CEO Max Levchin said the lender is testing technology that allows merchants to perform more advanced testing of promotional financing offers.

The Brazilian digital bank Banco Inter now has a license from the Federal Reserve Board and the state of Florida to establish a virtual "branch" in Miami.

-

Prosecutors claim the Forbes 30 Under 30 honoree maintained two sets of books to hide Kalder's actual revenue of just $60,000.

-

The buy now, pay later lender is carving out a lane for itself with exclusive deals with Intuit's Quickbooks Payments and Expedia's websites. It also will be the default BNPL provider for Bolt's one-click checkout.

-

HP CEO and current PayPal board chair Enrique Lores will take over March 1, following a deep slump in the payment company's key metric.

The Connecticut bank invited rival bankers, lawyers and regulators to share their experiences with and warnings on using AI.

Acquiring the $5.8 billion Northfield Bancorp would give Columbia a presence in both Brooklyn and Staten Island. The deal provides a window into the impact of New York Mayor Zohran Mamdani's plan to freeze rents on the city's multifamily real estate market.

Community bankers say credit unions and new fintech entrants are increasing the competition for deposits and loans, even as deregulation is lowering capital and compliance costs, according to a new survey from reciprocal deposit provider IntraFi.

-

Instead of fighting to keep the banking industry unchanged, perhaps it's time for banks to accept that change is inevitable and focus on adapting to remain competitive.

-

As tokenization increasingly brings instant settlement to transactions, the liquidity buffer that batch settlement has provided for decades is going to shrink and then disappear. Banks will need to rethink liquidity management.

-

While they may look like a tool for reinforcing customer's connection to their banks, loyalty coalitions present serious risks if they are not constructed properly and monitored continuously.

-

-

The payment company opened a new office in Dublin to battle rivals like Adyen, Stripe and PayPal.

-

Community bankers say credit unions and new fintech entrants are increasing the competition for deposits and loans, even as deregulation is lowering capital and compliance costs, according to a new survey from reciprocal deposit provider IntraFi.

-

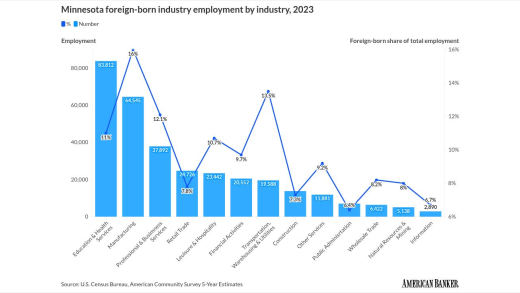

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

-

Pulte says a GSE stock offering remains likely in 2026, but other policy paths are in play. NMN survey data shows the industry expects broader changes first.

-

Federal Reserve Gov. Stephen Miran, who had been on a leave of absence from his position as Chair of the White House Council of Economic Advisers since he was confirmed to the central bank in September, resigned his CEA role Tuesday to uphold his promise to resign his White House role if he remained past the expiration of his term, which concluded Jan. 31.

- In-person EventsDelivered as neededLearn and connect at our industry relevant events.

- Virtual EventsDelivered as neededLearn and engage from anywhere at our industry-relevant virtual summits.

- WebinarsDelivered as neededInteractive presentations led by industry insiders on current trends affecting your industry.

- ResearchDelivered as neededContribute your insights to future research studies.

Two years on from a federal report recommending the creation of a resolution fund to guard against disorderly bankruptcies, concentration among nonbank mortgage companies has only increased. Congress must take action to avoid a crisis.

Doug Simons is a former investment banker who worked at Morgan Stanley, Credit Suisse and UBS as an advisor to U.S. banks and other financial institutions. Most recently, he served as a senior markets and policy fellow at the Consumer Financial Protection Bureau, where he advised the director and his team on issues related to the banking industry. In this role, he also represented the CFPB on FSOC's Systemic Risk Committee.

The Chief Wholesale Banking Officer at Truist in conversation with Chana Schoenberger, Editor-in-Chief of American Banker, about her business.

-

-

-

- Partner Insights from Infosys