-

The $74 million acquisition will allow First Mid-Illinois to expands it operatations in the Champaign-Urbana region in Illinois.

December 12 -

OneUnited is trimming branches and expanding digital offerings as it builds its brand as a backer of social justice that develops innovative products such as a Black-Lives-Matter-themed debit card.

December 11 -

MFA Acquisition, which plans to keep Maryland Financial Bank's name, wants to add more products and services after the deal closes.

December 11 -

Alpine Bancorp. in Illinois made its sale a highly inclusive process, forming a special evaluation team of senior leaders to help top management review offers.

December 8 -

Eureka, Calif.-based credit union will expand to Arcata.

December 8 -

Delaware-based CU's new charter will allow it to branch out further into the First State, as well as into Maryland.

December 8 -

The company has been working to address an informal agreement with regulators tied to Bank Secrecy Act compliance.

December 7 -

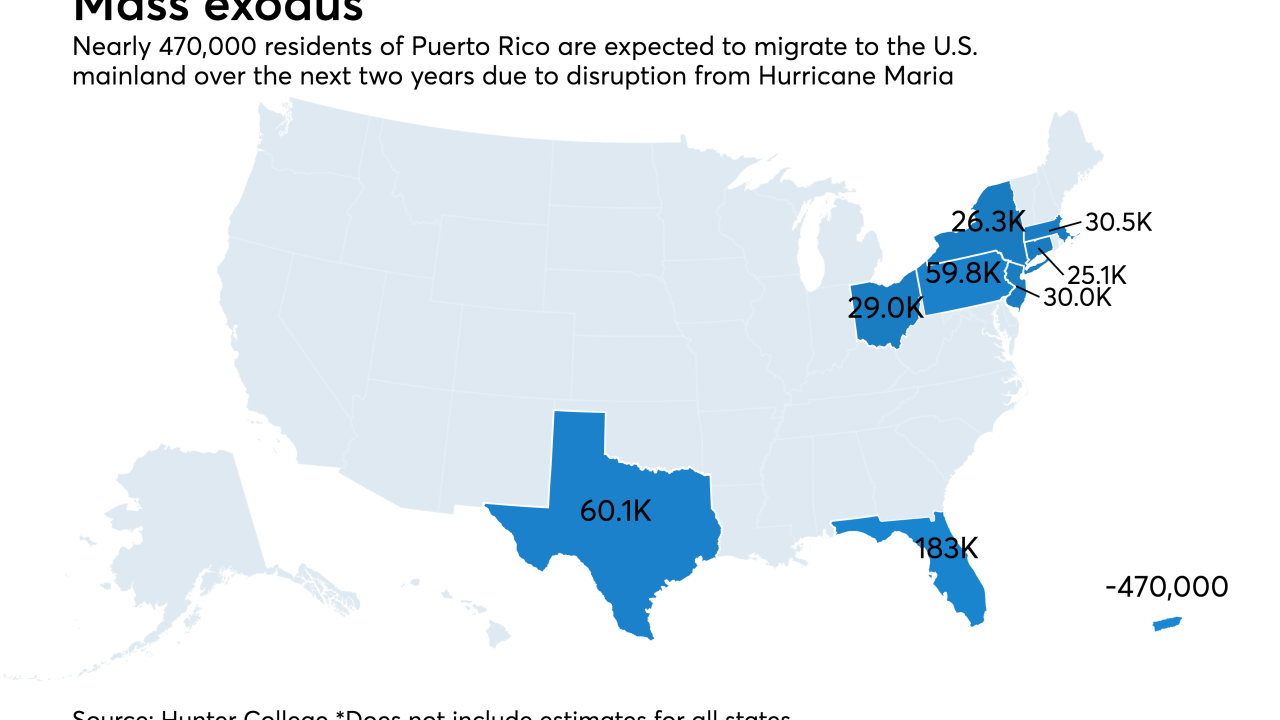

After tackling immediate problems, such as accessing electricity and arranging cash deliveries, bankers are facing a longer-term concern: What if customers who fled the island after Hurricane Maria don’t come back?

December 7 -

Dennis Zember, Ameris' chief operating officer, was named CEO of the company's bank. Edwin Hortman Jr. will continue to run Ameris.

December 7 -

The $32 million purchase of Sunshine Financial will provide First Bancshares with its first branches in Tallahassee, Fla.

December 6 -

The Pleasanton, Calif.-based credit union is also celebrating its 85th anniversary.

December 6 -

The Tennessee company also set high expectations for revenue opportunities while projecting it will deliver a 15% return on equity in 2019.

December 5 -

Eagle Bancorp vigorously defended itself after a potential short seller made claims of dubious insider dealings, pushing back harder than many banks have in the past.

December 5 -

The two tiny credit unions merged with the $313 million Pelican State on Nov. 1 and Dec. 1 of this year.

December 5 -

The company agreed to buy TCSB Bancorp, the parent of Traverse City State Bank, for $63 million.

December 5 -

The returns were part of the credit union's "Ent Extras" rewards program.

December 4 -

Credit unions all around the globe shot photos throughout the day on International Credit Union Day for the 20th anniversary of this special feature.

December 4 -

Sometimes it’s not enough to offer everyday value — you’ve also got to have some flash.

December 4 Credit Union Journal

Credit Union Journal -

Describing cybersecurity as the biggest risk facing the financial sector, Vice Chairman for Supervision Randal Quarles said regulators should more actively facilitate conversations between banks and national security agencies to boost digital security.

December 1 -

The $1.8 billion credit union has paid members more than $15 million since 2009.

December 1