-

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

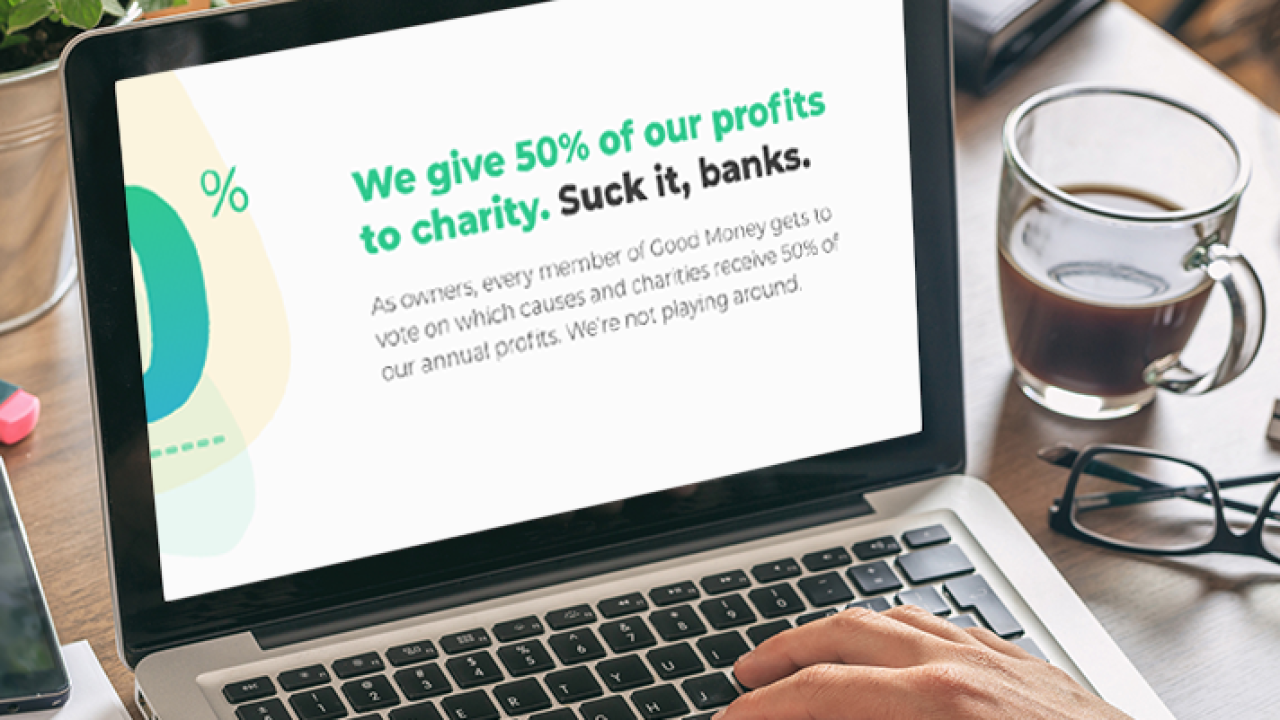

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

The regulator claimed Congress has already granted it the authority to define field-of-membership areas.

December 7 -

A recent report – supported by the National Council of Postal CUs – says the USPS is ill-equipped to manage the risks involved in offering banking services.

December 7 -

A report released Tuesday echoes bankers’ arguments that the USPS is ill-equipped to manage the risks.

December 4 -

Bank groups are pushing a variety of proposals to delay the loan-loss rule or soften its impact. The accounting standards board has agreed to review at least one of them — but at a pace that might not be fast enough for lenders.

November 21 -

Tester is the only Democratic supporter of the recent regulatory relief package sitting on the Banking Committee to win re-election this fall.

November 7 -

Jon Tester is the only Democratic supporter of the recent regulatory relief package sitting on the Banking Committee to win re-election this fall.

November 7 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

The assessment is designed to get banks on the same page in combating cybersecurity and make it easier for institutions and regulators to assess their performance.

October 25 -

Frank Sorrentino, CEO of ConnectOne, says bankers who are unwilling, or unable, to invest in technology upgrades may have to find buyers as competition heats up.

October 23 -

The association has invited FIS, Fiserv and Jack Henry to join a committee tasked with helping smaller institutions modernize technology.

October 23 -

Jeff Szyperski wants regulators to update the definitions of assessment areas under the Community Reinvestment Act, and remove 'arbitrary' asset thresholds from bank regulation in general.

October 22 -

A former employee of the banking trade group is accusing some of its executives of allegedly creating a “boy’s club” atmosphere that discriminated against women and minorities on staff.

October 21 -

Credit unions won't have to comply with the controversial rule until at least 2020, but a separate proposal on alternative capital could raise the ire of banking groups.

October 18 -

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

The Mass.-based credit union is the latest to drop its federal charter in favor of state oversight.

September 26 -

Unlike previous spots produced by the group that just backed candidates, the latest ones reflect a somewhat different approach.

September 19