Operation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

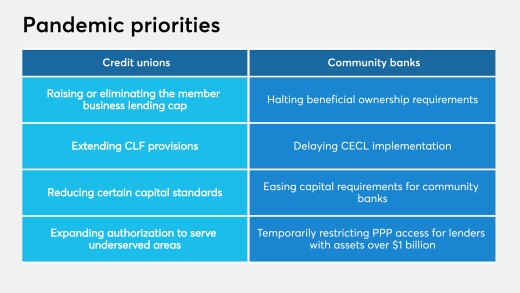

Bankers call credit unions’ latest efforts to ease limits on member business lending opportunistic. Credit unions say they're trying to help with the recovery effort.

Remote work has hampered business payment systems. Automated decentralized options are key to continuity, says Nvoicepay's Josh Cyphers.

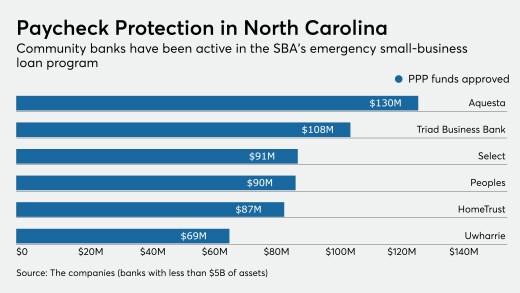

Triad Business Bank in North Carolina, which opened in March, has made $106 million in Paycheck Protection loans.

New Peoples Bankshares said the layoffs were necessary because of the coronavirus pandemic and "a changing financial services industry."

The interim rule will allow institutions with over $250 billion of assets to exclude certain assets from the supplementary leverage ratio to help them respond to the economic fallout from the coronavirus pandemic.

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

The Pittsburgh company’s sale of its stake in the asset manager yielded billions of dollars that could cushion the pandemic’s economic blow and eventually help fund a big acquisition.

-

Operation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

May 18 Operation HOPE Inc.

Operation HOPE Inc. -

Bankers call credit unions’ latest efforts to ease limits on member business lending opportunistic. Credit unions say they're trying to help with the recovery effort.

May 18 -

Remote work has hampered business payment systems. Automated decentralized options are key to continuity, says Nvoicepay's Josh Cyphers.

May 18Nvoicepay -

Triad Business Bank in North Carolina, which opened in March, has made $106 million in Paycheck Protection loans.

May 17 -

New Peoples Bankshares said the layoffs were necessary because of the coronavirus pandemic and "a changing financial services industry."

May 16 -

The interim rule will allow institutions with over $250 billion of assets to exclude certain assets from the supplementary leverage ratio to help them respond to the economic fallout from the coronavirus pandemic.

May 15 -

The central bank's Financial Stability Report said companies may face difficulties repaying debt given lower earnings, “which could trigger a sizable increase in firm defaults."

May 15