Laura Alix is a reporter at American Banker.

-

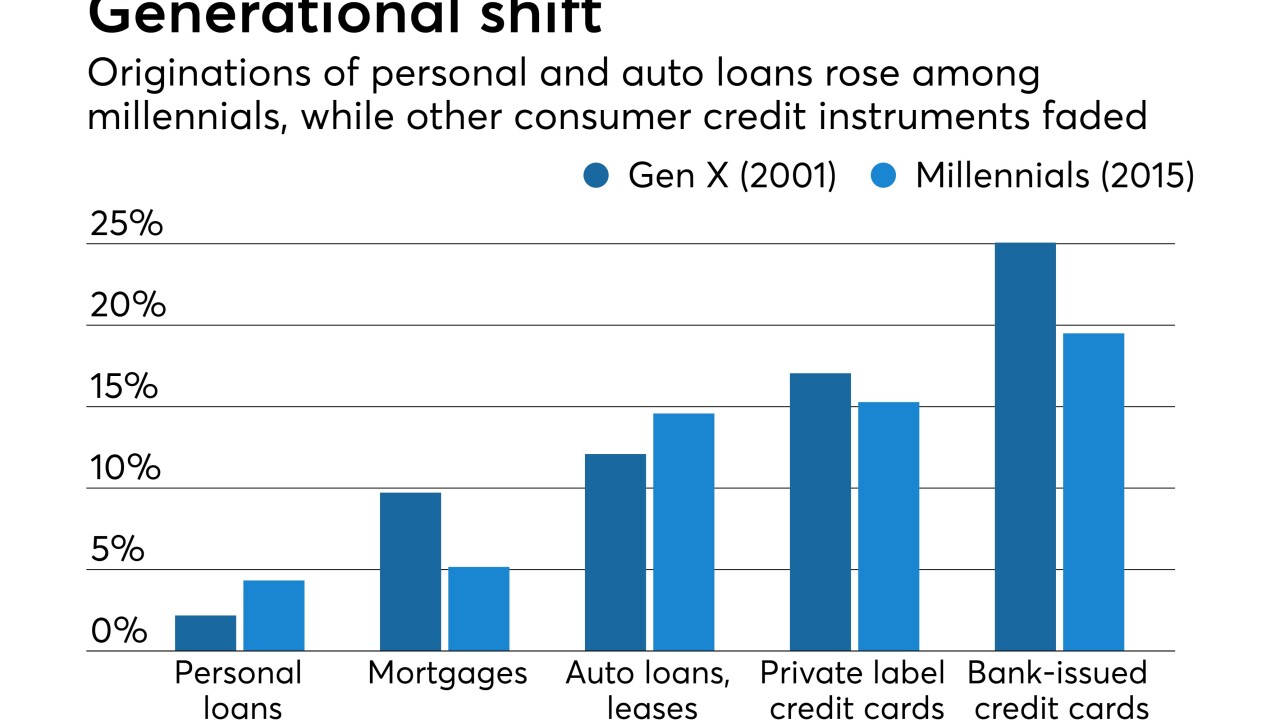

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

By Laura AlixAugust 30 -

To head off ethical concerns often raised by university-corporate partnerships, Bank of the West is not paying kickbacks for accounts. Instead it is cultivating student input and chipping in for scholarships, internships and emergency food assistance.

By Laura AlixAugust 22 -

Balances 90 days past due are noticeably higher in 2017, new N.Y. Fed data shows. Though the trend has a lot to do with positives like economic expansion and easier access to credit, officials say it deserves careful attention.

By Laura AlixAugust 15 -

People’s United recently won the deposit business of the states of Massachusetts and Vermont, punctuating a multiyear plan to expand in government banking. But it’s a hard niche to succeed in, and, as other banks can attest, it can invite controversy.

By Laura AlixAugust 15 -

Young businesses often prefer banks, especially community banks, over online lenders. However, traditional lenders need to make quicker decisions, simplify the application process and make other improvements, these customers say.

By Laura AlixAugust 8 -

The global bank’s U.S. unit has bounced back, aided by growth in deposits and wealth management profits as well as a focus on international customers. A $125 million investment in tech and branches hasn’t hurt either.

By Laura AlixAugust 4 -

Insurers are seeing modest gains in market share as banks, facing increased scrutiny from regulators, lightly tap the brakes.

By Laura AlixAugust 1 -

Core deposit growth might be the best indicator of which banks will have true staying power in the years ahead.

By Laura AlixAugust 1 -

Lustig, Glaser & Wilson often harassed the wrong consumers, demanded amounts that were not owed, bullied consumers into paying from exempt income, and failed to obtain legitimate documentation of those debts, state officials said.

By Laura AlixJuly 27 -

The Miami Lakes company’s chargeoffs of medallion loans increased fivefold, but profits rose thanks to gains in C&I, CRE and other types of loans.

By Laura AlixJuly 26