Fintech

Fintech

-

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

March 31 -

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

March 31 -

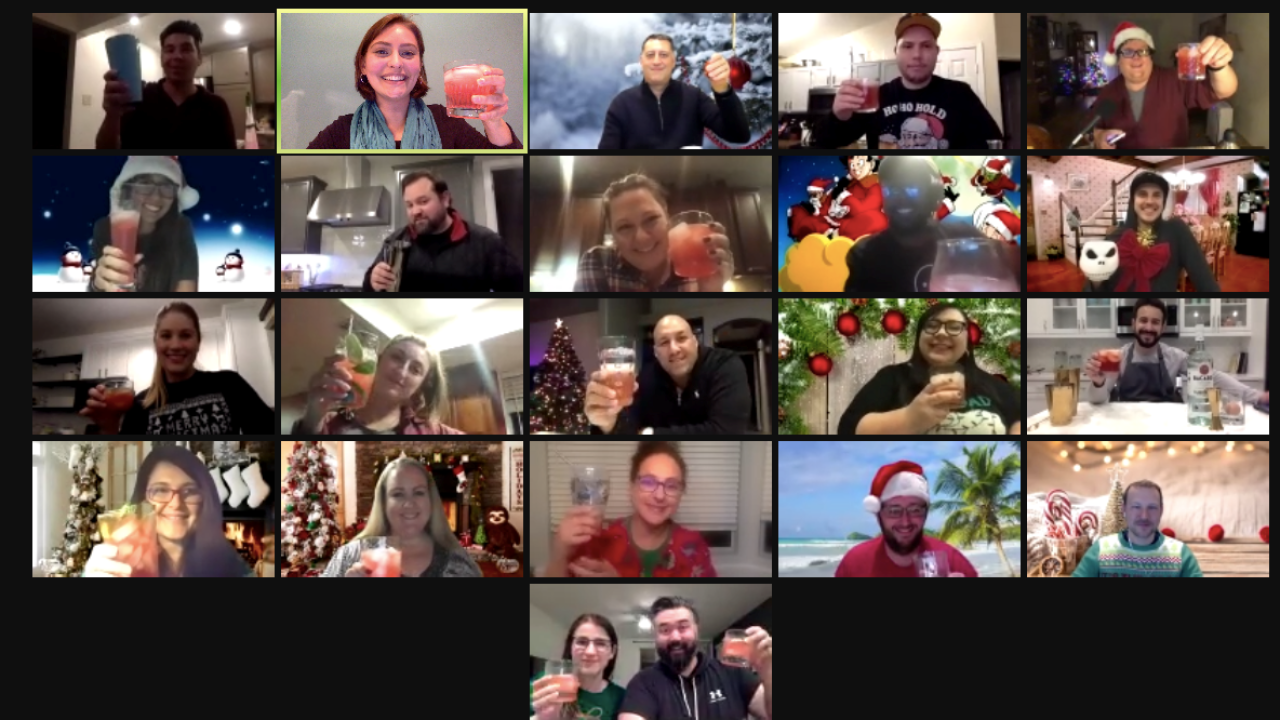

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

March 31 -

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

March 31 -

Known for giving away its signature canary-hued Converse to employees and clients, this small API-centric fintech is poised to become a significant player in open banking thanks to parent company Mastercard and its vendor status with Fannie Mae and Freddie Mac.

March 31 -

Half of Facet Wealth’s employees haven’t met face-to-face. Here is how the fintech is working to strengthen community.

March 31 -

This venture-backed company, which specializes in creating banking and payment platform APIs for other fintechs, attracts new recruits through a culture of learning.

March 31 - AB - Technology

Spiral is a self-described ethical banking app that encourages its customers to give back by letting them manage their charitable donations alongside their checking and savings.

March 31 -

MapleMark Bank in Dallas and the German fintech will let consumers choose from among three types of savings products including automated CD ladders that they can tailor to their own needs.

March 31 -

Peru is working to link banks, fintechs and mobile wallet providers into an interoperable hub for instant payments using real-time technology provided by Mastercard.

March 31 -

As the digital transformation journey accelerates the need for more collaborative, agile and tailored solutions between banks and fintechs becomes essential, says MYHSM's John Cragg.

March 31 -

Incumbent banks’ market position is underpinned by strong consumer trust and massive scale, but these historic advantages can no longer be taken for granted, Simon Wilson of Icon Solutions writes.

March 30 -

Large U.S. banks are directing their venture capital dollars to fintechs in capital markets, wealth management and "future-proofing."

March 29 -

Like their counterparts in the U.K., U.S. regulators should be working closely with the private sector to establish principles and guardrails to direct and focus tech advancements in ways that will protect consumers and financial stability.

March 29 -

Democrats have proposed a Congressional Review Act resolution to strike down the OCC rule, arguing it enables "rent-a-bank" schemes.

March 25 - AB - Technology

The challenger bank will apply some of the $40 million it raised from Truist, BofA and others to a microloan program aimed at Black and Hispanic groups. It also plans to offer a debit card through community development financial institutions and minority depository banks.

March 25 -

Fresh off the heels of a $180 million fundraiser in January, Citi Ventures-backed PPRO raised an additional $90 million in new investments in its latest equity round.

March 25 -

As accounts payable departments add robotics and other innovation, workflows and skill sets will adjust--but people won't disappear, says Nvoicepay's Lauren Ruef.

March 25 -

The country's banks and fintechs are still new to working together, giving Railsbank a chance to become a key player in open banking.

March 25 -

In a continuation of its Series D round to fuel its global expansion for cross-border payment solutions, Airwallex has raised $100 million in capital, valuing the fintech at $2.6 billion.

March 24