-

City sues seven banks for alleged price fixing on floating-rate bonds; analyst says “the most negative revelations are yet to come” in the 1MDB scandal.

February 22 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

The move, reported by The Wall Street Journal, could be part of a deeper foray into cobranded cards by Goldman, which has been expanding into consumer finance through its Marcus unit.

February 21 -

If verdict stands, it could raise ceiling on anti-laundering penalties; better-than-expected results buy Barclays chief more time on current strategy.

February 21 -

Congressional investigations are often rushed affairs that fail to dig beneath the surface. But the hiring of a veteran investigator who has tangled with Deutsche in the past suggests that this politically charged inquiry is likely to be thorough.

February 20 American Banker

American Banker -

The Michigan-based institution also awarded $315,000 in bonus reward points to members who use the CU's credit card.

February 20 -

Dan Schulman predicts digital payments market may reach $100 trillion; the bank exiting Estonia, Latvia, Lithuania and Russia.

February 20 -

The online consumer lender trimmed its losses in the fourth quarter and says an adjusted, non-GAAP metric suggests it's on the path to getting out of the red later this year.

February 19 -

The Rhode Island bank is one of several regionals that have snapped up dealmaking boutiques in recent years to bolster noninterest income.

February 19 -

Navient Corp. shares surged after Canyon Capital Advisors said it could boost a $3.1 billion takeover offer that was rejected by the student-loan servicer.

February 19 -

The venture capital arms of Alphabet Inc.’s Google and Salesforce.com Inc. are investing in U.K. payments startup GoCardless, which has has raised an additional $75 million to fund expansion.

February 19 -

CEO Corbat says “thousands” of call center jobs may be lost; Barclays shareholder sells all stock in the bank and Deutsche’s biggest slashes its stake.

February 19 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

Wymar Federal Credit Union in Louisiana has also distributed a bonus to members.

February 14 -

Stripe’s large and quickly expanding valuation enable it to forge connections among many sources of innovation, placing even more pressure on traditional technology providers and financial institutions.

February 14 -

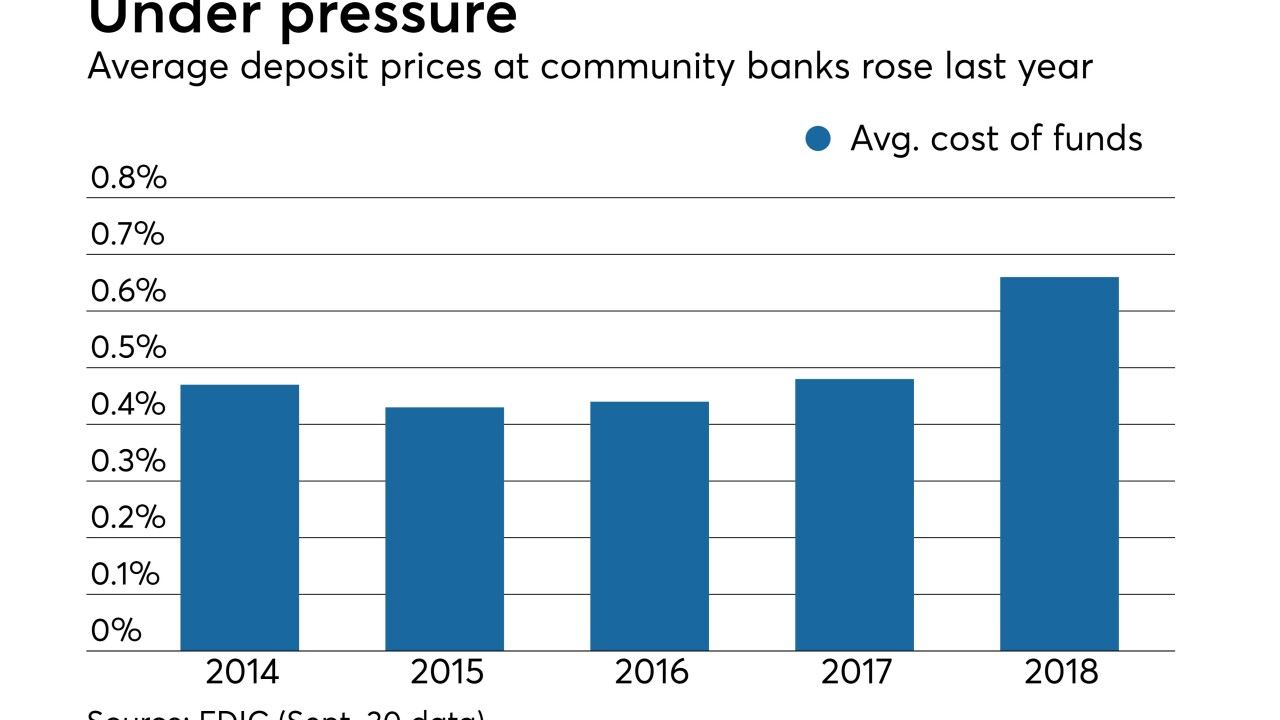

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

It often takes an underlying development, such as a major executive change or the launch of a new product or partnership to excite investors, but Diebold Nixdorf stock prices jumped Wednesday in the wake of a solid, but not outstanding, fourth quarter earnings report.

February 13 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12