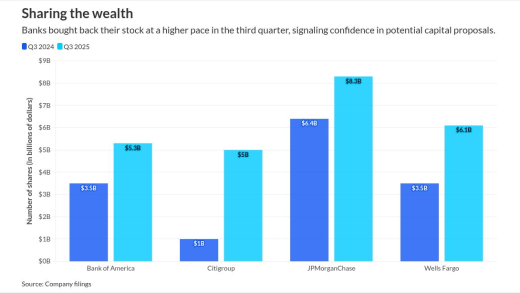

Large banks seem comfortable paring back their capital positions while they await an updated proposal on the so-called Basel III endgame. The rules are widely expected to be more lax than what was proposed during the Biden administration.

The credit bureaus will change the way they include information about tax liens and civil judgments in credit reports. This could spur lenders' use of alternative credit data.

-

Banks are taking hits in the stock market as they use 2024 to restructure balance sheets and inflation slightly increased in November.

-

Fast-growing innovation is sparking bullish sentiment following a boom-and-bust cycle of the past four years.

-

The account-to-account payment method has become prevalent in countries such as China, India and Brazil, but adoption has been slow in the U.S. and limited to small- and medium-sized businesses. That paradigm is expected to shift amid continued fintech investment.

In an international expansion move, AI-powered grocery cart startup Caper has begun a pilot with one of Canada’s largest grocery chains, Sobeys, at a suburban Toronto location.

Catastrophic weather events illustrate the risks and opportunities for banks.

The first-of-its-kind growth restriction established a new precedent for how regulators can address a broken bank culture. With scant information about why the cap was lifted, the action provides little clarity on what Wells did right — or what the Fed did wrong.

-

Specialized large language models should be harnessed to help financial institutions identify and halt fraudulent activity. The best model would involve regulator-approved pooling of anonymized customer data.

-

Financial services companies must incorporate digital, technical and cognitive empathy into the way they think about delivering their products in a digitized future.

-

The questions about whether the Home Loan banks receive a public subsidy has been settled. All that remains is for lawmakers to take steps to redirect that subsidy toward public benefits rather than corporate profits.

-

New York State's former top regulator Adrienne A. Harris has rejoined Sullivan & Cromwell as of counsel and senior policy advisor; Founders Bank appointed Karen Grau to its board of directors; Deutsche Bank's DWS Group is opening an office in Abu Dhabi; and more in this week's banking news roundup.

-

Earned wage access provider EarnIn, which historically has been known for direct-to-consumer EWA, is now offering a payroll software solution. The move comes as consumer advocate groups step up efforts for stricter regulation of the industry.

-

As the political dispute drags on, there are implications beyond government disbursements, potentially harming corporate cash positions and the larger economy, according to payment experts from Billtrust and research firms.

-

As the Office of the Comptroller of the Currency receives a spurt of applications for national trust charters from crypto and payments firms, bank trade groups are urging regulators to ensure proposed activities fit within the statutory limits of the charter and the law.

-

A new study has decoded banks' television commercials, analyzing what the messaging reveals about the bank behind the advertisement. When an ad leans too hard on emotions, researchers found, viewers should beware.

-

The head of the government-sponsored enterprise's oversight agency said the cuts were made to positions that weren't central to mortgages and new home sales.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Plaid

- Sponsored by S&P Global

- Sponsored by S&P Global

- Sponsored by S&P Global