-

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial -

Backers say a bill to limit asset growth instead of restricting brokered funds addresses concerns about expanding balance sheets at troubled banks. But skeptics worry it would open the door to greater risk.

July 8 -

The New York commercial bank says geographic diversification is a long-term necessity and that the interplay of its private banking and commercial banking businesses has helped it withstand the economic shock of the coronavirus.

July 8 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

Members of NW Iowa Credit Union soundly rejected merging into Siouxland Federal Credit Union. The pandemic could lead to more unexpected results.

July 7 -

The $338 million-asset institution already serves more than 3,000 members in the county who were able to join through affiliations with Harford County.

July 6 -

The New York-area companies' $489 million agreement runs counter to recent merger pacts built around branch cuts and more tech spending.

July 5 -

Ride-hailing services and public transit were gaining ground until the pandemic struck, but the outbreak has quickly and radically changed how consumers think about buying cars.

July 2 Credit Union Leasing of America

Credit Union Leasing of America -

The credit union has agreed to buy Elberfeld State Bank, broadening its reach in the Evansville, Ind., market.

July 2 -

The deal will create an $11 billion-asset banking company with operations in a number of markets around New York City.

July 1 -

Neil Dauby, the Indiana company's chief commercial banking officer, will have oversight of all operations, reporting directly to Chairman and CEO Mark Schroeder.

July 1 -

Christina O’Brien has worked at the Warner Robins, Ga.-based credit union for almost 30 years in a variety of roles.

July 1 -

Mesaba, which is also based in Minnesota, is the parent of American Bank of the North and Lake Bank.

July 1 -

The Greenville, S.C.-based institution will gain three branches and about $100 million in assets if members of Anderson Federal Credit Union approve the transaction.

June 30 -

Southwest Bancshares in San Antonio will have assets of $1.5 billion when it absorbs two affiliated banking companies in nearby cities.

June 30 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

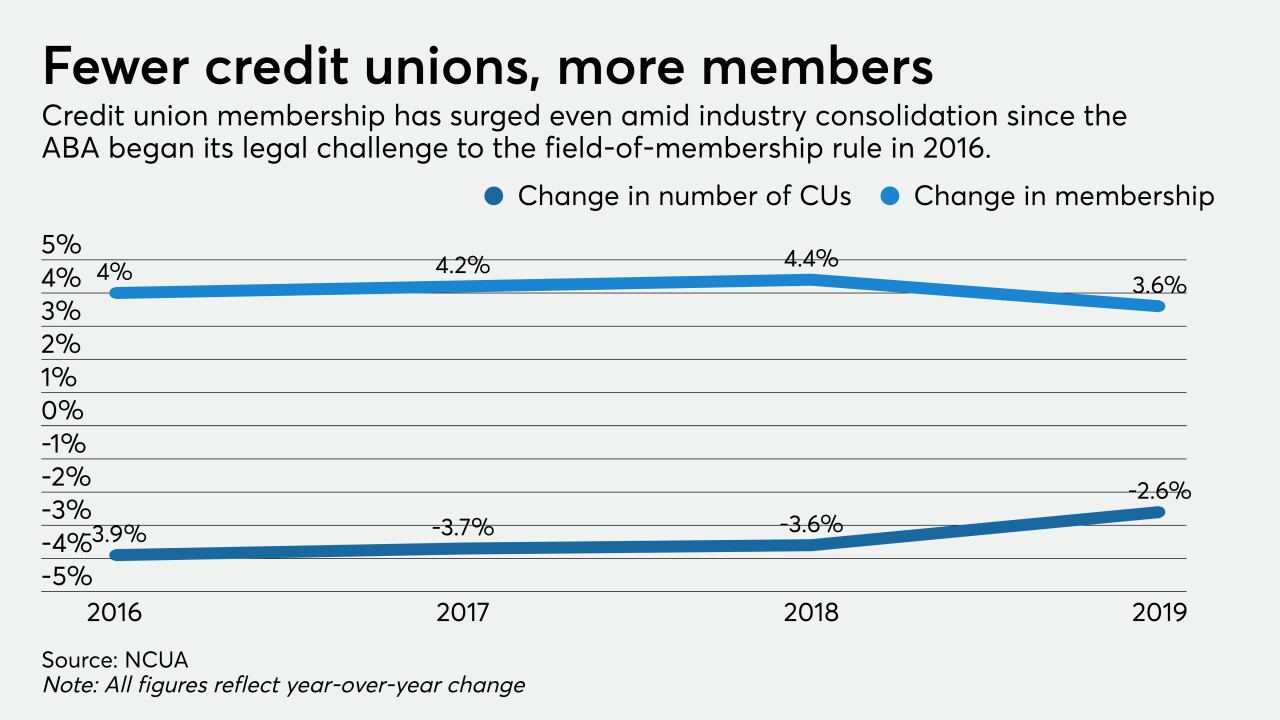

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The court's decision not to consider an appeal from the American Bankers Association is likely to be the last step in a legal saga dating back to 2016.

June 29 -

The Loan Source, the nonbank lender buying the Paycheck Protection Program loans, has similar deals in place with other lenders.

June 26 -

Following the completion of a merger between Canyon State CU and Deer Valley CU, the combined institution has unveiled its new name.

June 26