Consumer banking

Consumer banking

-

In the 11 months after Fifth Third completes its acquisition of Comerica, the Cincinnati bank plans to send 13 million-to-14 million pieces of paper mail to retail customers. CEO Tim Spence says the old-fashioned method "still works," and actually has some advantages over more modern modes of communication.

January 20 -

The Cleveland-based bank announced changes Tuesday to its board of directors, including the appointment of a new lead independent director. Last month, activist investor HoldCo Asset Management urged the bank's board to not re-nominate its longtime lead independent director.

January 20 -

The newly launched digital credit union, CineFi, aims to serve creative professionals in the Atlanta area as well as First Entertainment's existing member base in Los Angeles.

January 20 -

A significant majority of Americans are now living lives of permanent financial stress, and debt delinquency is on the rise. For bankers, that's a recipe for problems with profitability, and perhaps with safety and soundness.

January 19 -

MUFG Securities Americas is designated a primary dealer by the New York Fed; Founders Bank appoints Chris Lipscomb its senior vice president and chief lending officer; the Independent Community Bankers of America names Charles Yi senior executive vice president of government relations; and more in this week's banking news roundup.

January 16 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

Data collected by the Conference of State Bank Supervisors demonstrates a huge disparity in compliance costs between large and small banks. Policymakers in Washington who claim to support community banks must act to reduce regulatory burden.

January 16 -

Community Financial in Syracuse has agreed to purchase a small bank that's built its business model around end-of-life planning.

January 16 -

Noelle Acheson explains how on-chain vaults, born in decentralized finance, could shape the centralized banking of tomorrow.

January 15 -

The Swedish financial institution adds P2P payments as it tries to bolster its neobank aspirations. Payment firms don't like the U.K.'s potential restrictions on stablecoins and more in the American Banker global payments and fintech roundup.

January 14 -

Customers reported failed subscription payments and support issues, though a backup system kept some basic functionality online.

January 14 -

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

January 13 -

Coastal Financial in Washington State has acquired GreenFi, one of its fintech partners. The move is designed to buy time in order to figure out the best long-term strategy for the struggling neobank.

January 12 -

The 6-2 vote represents a win for the megabank, which has been fighting a nationwide push to organize its workers. Some 28 branches have voted in favor of unionization, while three have rejected unionization.

January 12 -

Despite attracting $2 billion in deposits, the cloud-native unit proved too expensive to maintain, prompting a strategic retreat by parent company SMBC.

January 12 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

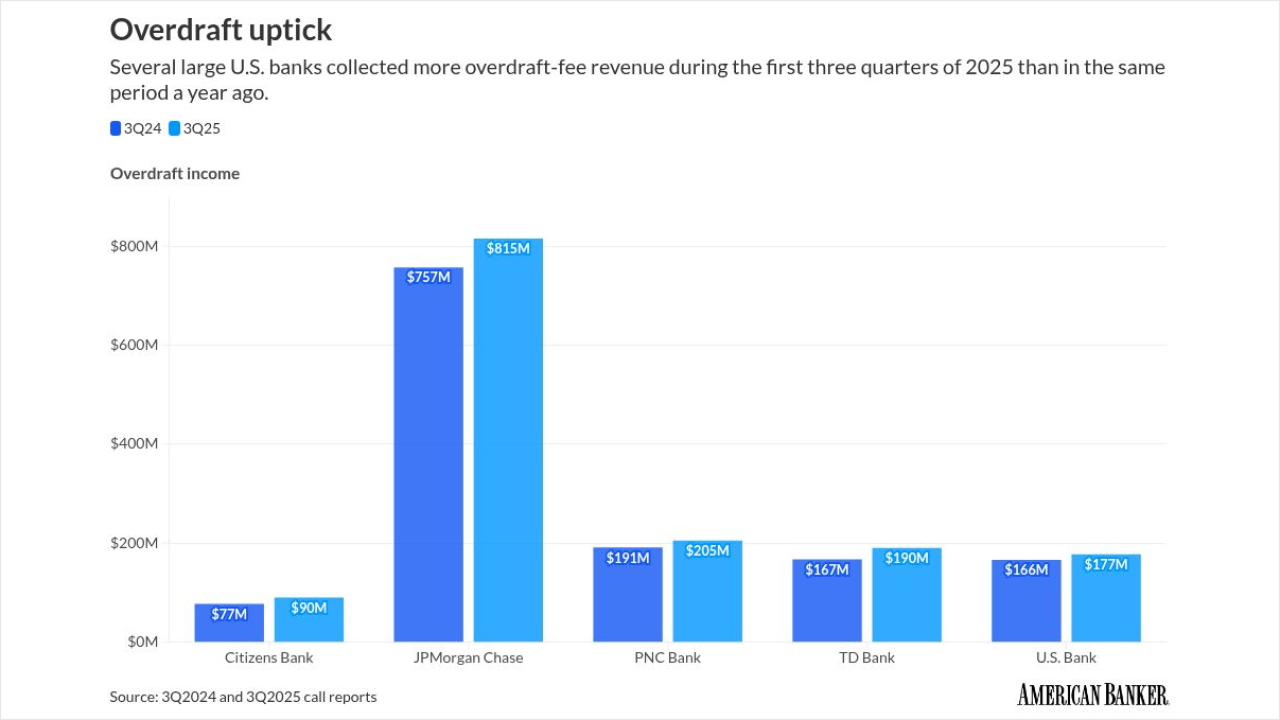

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Netherlands-based digital bank Bunq filed its second U.S. charter application this week after successfully receiving a broker-deal license late last year.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

House Financial Services Committee Chairman French Hill's community-banking package includes reciprocal deposits, tailoring and many other items on community bankers' wish lists.

January 7