-

The coronavirus has created unprecedented challenges for employers but these credit unions rose to the occasion.

September 20 -

A historic influx of deposits has brought the National Credit Union Share Insurance Fund’s equity ratio close to the point where premiums would be required, but the regulator’s plan is intended to boost it.

September 17 -

Second-quarter figures from the credit union regulator paint a grim picture for many states across a variety of key earnings metrics.

September 17 -

Two board members for the credit union regulator spoke during a NAFCU event, highlighting liquidity issues, plans for new departments at the agency and more.

September 15 -

Federal credit unions still account for more than 60% of active institutions, but their share of total assets continues to shrink.

September 14 -

The Liberty Lake, Wash.-based credit union has agreed to buy four branches from the Roseburg, Ore.-based bank.

September 11 -

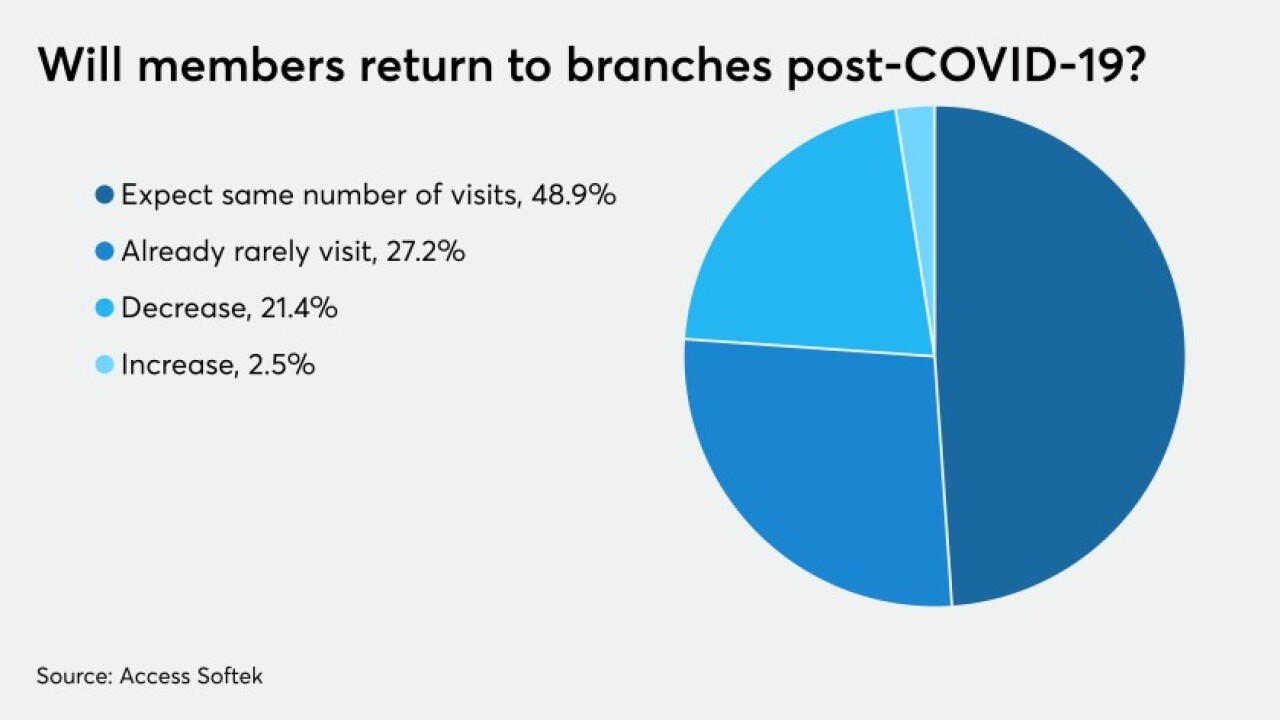

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

The pandemic and economic downturn upended most institutions' advertising plans for the year, and many credit unions have had to adjust not only their messaging but also the loan products they are promoting.

September 10 -

The industry saw small gains in many loan categories during the second quarter, but credit cards declined. A new study from WalletHub shows the biggest quarterly drop in credit card balances in over 30 years.

September 9 -

A recent victory for Navy Federal opens diversity jurisdiction to federally chartered credit unions, allowing them to more easily bring matters before federal courts.

September 9