Earnings

Earnings

-

The era of exceptionally strong loan performance in the credit card business has come to an end, and the Riverwoods, Ill., firm is feeling the effects.

April 25 -

Most of the delinquencies and chargeoffs were in the bank’s credit card and auto loan portfolios

April 25 -

Northwest, which produced lackuster first-quarter results, said it will close all 44 offices of Northwest Consumer Discount Co. by mid-July. The unit’s loans will be transferred to Northwest’s bank for servicing and collections.

April 25 -

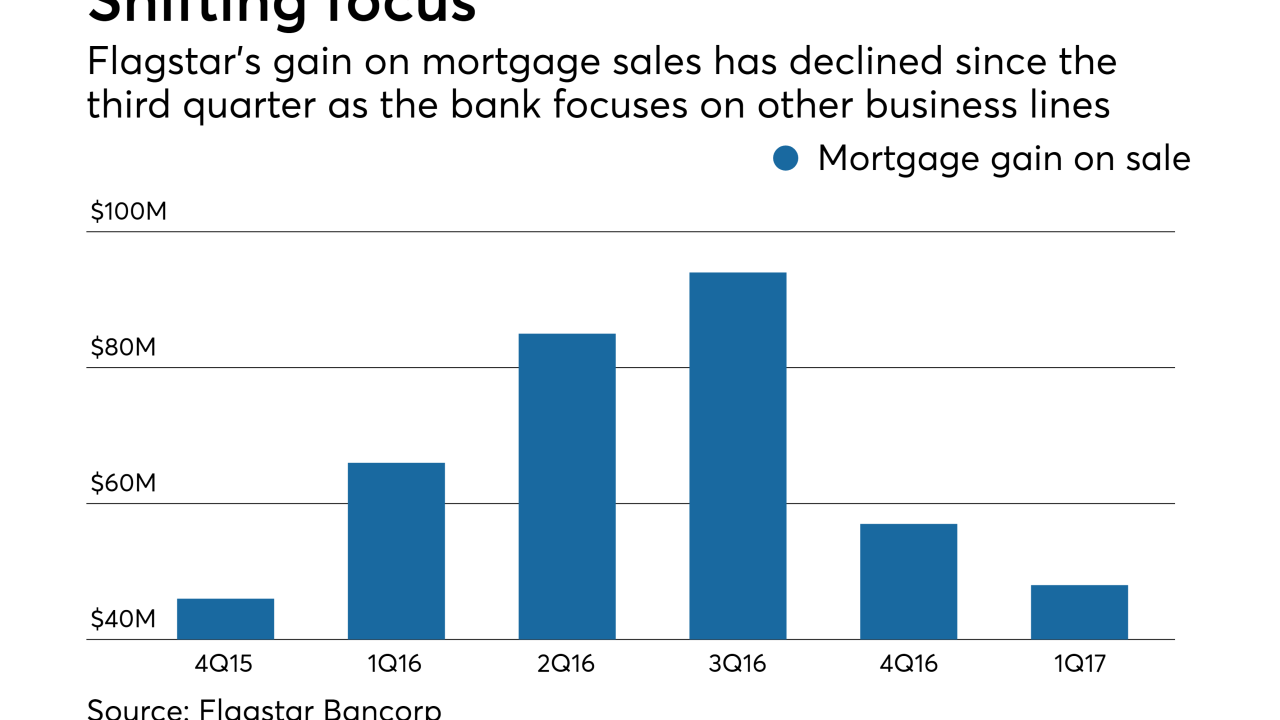

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

The results handily beat estimates as the company benefited from CEO Ellen Alemany’s ongoing effort to shed businesses and simplify operations.

April 25 -

The West Virginia company sold the mortgages to Residential Funding and ResCap Liquidating Trust between 2003 and 2007.

April 25 -

Merger-related expenses cut into the Pittsburgh company's earnings, though management is excited about growth opportunities in North Carolina.

April 25 -

Double-digit gains in assets under management and administration and higher interest rates more than offset rising expenses.

April 25 -

The Cincinnati company’s 1Q profits were hurt as it scaled back in key consumer and commercial credits, paid higher severance and saw fee income fall.

April 25 -

The Florida company relied on loan growth and loan sales to offset higher expenses and ongoing issues in its taxi medallion lending operations.

April 25