-

Navient and Nelnet, the two largest student loan servicers, avoided downgrades on some $18 billion of bonds by extending their maturities. Getting the required consents from investors would normally take ages, but recent innovations speeded the process.

May 3 -

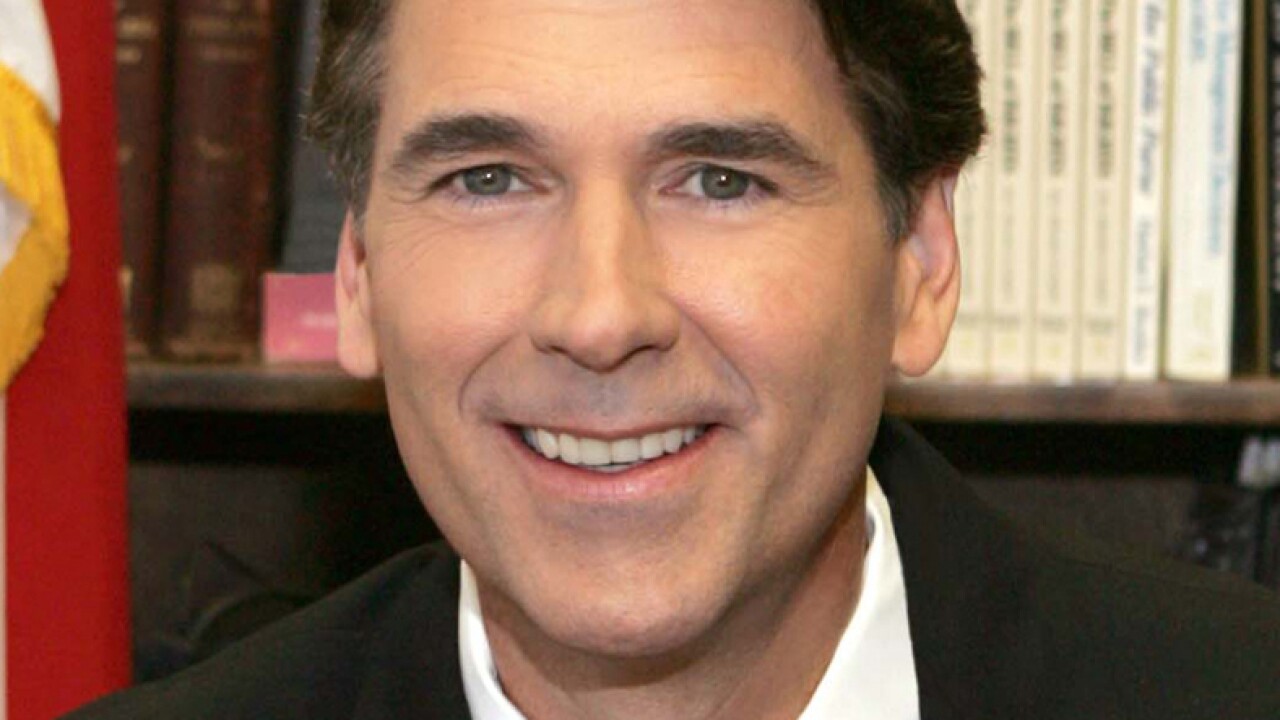

Richard Moore, CEO of First Bancorp in North Carolina, believes he can unlock more shareholder value through acquisitions and by taking advantage of disruption elsewhere.

May 3 -

Freddie Mac's serious delinquency rate dropped below 1% for the first time since 2008, lending credence to its efforts to expand credit access.

May 2 -

The company, which delisted from the Nasdaq in 2005, is looking to raise up to $64 million through an initial public offering.

May 2 -

In an echo of the rescue deals of 2007 and 2008, New Residential's CEO framed the transaction as something undertaken to benefit the entire industry.

May 1 -

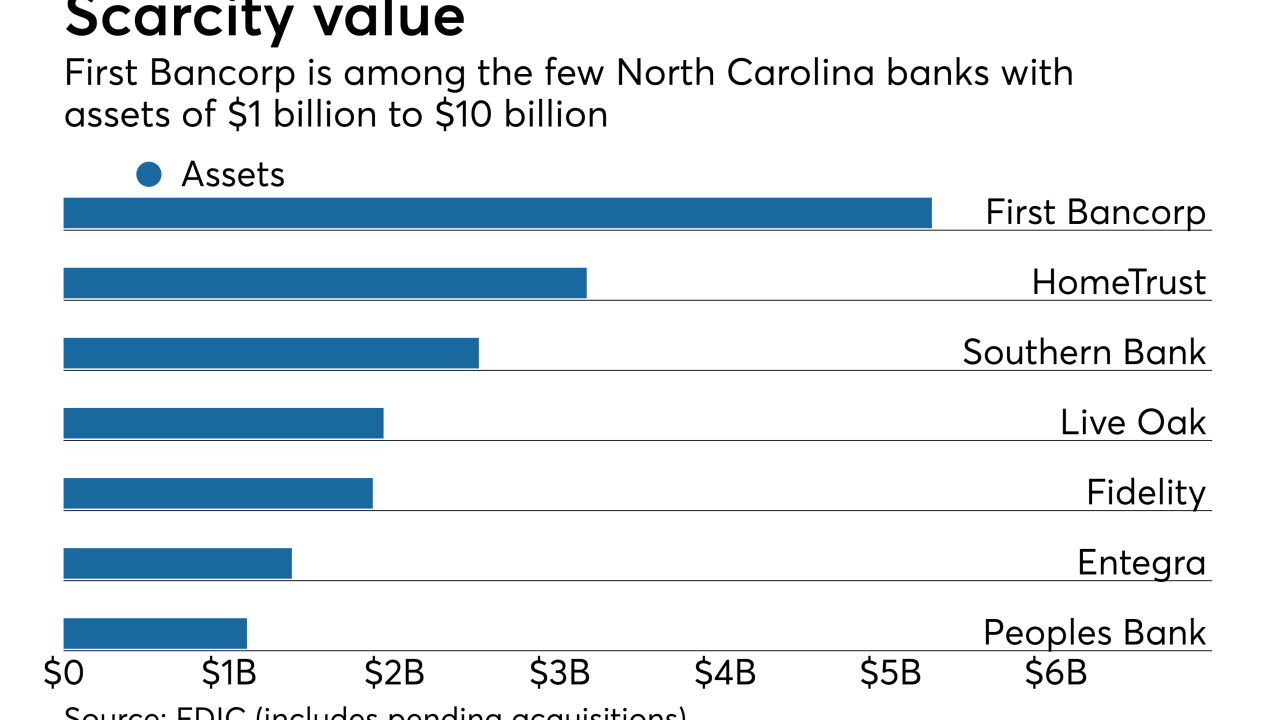

First Bancorp has emerged as one of the few consolidators in North Carolina at a time when many other banks in the state have opted to sell.

May 1 -

The $34 million acquisition is expected to strengthen Central Valley's banking operations in northern California.

May 1 -

The onslaught of regulatory actions against Ocwen may open the door for Nationstar to pick up a massive subservicing portfolio from the beleaguered servicer.

April 27 -

The acquisition will provide South State with more than $3 billion in assets and a larger operation in North Carolina.

April 27 -

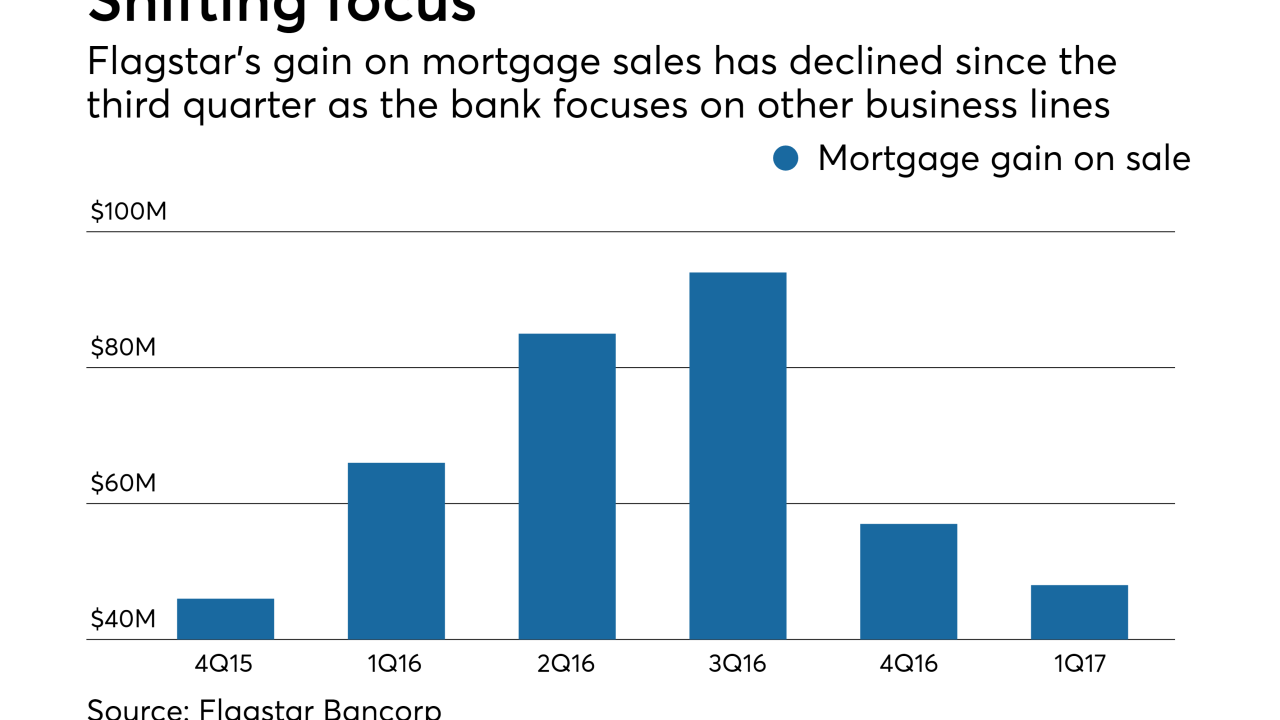

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25