Consumer banking

Consumer banking

-

-

Gov. Michelle Bowman said the agency's analysis of certain deals should weigh the competitive threats posed by technology companies and nonbanks.

February 16 -

Others, like JPMorgan Chase, have shut down their mobile-only brands. But Rising Bank, Midwest BankCentre's three-year-old neobank, is meeting its deposit goals, adding new products and avoiding cannibalization, says Dale Oberkfell, the bank's president.

February 16 -

A full rebound won’t occur until next year at the earliest because of the slow vaccine rollout, most executives at small banks said in a new survey. Last summer, more than half expected a turnaround this year.

February 15 -

-

Transportation and clean-energy upgrades could create significant new lending opportunities, but some observers fear the government will foot the bill through a special tax on banks and other financial firms.

February 11 -

Ken LaRoe, whose First Green Bancorp was sold a few years ago, is seeking approval for a de novo called Climate First Bank that would cater to low-income communities hurt by climate change and favor ecology-minded tech vendors.

February 10 -

In his new book, the Princeton lecturer and financier JC de Swaan contemplates what it means to be virtuous in a financial system that prioritizes profits and shareholder returns.

February 10 -

The department of financial services will grant credit under the state's community reinvestment law to New York-chartered banks and credit unions that finance projects aimed at helping low-income communities better adapt to a warming world.

February 9 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

Aside from the cash infusions, the San Francisco-based bank will assign dedicated teams to provide the lenders with financial, technology and product expertise.

February 8 -

The regional bank is switching VirtualBank, a digital-only unit added through a recent merger, to a core system that relies on Finxact software and Amazon Web Services. The move epitomizes the industry's cautious approach to cloud-based technology.

February 8 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

Free financial education programs and easier access to safe small-dollar loans are among the ways banks could help put low-income minority households on a path to prosperity.

February 8 -

The North Carolina-based credit union, which purchased the vacant bank branch last summer, serves some members across the state line but has not had a brick-and-mortar presence there until now.

February 5 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

To avoid taxes on the divestiture of a commercial lending unit, Woodforest National Bank backed an Alabama redevelopment project through a government program that promotes investment in underserved communities.

February 4 -

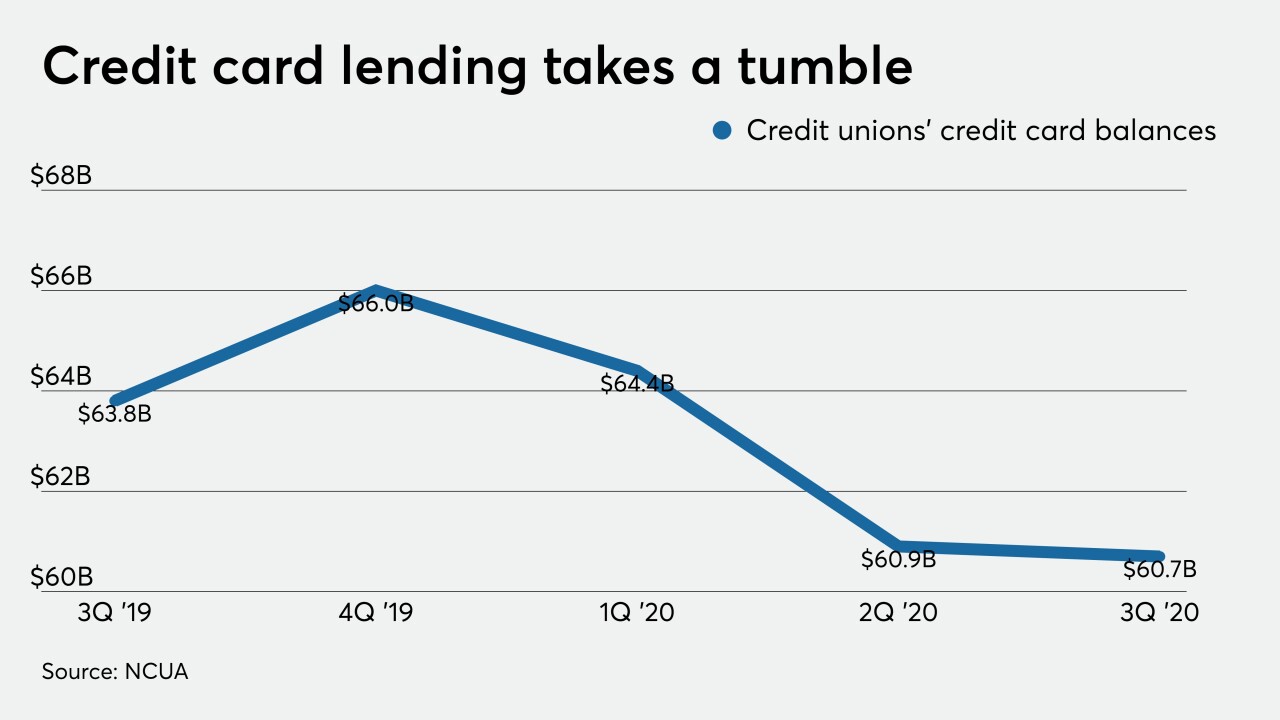

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4