Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

ZestFinance is bringing its machine learning software ZAML to Brazilian retailer Via Varejo and its digital banking subsidiary Banqi to power the credit underwriting for Varejo’s “carnês” point-of-sale microfinance lending product.

July 19 -

Swift completed a seven-country trial of its cross-border GPI Instant payment service resulting in the successful integration with Singapore’s domestic instant payment network FAST.

July 18 -

The developer of the internet-connected card Dynamics Inc. will use Sprint’s Curiosity internet-of-things service to power the over-the-air device management and intelligent data capabilities of its Wallet Card.

July 18 -

Swift is building out its Global Payments Innovation (GPI) service to allow corporations to initiate and track payments across all of their banking partners from a single source.

July 17 -

Often overlooked as prospects by financial services institutions who have increasingly focused on the wealthy, hourly workers represent a massive pool of underserved consumers with distinct financial needs.

July 11 -

Vehicle payment technology startup Car IQ raised $5 million in a Series A funding round that included Citi Ventures as an investor.

July 10 -

Prepaid card and payments technology company InComm has acquired Meridian Loyalty, a full-service incentives business that caters to corporations.

July 9 -

Merchant acquirer Credorax has engaged money transfer company Small World Financial and other partners to cover a broader mix of banking and payment acceptance available to the companies' European clients.

July 9 -

Sensing a profitable opportunity in an underserved market, a variety of companies — ranging from traditional banks to fintech startups and even Amazon — are rushing into selling secured credit cards and other products designed for consumers with poor or thin credit.

July 9 -

U.K.-based small business lender Capital on Tap has partnered with small business software provider Receipt Bank to launch a new credit card with access to credit lines.

July 8 -

Swish is expanding to physical stores to extend usage among the millions of Swedes who use the app for account-to-account transfers.

July 3 -

FamilyMart and 7-Eleven Japan are using mobile payment technology to compete with each other and attempt to manage the country's labor shortage.

July 2 -

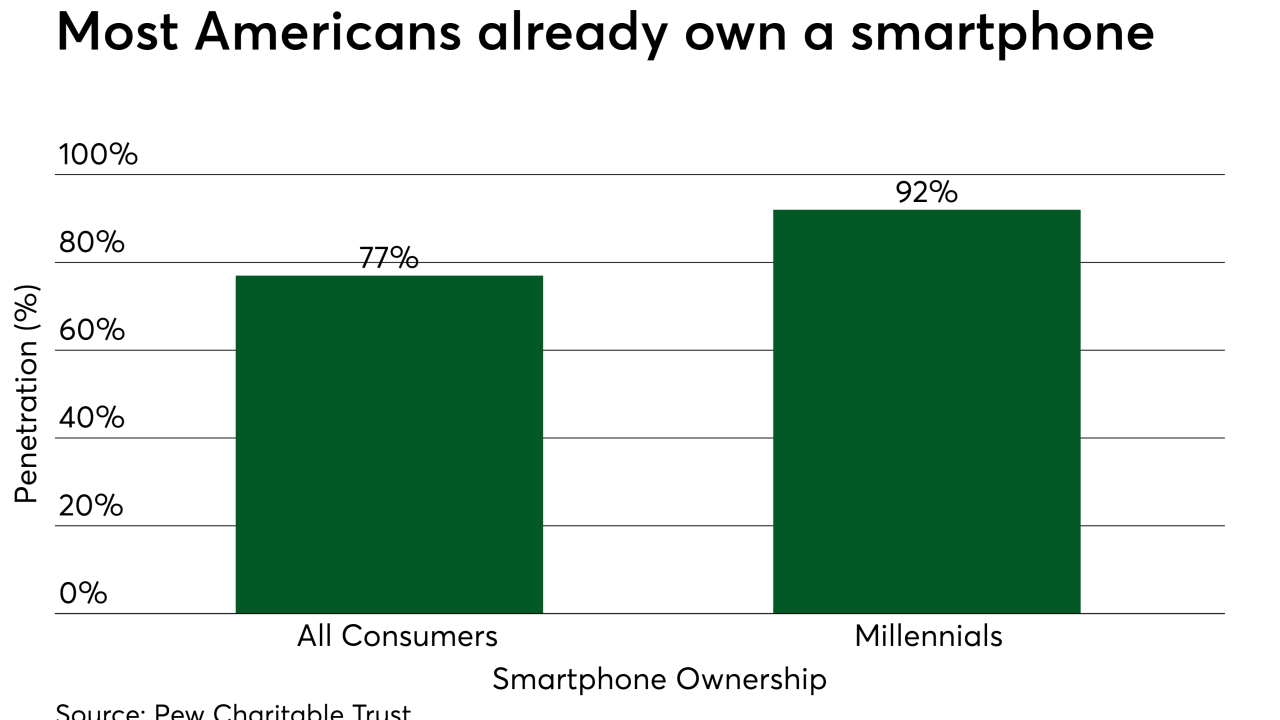

Fiserv is supporting mobile bill presentment in to meet a growing demand for receiving and paying bills through smartphones, which are now nearly ubiquitous in the U.S.

July 1 -

Visa has signed a definitive agreement to acquire the Los Angeles-based chargeback and dispute resolution platform provider Verifi.

June 28 -

Installment lending, whether it’s online or at the physical point of sale, is a market sector that has been experiencing a global boom in consumer demand for the last several years. Is this a short-term trend or are there potentially deeper-rooted factors that could make installment lending, especially online, a major source of future loans?

June 28 -

Merchant holdouts are finally warming to the likes of Apple Pay, years after the mobile wallet's launch. Competitive offerings have also flourished from mobile operating systems and phone providers.

June 24 -

In a bid to keep pace with coffee arch-rival Starbucks’ delivery and mobile order-ahead services, Dunkin’ is working with Grubhub to roll out New York delivery.

June 18 -

The fraud challenge faced by issuers and merchants alike has become increasingly complex over the last few years with the prevalence of e-commerce and cross-border payments. Visa's response to these trends has benefited heavily from the global scale it got by reabsorbing Visa Europe in 2016.

June 17 -

PPRO needed a quick fix to retain clients looking for a Latin American payments solution, acquiring local payments specialist allpago rather than embark on an IT project.

June 13 -

Long gone are the days when consumers had their Social Security and driver’s license numbers pre-printed on their paper checks for faster identity verification. Consumers now understand that such precious elements of their identity need to be better protected.

June 12