-

Equity warrants. Capital calls. Off-balance-sheet accounts. SVB's unusual business model thrives on financing rainmakers and cutting-edge firms, but old-school issues like overconcentration, unpredictable fee income and stock market swings lurk in the background.

May 15 -

Year to date Dec. 31, 2017. Dollars in thousands.

May 14 -

On Dec. 31, 2017. Dollars in thousands.

May 14 -

On Dec. 31, 2017. Dollars in thousands.

May 14 -

Lenders are taking steps to reduce exposure to fluctuations in oil prices, including getting tougher in demanding that drillers use commodity hedges.

May 14 -

State Bank popped up on the Houston company’s radar eight years ago, but management waited until now to strike.

May 14 -

Artificial intelligence will reshape the job landscape at banks; people still want to open accounts at a branch; Mick Mulvaney stacks CFPB bench with political appointees; and more from this week's most-read stories.

May 11 -

Capitol Federal Financial has mostly relied on mortgages throughout its history. Its acquisition of a commercial lender will change that.

May 11 -

The Tulsa, Okla., company has quietly carved out a niche financing tribal casinos within its footprint, and now it’s ready to take the business into new markets.

May 11 -

This would be the bank’s first foray into credit cards; Wells Fargo says it won’t be able to comply with Fed requirements before next year.

May 11 -

With the regulatory relief bill set to become law soon, some congressional Republicans are already calling for additional rollbacks to the Dodd-Frank Act. There’s one thing they should keep in mind: Community banks had a hand in the crisis too.

May 10

-

The legislation, which still needs Senate approval, would let the head of the Small Business Administration raise the program's cap in periods of heavy demand.

May 8 -

Legal costs and legacy issues related to previous management continue to weigh on the online lender's results.

May 8 -

Eric Itambo will become chief banking officer of CoBank, where he will oversee all lending operations.

May 8 -

The online business lender would have reported its second straight quarterly profit if not for one-time costs tied to layoffs and lease terminations.

May 8 -

The removal of costly appraisal requirements on tens of thousands of smaller commercial properties could help community banks better compete for loans they say they have been losing to nonbank lenders.

May 4 -

Attorneys for then-President Robert Harra said he is innocent and will file an appeal. The case centers on a scheme said to have been carried out during the crisis years, before the bank was sold to M&T.

May 3 -

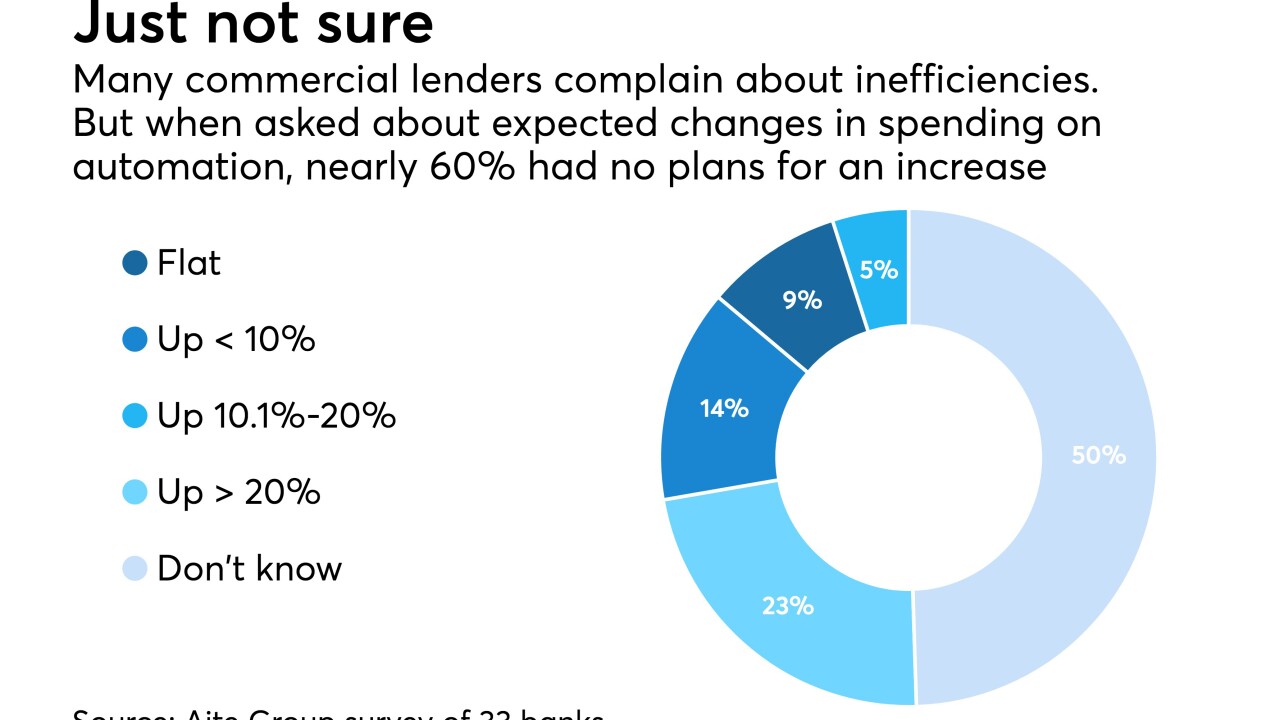

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

Green Apple Bank & Trust, which recently filed an application with regulators, plans to open in the western part of the state by the end of this year.

May 2