Credit unions are falling behind the curve when it comes to data analytics.

That’s one of the revelations of a recent survey by Best Innovation Group Inc., a technology innovation and development company, which examined data analytics and adoption at credit unions.

The survey of 85 institutions was released last week in conjunction with OnApproach, a credit union service organization and a provider of big data and analytics solutions for credit unions. It was taken in July and August 2018. The groups surveyed CUs from across the asset spectrum, though the bulk of respondents had assets of $250 million or more.

Among the findings in BIG's report:

- A majority of CUs appear to be putting off data analytics spending. Fifty-five percent of respondents say they intend invest in data during the next three to five years, while 35 percent say they investments will take place in the next one two years.

- 65 percent admit they have “neither a roadmap nor a strategy” regarding the use of data analytics in their organizations

- 45 percent of credit unions do not have a data analytics strategy in place

- One-third of CUs say they are “moving forward slowly” with data analytics on a departmental or project-by-project basis

- One-third do not view data as “important to their business strategy”

- Only one-third say they have “holistically embraced” data as “strategically important”

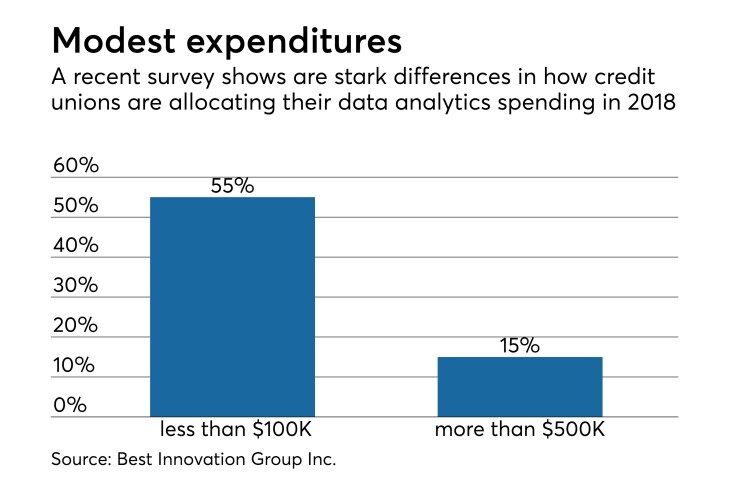

- Of those CUs that have a data analytics budget in place, just over half anticipate spending les than $100,000 on analytics in 2018, while one-third expect to spend more than $200,000 and 15 percent plan to spend more than $50,000

- More than two-thirds of the credit unions surveyed have purchased some type of analytic tools in the last 12 months.

According to Kirk Kordeleski, senior managing partner and chief strategy officer at BIG, the report offers a “troubling revelation” because it reveals that CUs are investing in products with “no clear path to value.”

“BIG’s survey revealed that only 10 percent of credit unions believe they are on an equal playing field with their banking and fintech competition regarding their all-important data strategy,” he said in a press release. “Ninety percent are two or more years behind what they feel is the industry benchmark.”

Despite that, BIG noted in the report, the tide is beginning to turn as more institutions recognize the value of analytics.

“Many credit unions have started to embrace data strategies as a means to deliver improved service, increase market share, improve lending/income and to identify ways to be more operationally effective,” the survey stated. “These investments bode well for improved growth, service and bottom lines. On the other hand, almost half the credit unions do not have a strategy in place and those that do are budgeting relatively few dollars to their strategies.”

In contrast, BIG warned, credit union competitors are growing market share by investing heavily in data tools, decisioning, fintech partnerships, and preparing themselves for advances in machine learning and artificial intelligence.

“Most credit unions are not thinking about or investing in these key areas of future competitiveness,” the company cautioned.

BIG further indicated that while credit unions have some advantages, i.e., they have more centralized systems, the ability to cooperate for scale, they are nonetheless “behind the curve” in data analytics and need to “embrace the concepts and strategies to more effectively compete in the future.”