Consumer banking

Consumer banking

-

Bank of America is planning to open 165 new branches by the end of 2026. As brick-and-mortar locations remain critical for adding new customer accounts, JPMorgan Chase and Wells Fargo are also making targeted additions to their branch networks.

September 23 -

The suit was filed by three New Jersey residents who alleged that BofA froze their prepaid debit cards during a pandemic-era fraud wave, blocking them from accessing unemployment benefits.

September 23 -

After doing "some really intensive thinking," the Buffalo-area lender said it found the partner it was looking for in the Norwich, New York-based NBT Bancorp.

September 23 -

If companies want to keep partnering with banks to build innovative financial services, they need to stop thinking about regulation as their partner banks' problems and start being part of the solution.

September 23 -

-

-

-

After Republican presidential nominee Donald Trump said he intends to place a temporary cap on credit card interest rates, many felt the plan would create a large constriction of credit.

September 20 -

The Honolulu-based seller said it rejected a competing bid from an investor group and would stick with its plan to sell to Hope Bancorp for $78.6 million in stock.

September 20 -

Deposits rose by an average of 14% at each branch in counties where banks advertised on TV, a new academic paper finds. The results line up with the view of bank marketers that television remains essential even as digital options flourish.

September 19 -

Hundreds of thousands of Americans leave prison each year with little or no financial literacy. It's in the interest of banks and the communities they serve to educate them.

September 19 -

Policymakers signaled more reductions lie ahead, a development that could curb lenders' net interest income in the near term but support economic growth and credit quality.

September 18 -

Only two de novo banks have opened in 2024, while more than 100 launched annually prior to the 2008 financial crisis. Experts don't agree on how to solve the problem.

September 18 -

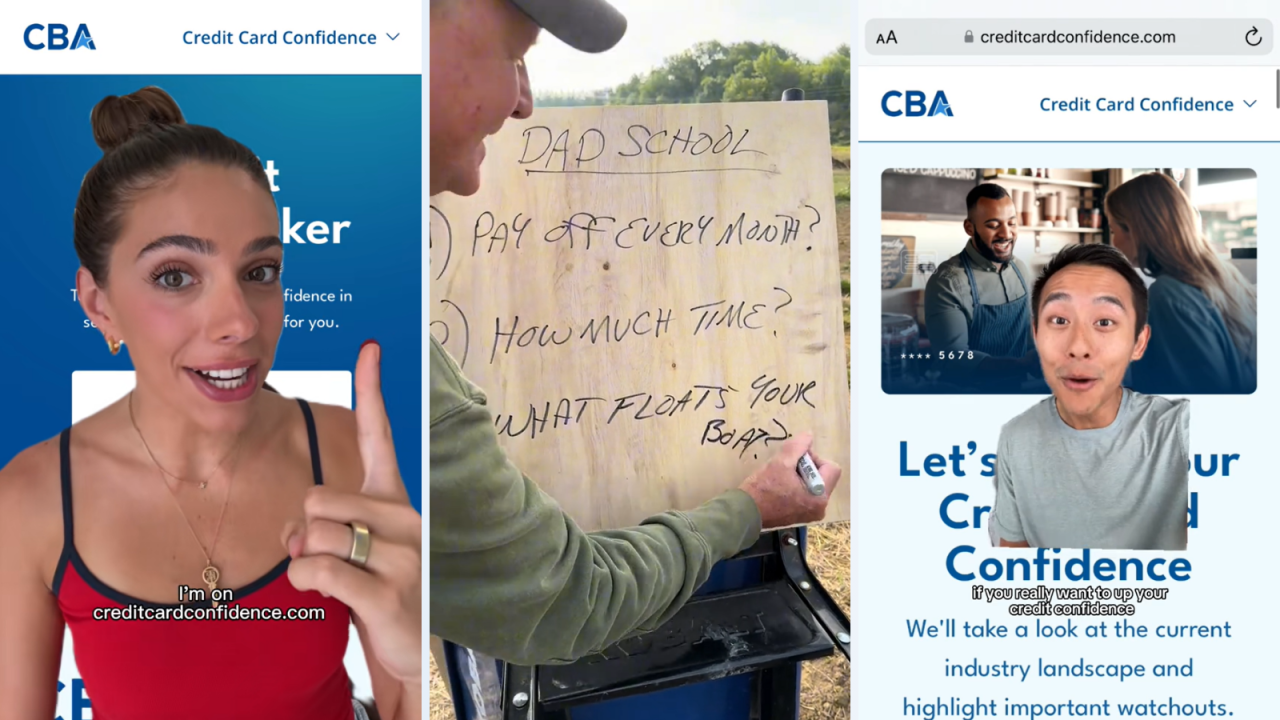

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

September 18 -

CEO Colin Walsh believes his company is positioned to benefit from consumers that prize the convenience of technology opting for the safety of a "real bank."

September 17 -

Donald Felix, who has previously worked at JPMorgan Chase and Citi, will become Carver's president and CEO on Nov. 1. He succeeds interim CEO Craig MacKay, who's been running the unprofitable bank for the past year.

September 17 -

The New York community bank cited the contribution of BaaS to its core financial results, evolving regulatory expectations, and the cost of talent and technology needed to scale as factors in this decision.

September 17 -

St. Mary's Bank in New Hampshire tries to serve members as it has for 116 years, while dealing with today's cybersecurity and fraud concerns.

September 16 -

Independence Bank of Kentucky said 14 customers had reported receiving the bills, which included text such as "for motion picture purposes."

September 16 -

EverBank Financial in Florida said the deal would give it $900 million of loans and $2 billion of deposits. Should the deal close in early 2025 as planned, it would end a long saga for Sterling.

September 16