The NACUSO annual gathering and a new event focused on cannabis banking for the industry have both been shuttered.

Online platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.

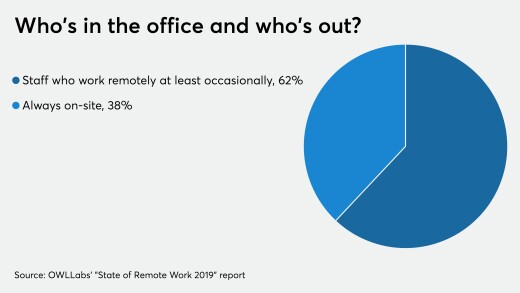

As more states close schools and issue shelter-in-place directives, credit unions are increasingly shifting their staff to work-from-home arrangements.

With coronavirus taking a significant chunk out of physical retail and services, the use of call centers and phone interaction with customers becomes even more important.

Heritage financial institutions that don’t support emerging embedded payments and banking risk further erosion of younger cohorts and losing material franchise value to fintechs, challenger or neo-banks equipped to originate and service accounts at the edge of partner networks, say payment consultants Richard Crone and Heidi Liebenguth.

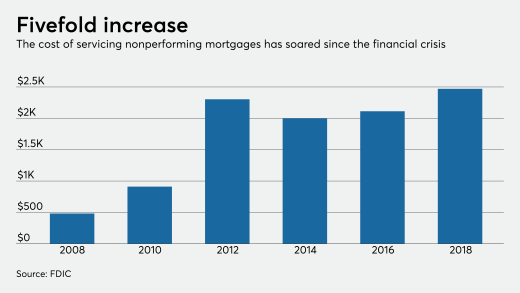

The pandemic has upended staffing plans, sparked concerns about servicers’ capacity to handle the expected crush of missed payments, and even raised questions about their ability to stay afloat.

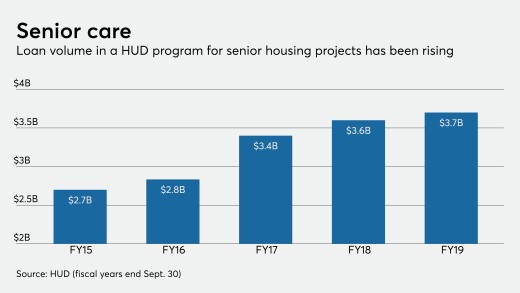

Lenders are concerned that the coronavirus outbreak will increase vacancies and add to credit risk.

The establishment of the Primary Dealer Credit Facility is among a flurry of recent actions by the central bank to limit the economic impact of the coronavirus.

-

The NACUSO annual gathering and a new event focused on cannabis banking for the industry have both been shuttered.

March 18 -

Online platforms and apps can be utilized to quickly support small businesses and consumers facing unexpected financial hardship.

March 18 Georgetown University Law Center

Georgetown University Law Center -

As more states close schools and issue shelter-in-place directives, credit unions are increasingly shifting their staff to work-from-home arrangements.

March 18 -

With coronavirus taking a significant chunk out of physical retail and services, the use of call centers and phone interaction with customers becomes even more important.

March 18 -

Heritage financial institutions that don’t support emerging embedded payments and banking risk further erosion of younger cohorts and losing material franchise value to fintechs, challenger or neo-banks equipped to originate and service accounts at the edge of partner networks, say payment consultants Richard Crone and Heidi Liebenguth.

March 18 Crone Consulting

Crone Consulting -

The pandemic has upended staffing plans, sparked concerns about servicers’ capacity to handle the expected crush of missed payments, and even raised questions about their ability to stay afloat.

March 17 -

Lenders are concerned that the coronavirus outbreak will increase vacancies and add to credit risk.

March 17