Consumer banking

Consumer banking

-

Year to date through Jun. 30, 2020. Dollars in thousands.

August 31 -

Year to date through Jun. 30, 2020. Dollars in thousands.

August 31 -

After dropping for the past two years, reputation scores are once again rising, thanks largely to the goodwill banks have earned by helping customers and employees weather the coronavirus outbreak.

August 30 -

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds before the bank's December 2017 collapse.

August 29 -

The company said the sale will provide more consistent financial results and allow it to redeploy funds to support other businesses.

August 28 -

The Iowa company said the coronavirus outbreak and litigation against AimBank will postpone the deal's completion by a few months.

August 28 -

Mike Duncan had kept a low profile as chairman of the U.S. Postal Service’s board of governors until it hired Louis DeJoy as postmaster general. Now he is sharing an unwanted spotlight with the embattled DeJoy.

August 28 -

Bankers have long opposed the idea of the U.S. Postal Service taking deposits and making loans directly, but some in the industry are open to the idea of letting banks and credit unions offer services at post offices.

August 28 -

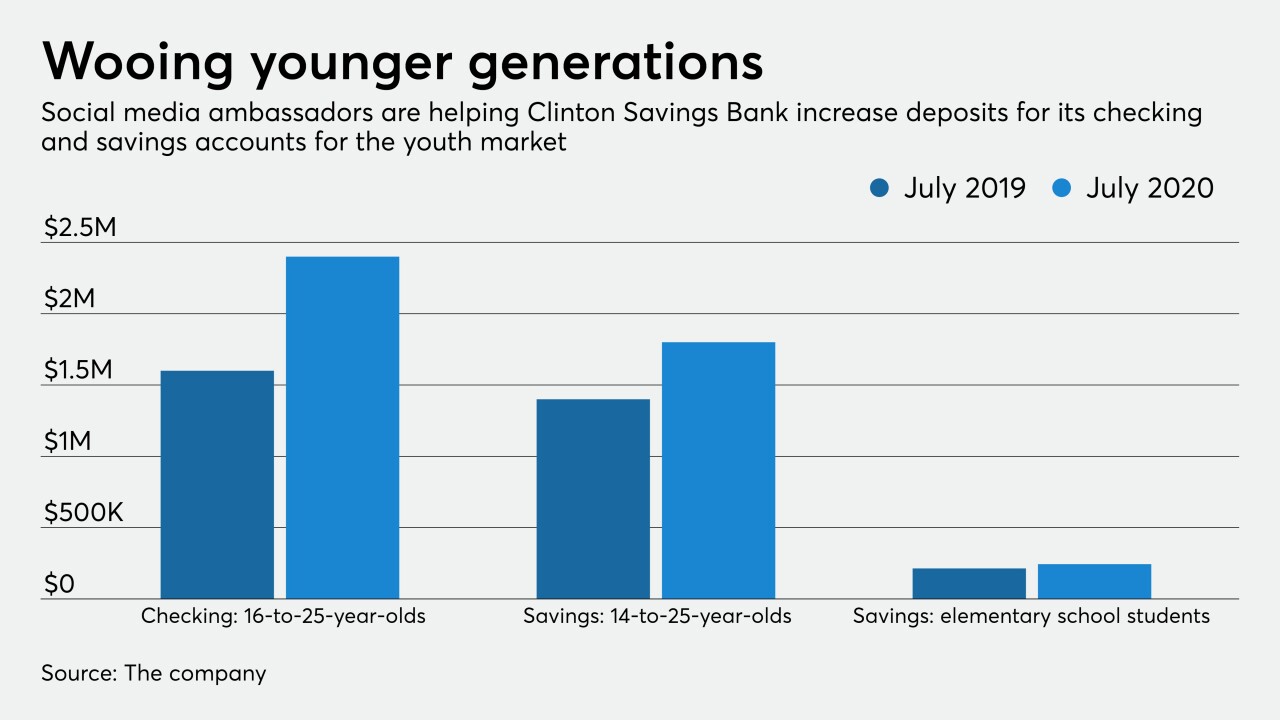

Bank of America and Clinton Savings Bank in Massachusetts are targeting consumers at a young age and hoping to keep them for life.

August 28 -

Data from the National Credit Union Administration shows that despite a dip during the second quarter, the rate of industry consolidation has not changed dramatically from last year, despite the pandemic.

August 28 -

The company said migration to digital channels spurred its decision to shutter locations across five states.

August 28 -

All parts of the payments industry can preserve cash, but mandates may be necessary, says Moorwand's Luc Geuriane.

August 28 -

The company will use Savoy's midtown Manhattan office to coordinate business development efforts around the city.

August 28 -

-

Branches in the Gulf Coast region largely avoided massive flooding. Now bankers must assess the impact on employees and customers.

August 27 -

A historic charter award defines a new beginning for digital banking, Varo Money becomes the first consumer fintech in US history to gain full regulatory approval to become a national bank

-

Several months after the pandemic took hold, Diebold Nixdorf and NCR have adopted an ATM recovery strategy that stresses contactless access as well as innovations that are similar to other industries that traditionally rely on kiosks.

August 27 -

With the USPS emerging as an election-year flashpoint, postal banking is an idea that could gain steam. But a number of proposals are out there, and they have wildly varying implications for financial inclusion.

August 26 -

The agencies completed steps to ease a community bank capital measure temporarily and to delay a new credit-loss accounting standard.

August 26 -

The Los Angeles company will remain a community development financial institution when it acquires the parent of City First Bank in Washington.

August 26