Fintech

Fintech

-

Attackers stole over $340,000 in stablecoin from the Venezuela-focused app. The incident adds to recent troubles including frozen accounts at JPMorganChase.

January 6 -

The lender traps consumers in an "exploitative cycle of debt," Brandon Scott said.

January 2 -

Fintechs sought to acquire the rights and privileges of bank charters in various ways this year, from de novo applications to buying up banks.

December 31 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

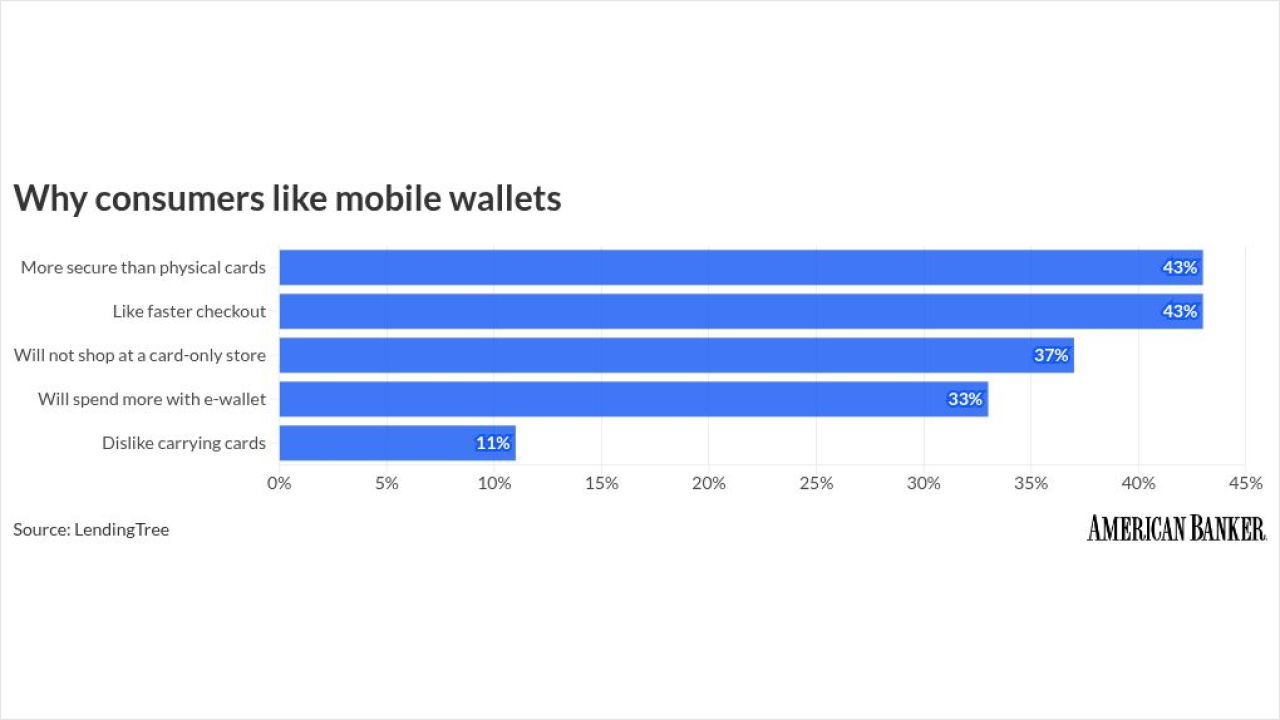

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

Fintechs are wrong to demand wholesale consolidation of community banks in the U.S. Real innovation doesn't stem from wiping out smaller institutions or forcing consolidation. Innovation comes from fair competition, secure data protocols, and clear rules that apply equally to banks and fintechs of all sizes.

December 23 -

Some consumers have been waiting a year and a half to get their money back.

December 22 -

The bank technology company is adding offices in the U.S. and India as part of its quest to reach clients outside of its U.K. home base.

December 19 -

Here are the 10 stories our readers paid the most attention to in a year of political, economic and technological change.

December 19 -

The Nashville community bank is focusing on growing its "digital branches" through fintech partnerships and embedded banking with its latest funding round.

December 16 -

-

These are the executives, regulators, investors, disruptors and firebrands who will have the biggest impact on bankers in the coming year.

December 16 -

The small Missouri community bank partnered with embedded banking provider Treasury Prime to connect with fintechs and signed on its first sponsoree earlier this year.

December 15 -

The payments fintech reported an $8 billion valuation as it aims to establish a second global headquarters in Silicon Valley and expand into Europe and the U.K.

December 11 -

The firm's consumer account, which offers a 3.5% yield on savings, could appeal to the founders of startups that it already serves.

December 11 -

The Brazilian fintech is on the hunt for an acquisition since new rules approved in November forbid the use of "bank" in a brand unless the company holds a banking license, which Nubank does not.

December 11 -

PayPal and other fintechs already offer small business loans based on future payment flows, creating a competitive market.

December 9 -

The lawsuit alleges the fintech giant secured its own corporate data with strong MFA while leaving client systems vulnerable to compromise.

December 9