Consumer banking

Consumer banking

-

Consumer demand for digital financial services will inspire a wave of new partnerships.

November 19 -

Billionaire Jack Ma’s Ant Financial Services Group said it may apply for a virtual banking license in Singapore, a move that would add a heavyweight contender to the race.

November 19 -

In recent months federal regulators have been speaking out on the risks that extreme weather events pose to the financial system, something their European counterparts have been doing for some time.

November 18 -

Bryce VanDiver and Daniela Hawkins at Capco make the case that offering easy-to-use payment rewards is the way to win the loyalty of digital-only customers.

November 18 -

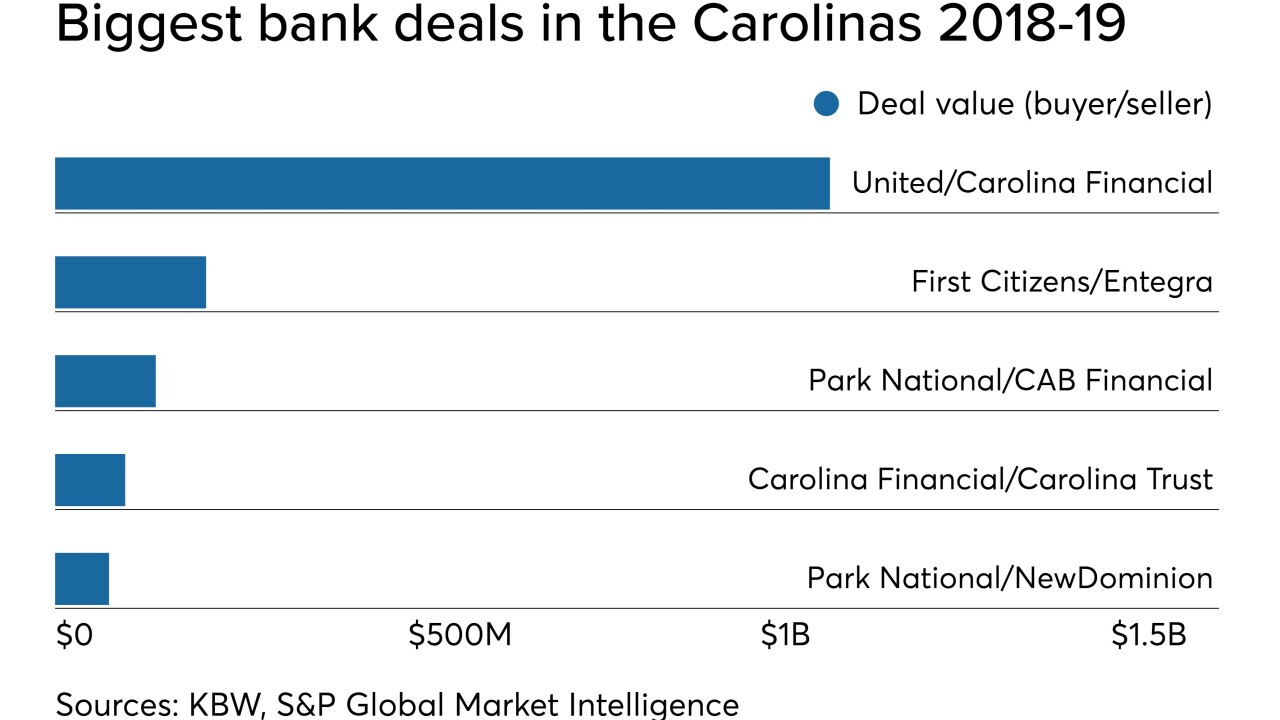

United Bankshares in West Virginia was willing to pay a healthy premium for Carolina Financial, one of a dwindling number of available banks with more than $4 billion in assets.

November 18 -

Stephen Calk, who faces a bribery charge in connection with loans his bank made to former Trump campaign chair Paul Manafort, is asking a judge to suppress evidence that prosecutors obtained from his mobile phone.

November 18 -

The Bakersfield, Calif.-based institution has applied to convert to a state charter.

November 18 -

The remote deposit capture tech at the center of the dispute is used by 6,500 institutions. That may mean other institutions will have to pay licensing fees to USAA.

November 18 -

The company will pay $1.1 billion for Carolina Financial in Charleston, S.C., in a deal that will add nearly $5 billion in assets.

November 18 -

It’s only a matter of time before Silicon Valley “overturns more complex banking functions”; banks would have to help FinCEN identify suspicious firearms sales.

November 18 -

By working with the tech giant on its consumer checking account, Stanford FCU hopes to grow but some wonder about the broader implications for fields of membership.

November 18 -

Consumer trust issues have long been a stumbling block for challenger banks, but many say Google will face bigger obstacles.

November 17 -

Earnings hit could be avoided if BB&T and SunTrust complete deal by 2020; Fannie and Freddie will likely exit conservatorship by 2024, Calabria says; tired of paying 'ransom' to core vendors, two small banks fund new one; and more from this week's most-read stories.

November 15 -

The company says it's responding to the feedback of consumers who want online options beyond savings products.

November 15 -

More banks in the state are considering acquisitions to cut costs and combat margin pressure.

November 15 -

The Soboba Band of Luiseño Indians plans to form a holding company and raise $25 million for Legacy Bank.

November 15 -

If regional banks really want to compete against behemoths and nonbank entrants they need to emphasize products over M&A.

November 15 -

The junior member of the National Credit Union Administration board has proposed additional oversight for larger credit unions, citing a “guiding principle” of “uniformity between the regulators.” That could pit him against much of the rest of the industry.

November 15 -

Readers react to the FDIC's fine against a bank over a 5-year-old consent order, Regions Financial's about-face on acquisitions, HUD's promotion of a controversial CFPB official and more.

November 14 -

A recent bank failure and a new legislative effort are again drawing attention to the struggles of black-owned banks since the crisis — and the fact that only 21 are left.

November 14