-

The Dallas consumer lender says it plans to boost subprime originations again after retooling its portfolio and taking stock of the economy.

October 27 -

Barclays and the Justice Department, engaged in a legal battle over the suspected fraudulent sale of mortgage securities a decade ago, have revived discussions about reaching an out-of-court settlement, according to people with knowledge of the situation.

October 27 -

The tighter spreads on the fintech student lender's latest securitization should help offset a rise in the underlying benchmark rates, keeping its funding costs low — and helping it compete more effectively.

October 27 -

The company, which agreed to buy Southwest Bancshares in Mobile, also plans to sell $45 million in stock to help fund the deal.

October 24 -

Banks are swapping out long-term holdings for short-term securities to manage interest rate risk. But in the process, they are sacrificing yield — and ammo they might need to pay more for deposits to retain customers.

October 24 -

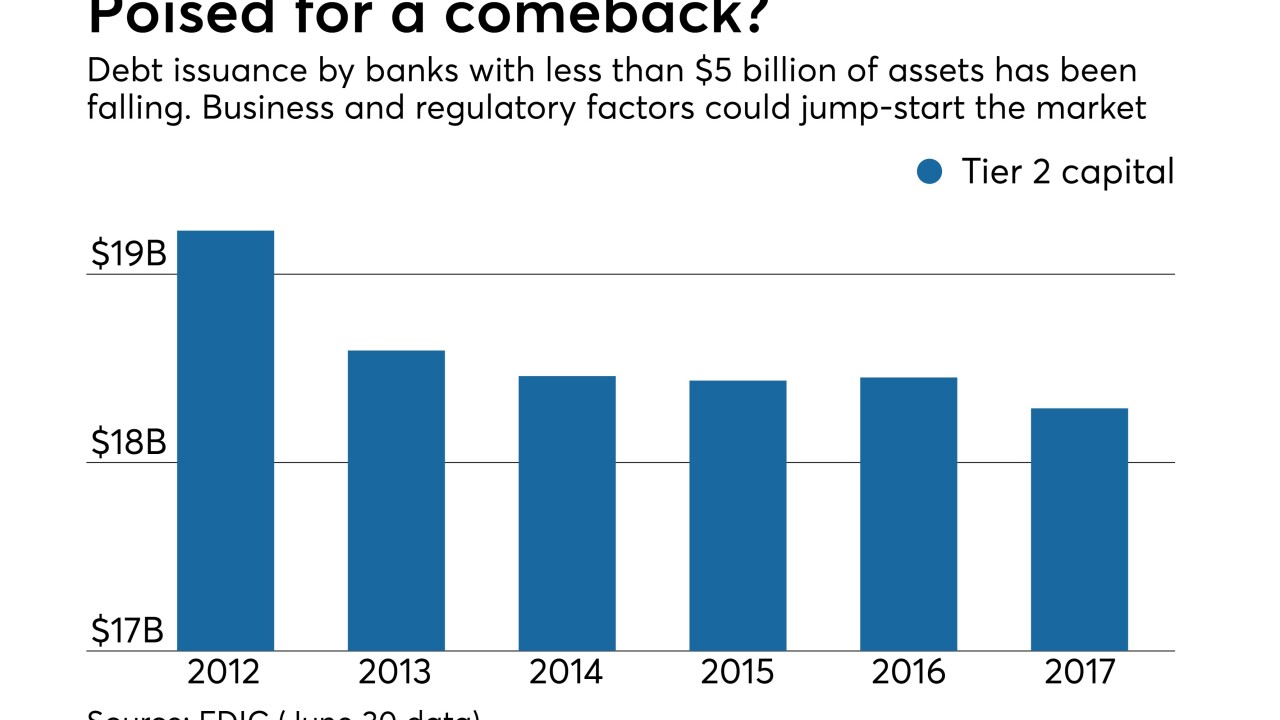

Increased investor appetite and the emergence of specialized debt ratings are expected to spur demand, and community banks are looking for ways to fund expansion and hedge against future economic downturns.

October 23 -

Flush with capital and facing stiff competition for customers, many regional banks appear to be mulling acquisitions to accelerate growth.

October 20 -

While some tackle the problem by offering their own consolidation loans, Sallie Mae is developing products with extended terms that reduce borrowers' monthly payments in an effort to discourage borrowers from refinancing in the first place.

October 19 -

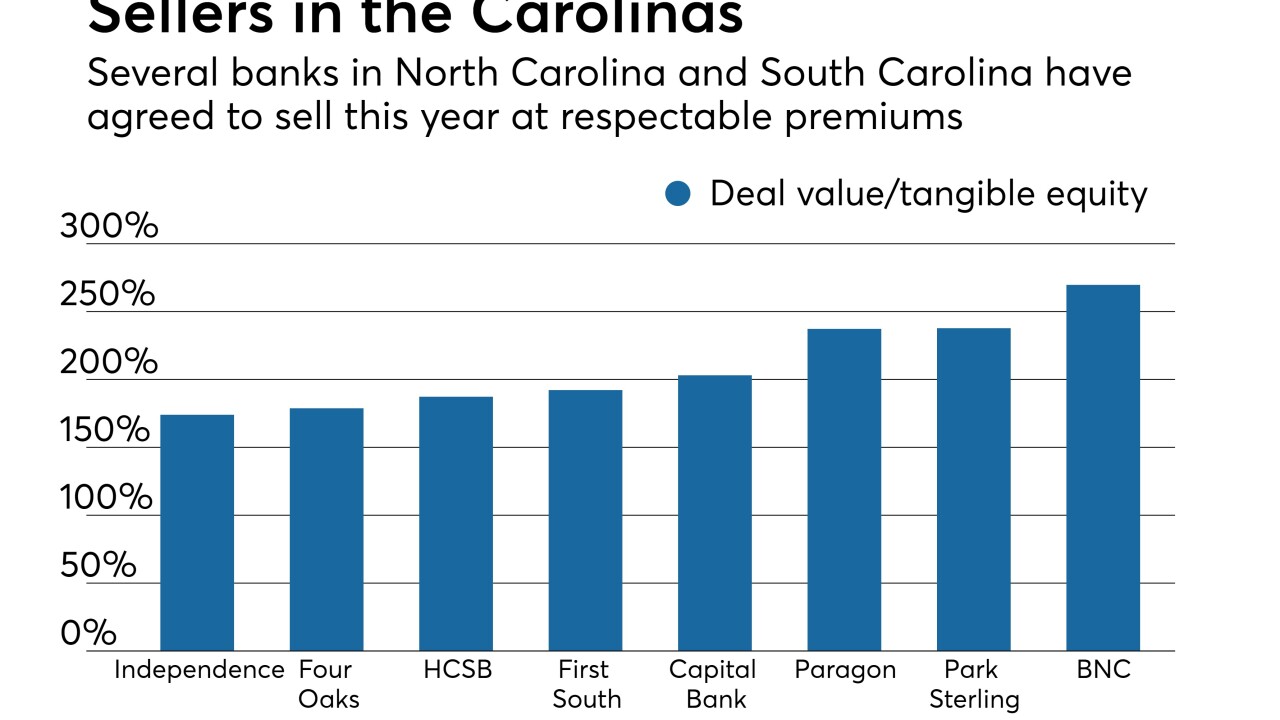

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

Navient has suspended stock buybacks to buy and expand a debt-refinancing firm that faces stiff competition from fintechs, and some shareholders aren’t happy.

October 18