-

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23 -

Voice and text banking will be embedded in the Minneapolis bank's mobile app through a chatbot assistant that also caters to users with disabilities.

July 23 -

The IBM-BNP collaboration and other new developments show that high-profile breaches haven't deterred banks from using the cloud to store data.

July 22 -

The online lender has already branched out into facilitating payments and analyzing cash flow for small-business customers. Its new checking account is meant to round out those services.

July 22 -

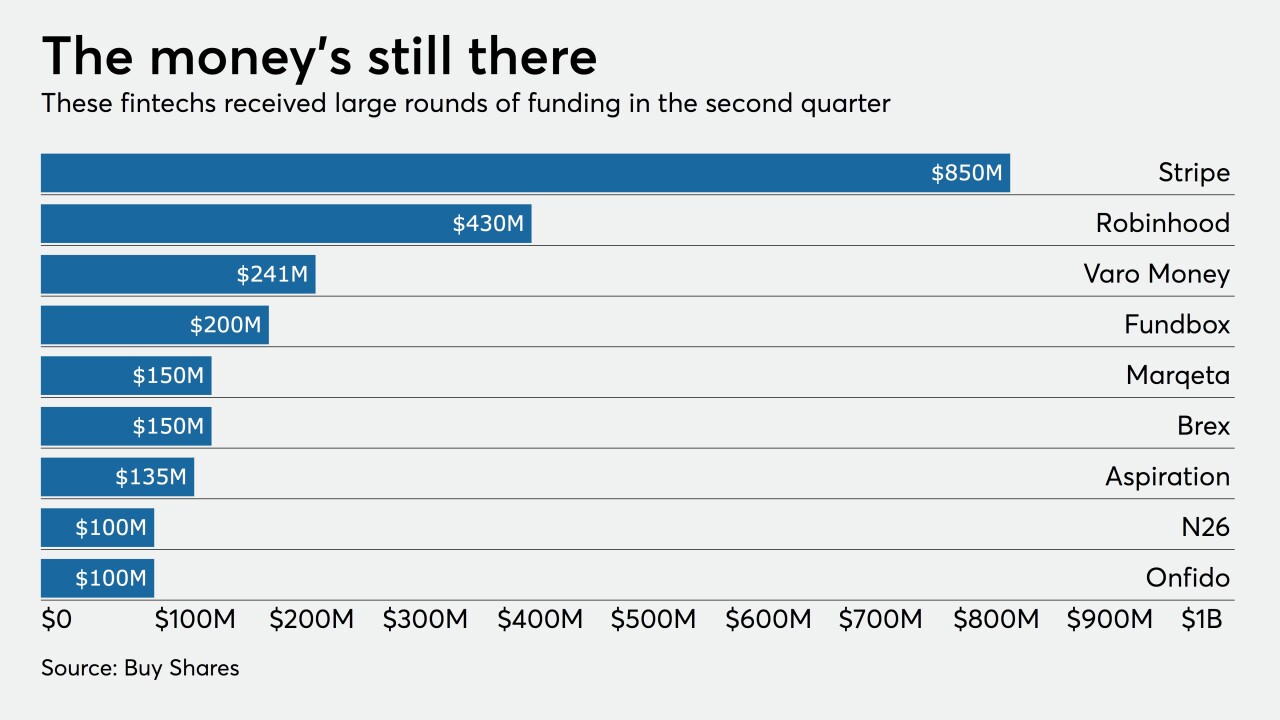

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

Fintechs like Greenlight and gohenry have drawn millions of teens with features like savings goal tracking and customizable debit cards.

July 16 -

Rho initially focused on startups, but now it’s targeting businesses with 100 or more employees.

July 16 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

After tech firms assisted community bankers in processing applications in the Paycheck Protection Program, small-business lenders are continuing to engage with cloud providers and other outside companies to automate the loan forgiveness process.

July 10 -

The Wall Street firm is jumping into a market dominated by a handful of big U.S. banks, betting that superior technology can lure companies with complex cash-management needs.

July 8 -

The days of meeting with mentors and pitching investors in person are at least temporarily over, but fintech incubators, accelerators and boot camps are finding creative ways to replicate these valuable experiences online.

July 7 -

Some financial institutions are using emotion AI, which picks up subtle signals over text, audio and video, to help their customer service agents do their jobs better.

July 7 -

Jane Gladstone, new president of Promontory Interfinancial Network, says the recession will accelerate the shakeout among the nonbank disruptors and that small banks have an opportunity to forge new bonds with the survivors.

July 6 -

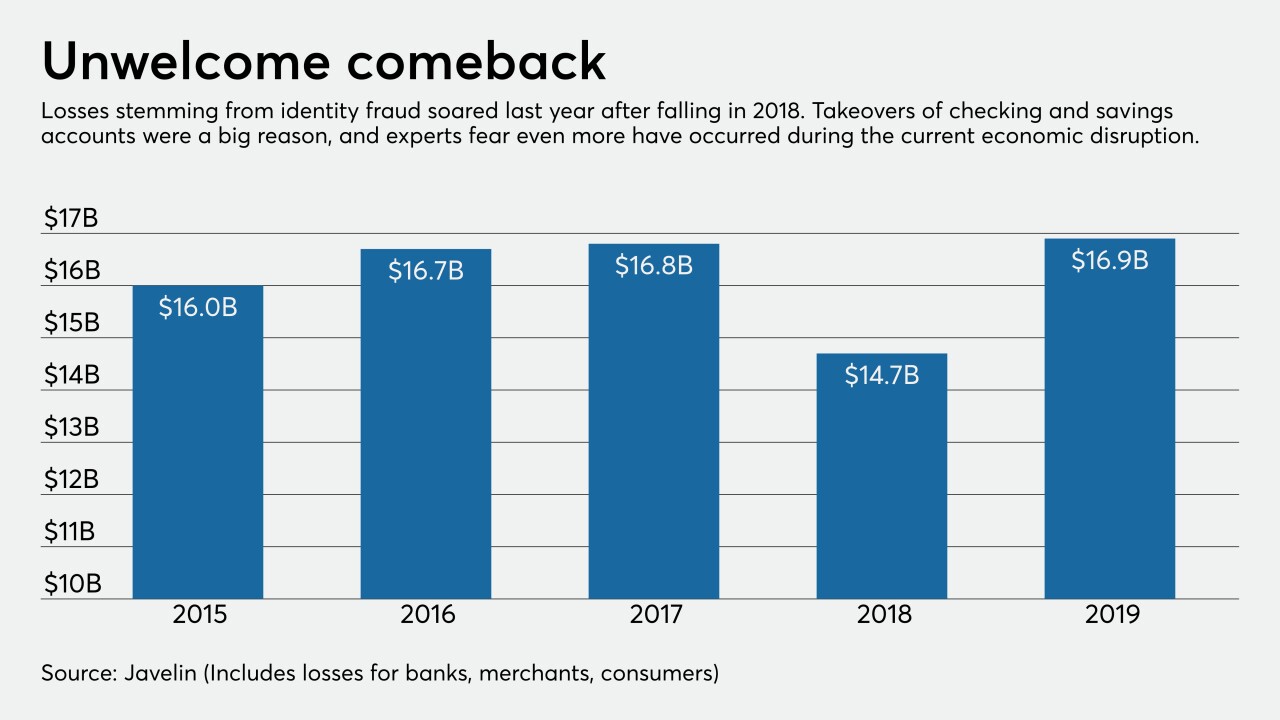

Axcess Financial is using stronger authentication, studying up on bad actors and planning to use a federal service that automates verification of Social Security numbers.

July 2 -

Banks are using emotion AI, which picks up subtle signals over text, audio and video, to help their customer service agents do their jobs better.

June 30 -

Thanks to their close relationship with the card networks, banks stand to benefit most from deals like Mastercard’s agreement to buy Finicity and Visa’s pending purchase of Plaid. The prospects for fintechs and consumers are dicier.

June 29 -

Citizens Bank and Citigroup are among the financial institutions plugging away at a service that has gained little traction among customers.

June 26 -

Upstart, which specializes in the use of alternative data and AI in credit decisions, will make car loans directly and sell its technology to banks and other lenders.

June 24 -

The company’s U.S. chief executive says the primary goal behind the app it rolled out Wednesday is to help customers improve their financial health and avoid overdrafts.

June 24 -

Challengers like Joust, Lili and NorthOne that offer banking services to freelancers and small-business owners are getting record levels of new customers as the traditional workforce thins.

June 23