-

Visa's growth beyond plastic cards relies heavily on tokenization, a strategy that should get a major boost from its planned acquisition of CardinalCommerce.

December 1 -

Banks tend to respond to ATM and payment breach risks after an incident. They need to get more proactive.

December 1 CAST

CAST -

With access to financial transaction data under threat by hurdles imposed by certain financial institutions, it should be up to consumers to decide how their data is used to improve their financial well-being,

November 30Financial Data and Technology Association of North America -

Financial industry groups have rolled out a plan for keeping bank customers' data safe if a mega-disaster, like a massive attack or a natural disaster, strikes.

November 29 -

As the holiday shopping season kicks off, retailers are preparing for an influx of payment volume from shoppers and scammers alike. Here are a few of the problems they face.

November 28 -

JPMorgan Chase seeks to reshape its business through technology, but there is a natural gap between the megabank and Silicon Valley startups. Larry Feinsmith's job is to bring the two together.

November 28 -

Whether or not retailers are properly guarding their payment hardware and their in-store networks, a bigger issue might just be the workers who have access to retail organizations' data — including both regular staff and temporary holiday workers.

November 25 -

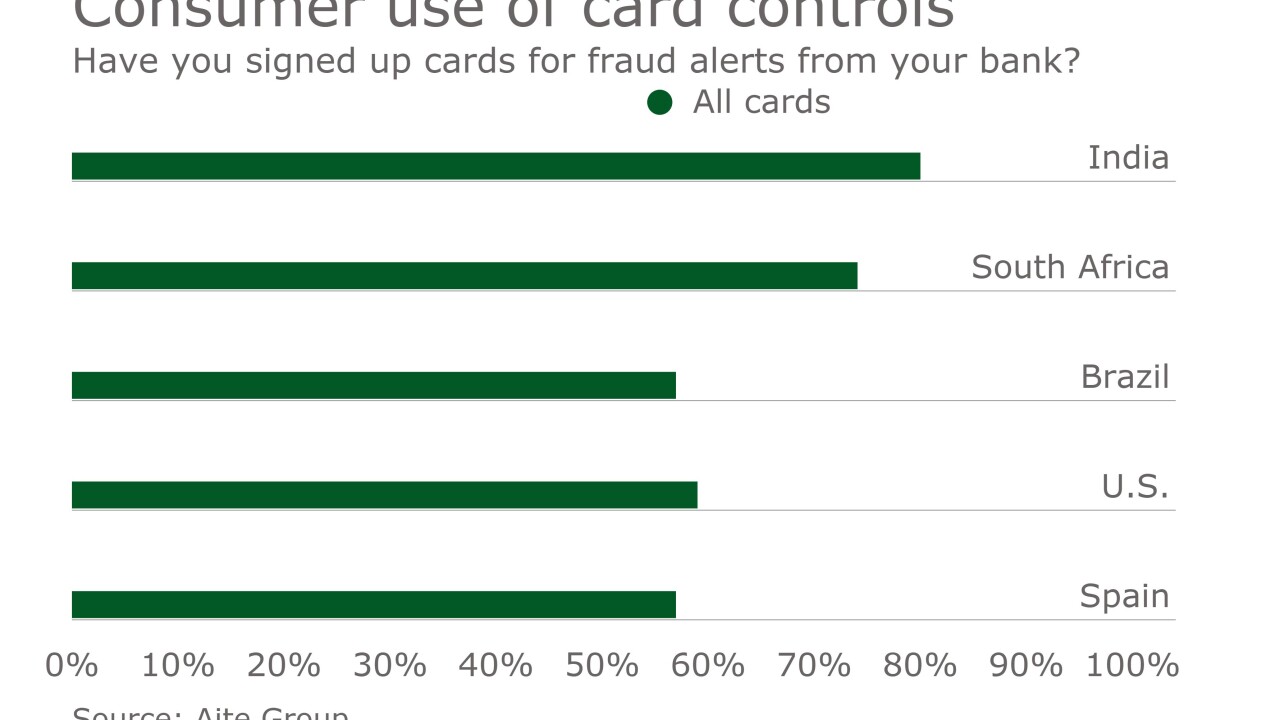

Mobile apps that allow consumers to control their payment cards are becoming more popular as banks use payment security as a way to build customer relationships.

November 22 -

A full year into the EMV migration, crooks are expected to be even more aggressive about attacking soft spots in online and mobile transactions.

November 21 -

Distinct business plans in promising areas such as smart use of consumer data, cybersecurity and content creation, according to Bank of America Merrill Lynch commercial banking executive Scott Olmsted. And that is just the beginning of his list.

November 21 -

Banks are warming to behavioral biometric software as one of an array of choices to prevent digital banking fraud.

November 18 -

Mastercard will launch its “selfie pay” system in the Asia-Pacific region next year, expanding the global reach of its biometric identity-verification service for online payments to more markets as part of a gradual worldwide rollout.

November 17 -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

The once-booming market for reloadable prepaid cards has seen a slowdown in new-account growth in recent years amid heavier competition and consolidation, causing longtime providers to look for ways to stand out in a crowded field.

November 15 -

As online fraud becomes more pervasive, merchants need to strengthen their defenses against would-be cyber thieves.

November 15 -

Digital payments security provider V-Key will protect the cloud-based payments network of Ant Financial Services Group (Alipay) with its virtual secure element software.

November 14 -

Any company that uses point of sale systems or technology is at risk.

November 11 CoSoSys

CoSoSys -

The president-elect's policies on taxes, offshoring, surveillance and other issues will affect bank technology officers and their vendors in a variety of ways. The positives may slightly outweigh the negatives.

November 10 -

To jawbone Mexico into paying for the wall, President-elect Trump has threatened to suspend remittances. Such a move would disrupt one of the busiest corridors of money in the world.

November 9 -

Tesco Bank in Edinburgh, Scotland, has refunded 2.5 million pounds (about $3 million) to 9,000 customers who were affected by a large-scale online banking cybertheft last weekend.

November 9