Polo Rocha is a Mexico-based freelance reporter who worked at American Banker from 2021 to early 2025, covering consumer finance and national banking trends. He previously covered the Federal Reserve at S&P Global Market Intelligence and state politics at WisPolitics.com. He graduated from the University of Wisconsin-Madison and has a master's in finance degree from Johns Hopkins University.

-

The bank’s decision to offer home improvement loans directly will not have a material impact on profits at the Atlanta-based fintech, according to GreenSky.

By Polo RochaAugust 12 -

Moore Capital Holdings alleges that TD showed a “total and systemic failure” to respond to a cyber scam that cost the company more than $275,000.

By Polo RochaAugust 11 -

Steven Black was a board member of BNY Mellon when Wells CEO Charlie Scharf led the trust bank. He will become Wells Fargo’s fifth chairman in five years.

By Polo RochaAugust 10 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

By Polo RochaAugust 4 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

By Polo RochaJuly 29 -

Community banks, which rely more on the charges than their larger counterparts do, were instrumental in staving off new regulation during the Obama era. But much has changed since Democrats last held power in Washington.

By Polo RochaJuly 27 -

Derek Ellington will replace Steve Troutner, who is stepping down for personal reasons. He will report to Mary Mack, the bank's CEO of consumer and small-business banking.

By Polo RochaJuly 23 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

Tanya Sanders, who joined the company in 2019, takes the reins as the division's loan growth is on an upswing. She will succeed Laura Schupbach, who is retiring after 26 years at Wells.

By Polo RochaJuly 21 -

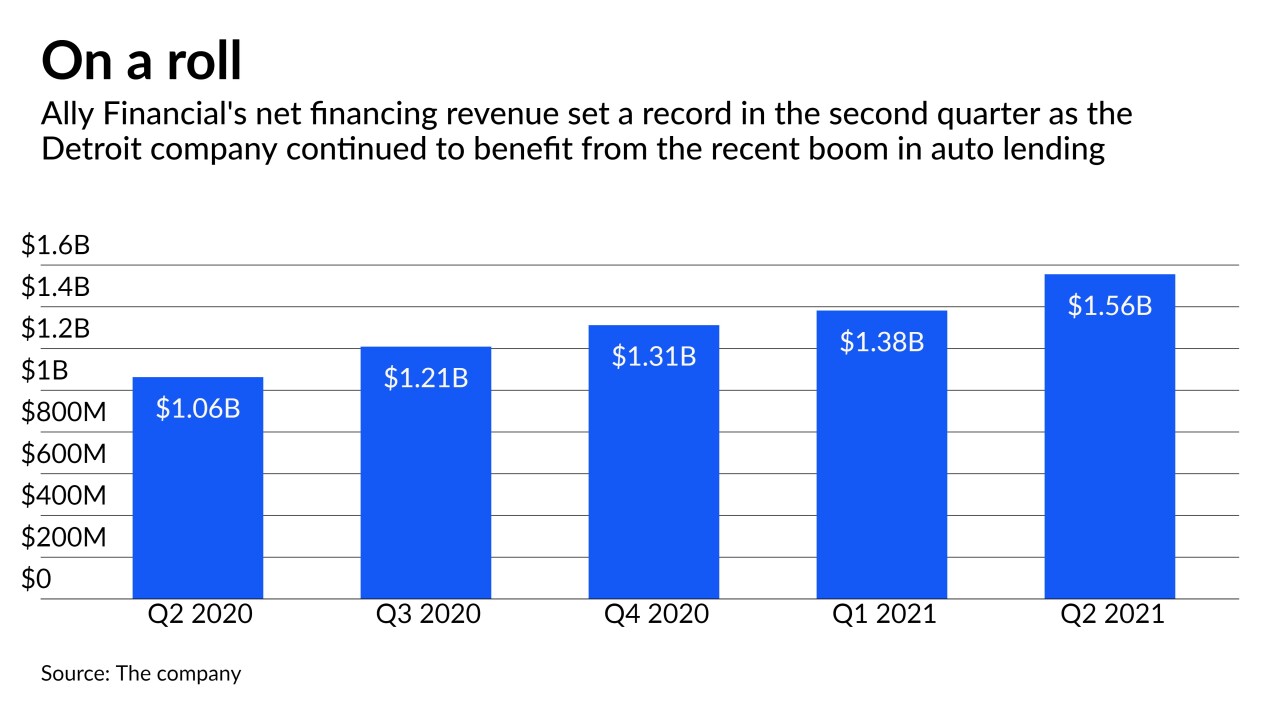

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

By Polo RochaJuly 20 -

Pro basketball sponsorships have long been the domain of banks and other traditional advertisers. But now companies like Chime, LendingTree and FTX.us are making their names known through partnerships with NBA teams.

By Polo RochaJuly 19 -

The agreement will likely end a three-year-old dispute over allegations that the company misled borrowers by promising no hidden fees on its consumer loans.

By Polo RochaJuly 15 -

The bank's noninterest expenses fell by 8% in the second quarter — a sign that CEO Charlie Scharf is making progress in reining in spending that had been soaring in recent years amid heightened regulatory scrutiny. He ultimately hopes to reduce gross expenditures by $8 billion annually.

By Polo RochaJuly 14 -

The credit card issuer’s move will increase the pay of more than 5,000 employees. Numerous banks have recently raised their minimum wages in a competitive labor market.

By Polo RochaJuly 13 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

By Laura AlixJuly 13 -

Wells CEO Charlie Scharf, a former Jamie Dimon protege, has surrounded himself with JPMorgan Chase alumni. Ling will start in October and join the company’s operating committee.

By Polo RochaJuly 8 -

Prosecutors have rested their case against onetime bank CEO Stephen Calk, who allegedly approved millions of dollars in loans in exchange for a potential job in the Trump administration. Federal Savings Bank employees have testified against Calk, whose lawyers have sought to shift blame to underlings

By Polo RochaJuly 8 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

By Polo RochaJuly 2 -

CEO Richard Fairbank told employees they can continue to work remotely on Monday and Friday, though the company is still encouraging them to “spend meaningful time” in the office collaborating.

By Polo RochaJune 30 -

Nine of the 12 largest banking companies in the U.S. proposed higher quarterly payouts to shareholders. In announcing the actions, the banks touted their strength after more than a year of economic dislocation.

By Polo RochaJune 28