-

The Los Angeles company has established a network that is designed to help verify the identities of consumer and small-business borrowers. It says 20 lenders are participating and that it is trying to recruit more.

June 12 -

Ken Lehman will gain a 40% stake in the Tennessee bank as part of a broader plan to raise $13 million.

June 12 -

Director Mark Calabria urged lawmakers to grant the agency chartering authority similar to that of bank regulators to boost competition in the mortgage market.

June 12 -

Several prospects, including JPM’s Gordon Smith, are reluctant to take on a thankless job; lower interest rates, quiet trading will yield disappointing results.

June 12 -

The Australian API payments and rewards platform provider Verrency has closed on a $7 million (AU$10 million) Series A funding round, bringing the total funds raised to-date to $14 million (AU$20 million).

June 11 -

Payments software provider SpotOn Transact LLC has received $40 million in new funding from Franklin Templeton and participant Dragoneer Investment Group.

June 11 -

Digital payments are creating a wealth of data that can be used to inform other types of financial services for managing debt or promoting financial inclusion — and these services are, in turn, attracting the interest of venture capitalists.

June 11 -

Alkami Technology said it would use its latest round of funding to expand its white-label services for small banks and credit unions.

June 10 -

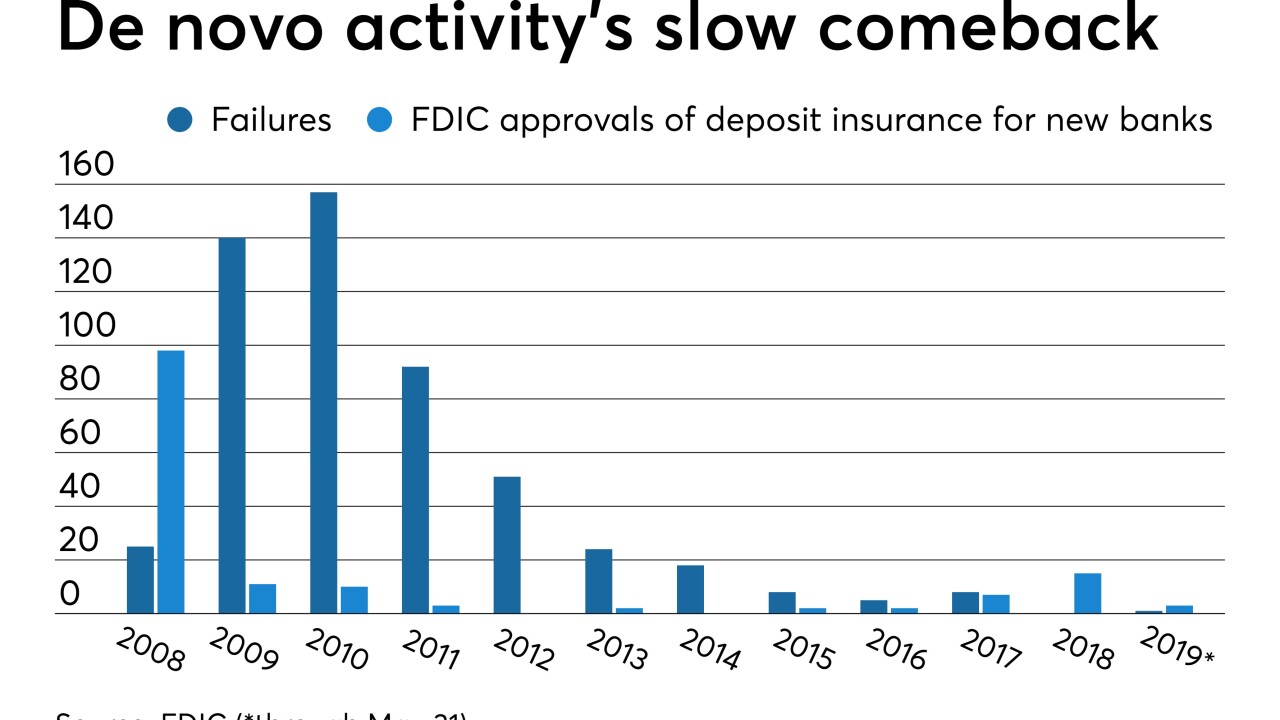

Founders Bank is the latest de novo effort that will target the nation's capital.

June 10 -

The Tampa-based institution says it is poised for growth, but the new asset class also opens it up to additional scrutiny from the CFPB.

June 10 -

A trio of big deals in the payments and financial tech area and continued bank and venture capital interest in fintech investments are creating expectations for a banner year.

June 10 -

The group behind Bank of St. George is looking to bring in up to $22 million in initial capital.

June 7 -

Highland Associates has $26 billion in assets under management on behalf of not-for-profit medical endowments and foundations. Regions Financial is following the lead of other regionals, which have been scooping up investment firms that specialize in health care.

June 7 -

Brazil is the latest Latin American country to establish plans for a low-cost instant payments network with the aim of increasing financial inclusion and eliminating cash from the economy.

June 7 -

Readers weigh potential risks in the leveraged loans market, debate Herb Sandler's legacy, consider the role the Fed should play in real-time payments and more.

June 6 -

Loans grew amid a surge in deposits, while membership surpassed 117 million and industry consolidation continued.

June 6 -

Credit unions collect more in fee income than their banking counterparts. That could become problematic as the political winds and consumer preferences shift.

June 6 -

Many community banks have given up on national mortgage platforms as not worth the effort, but organizers of NXG Bank in Maryland say they have a plan to make one work.

June 4 -

Regional and small banks are striking digital partnerships and launching new savings offerings as they attempt to steal away business from bigger institutions.

June 4 -

The online lending marketplace will use the equity financing from WestBridge Capital to diversify the digital products its offers banks trying to compete for small-business borrowers, its CEO says.

June 4