Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

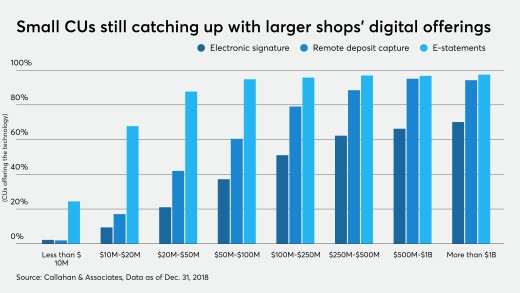

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

It’s a time of challenges, but fraud teams who adapt well to them will strengthen their systems, and their understanding of their customers and their business, says Identiq's Urid Arad.

Amid the worldwide coronavirus crisis, making cross-border payments to emerging markets has been akin to putting together a jigsaw puzzle without many of its pieces.

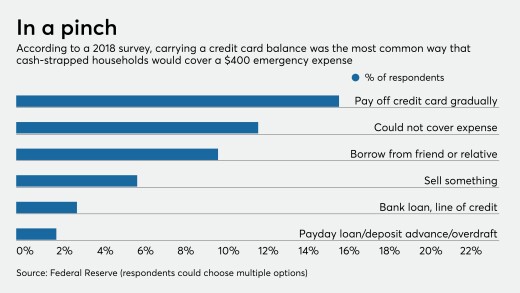

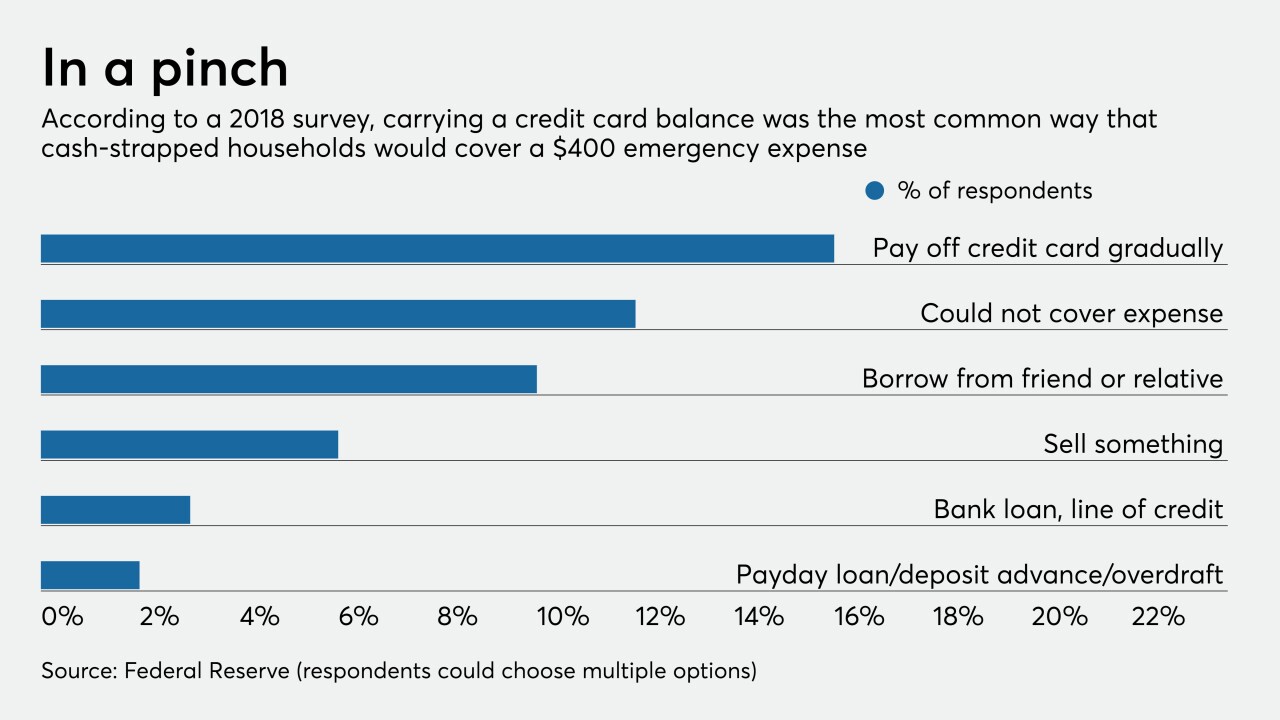

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

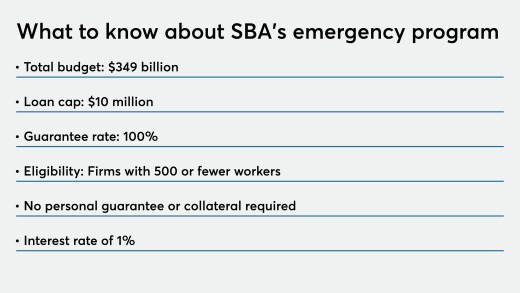

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

The worsening economy brought on by the coronavirus pandemic has big banks rethinking who they will lend to.

-

Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

April 3 -

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

April 3 -

It’s a time of challenges, but fraud teams who adapt well to them will strengthen their systems, and their understanding of their customers and their business, says Identiq's Urid Arad.

April 3 Identiq

Identiq -

Amid the worldwide coronavirus crisis, making cross-border payments to emerging markets has been akin to putting together a jigsaw puzzle without many of its pieces.

April 3 -

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

April 2 -

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

April 2