-

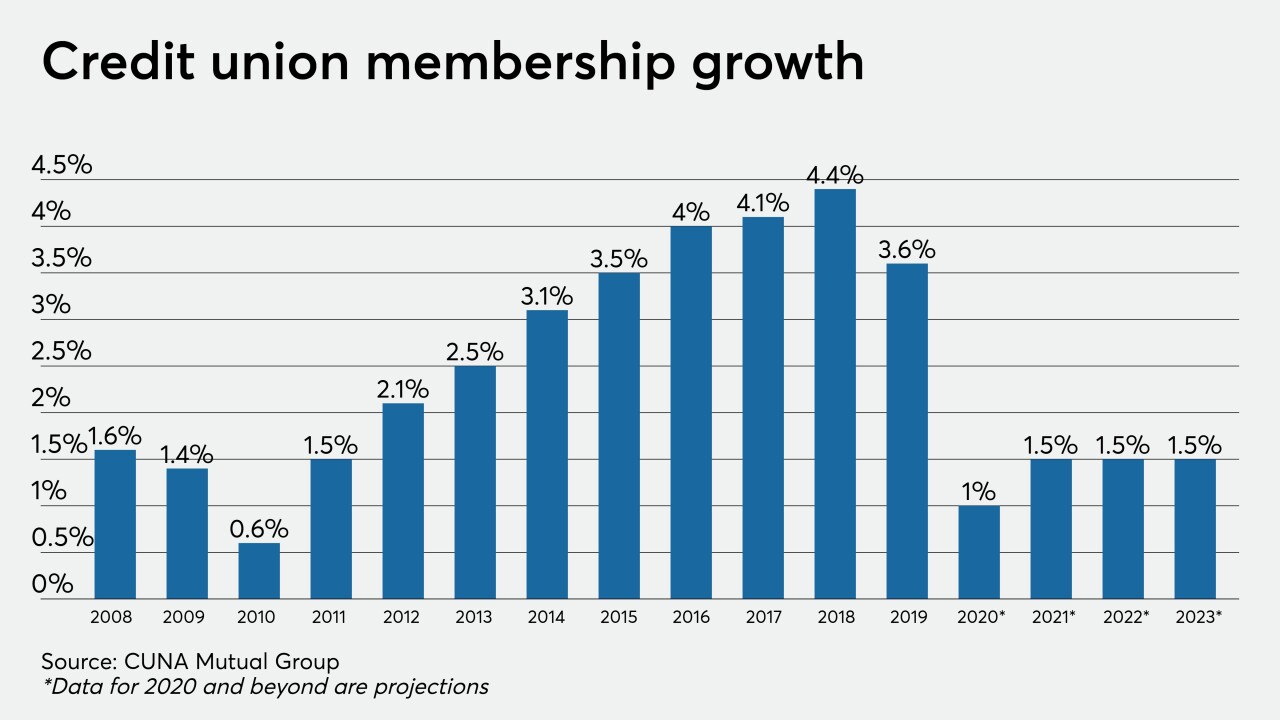

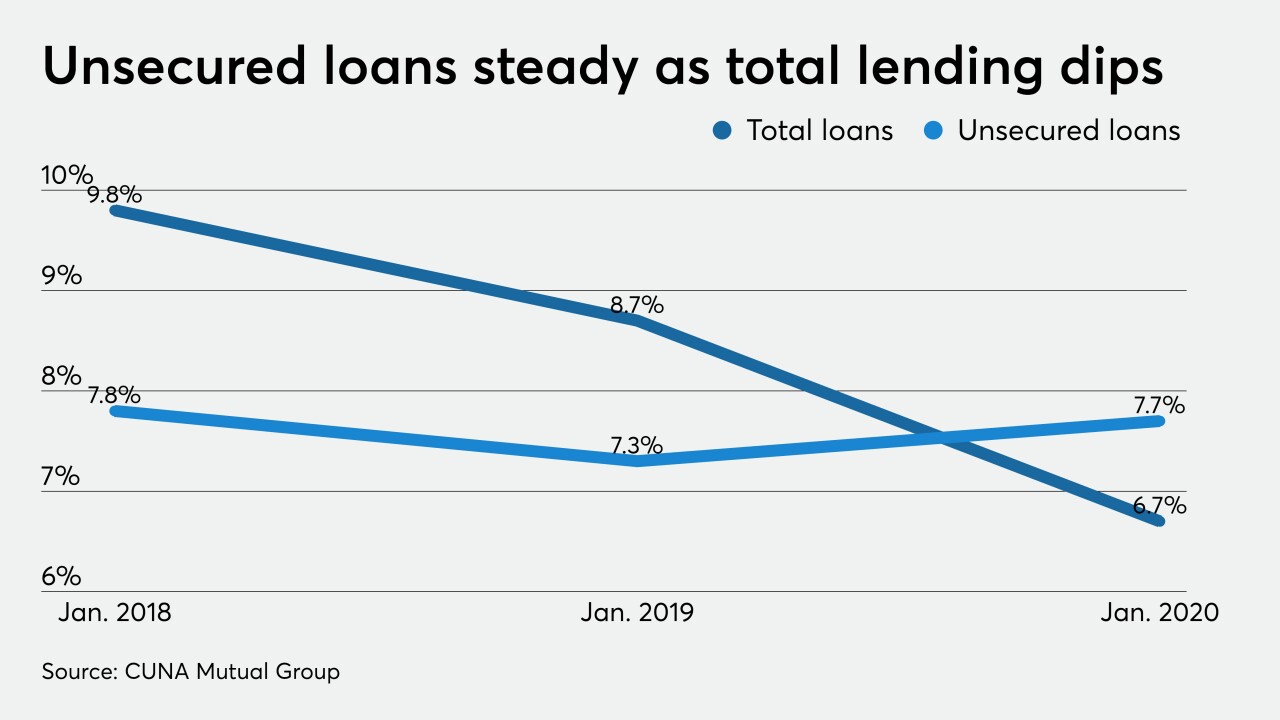

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

N.W. Iowa CU has agreed to merge into Siouxland FCU, citing rising technology costs and an increasingly complex compliance environment.

April 29 -

With its "people helping people" mindset, the industry is uniquely positioned to serve consumers who are suffering during the pandemic. Credit unions need to capitalize on this.

April 28 PenFed

PenFed -

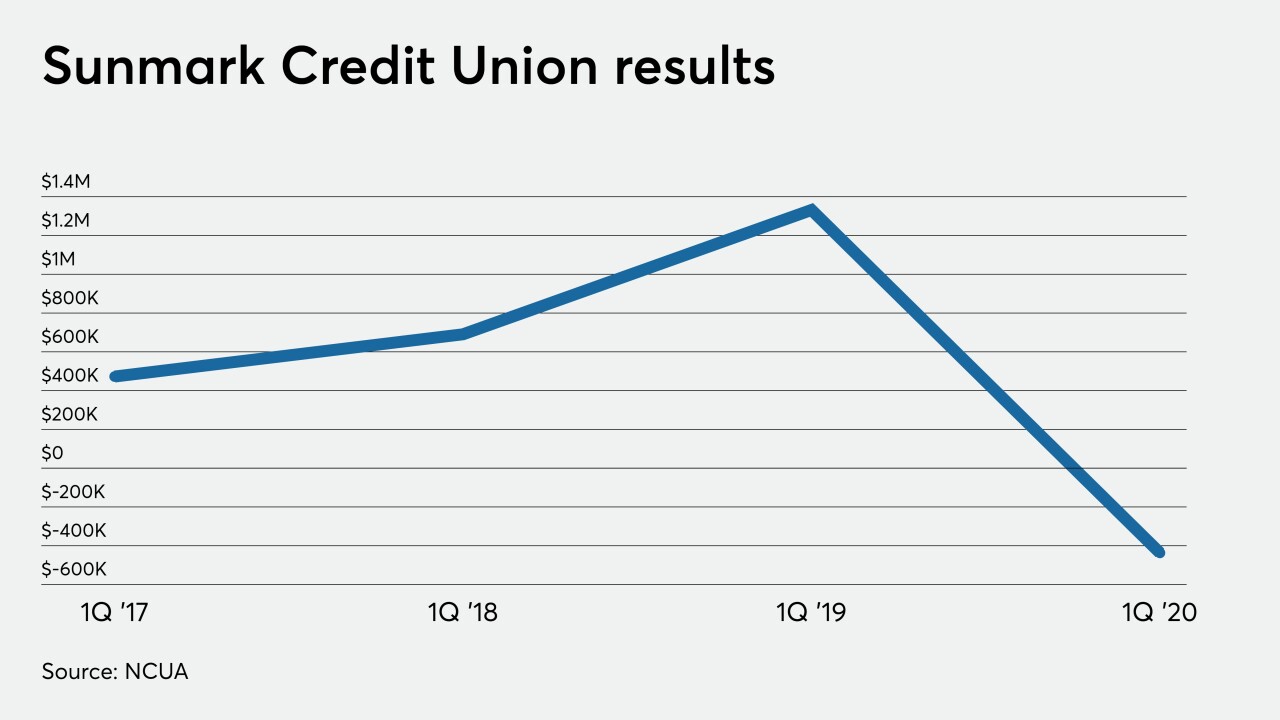

The New York-based credit union is set to absorb Hudson River Financial FCU and Columbia-Greene FCU following charter conversions at those institutions. Sunmark has picked up at least two other small CUs within the last 18 months.

April 27 -

Members of Andigo Credit Union in Schaumburg, Ill., have approved a proposed merger into Consumers Credit Union in Gurnee, Ill.

April 24 -

The value of serving a specific employer or a limited field of membership has diminished over the years. COVID-19 is just the latest crisis that shows how dangerous this concentration can be.

April 23 -

Southwest HealthCare Credit Union agreed to merge into Canyon State because of increased competition and regulatory demands.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

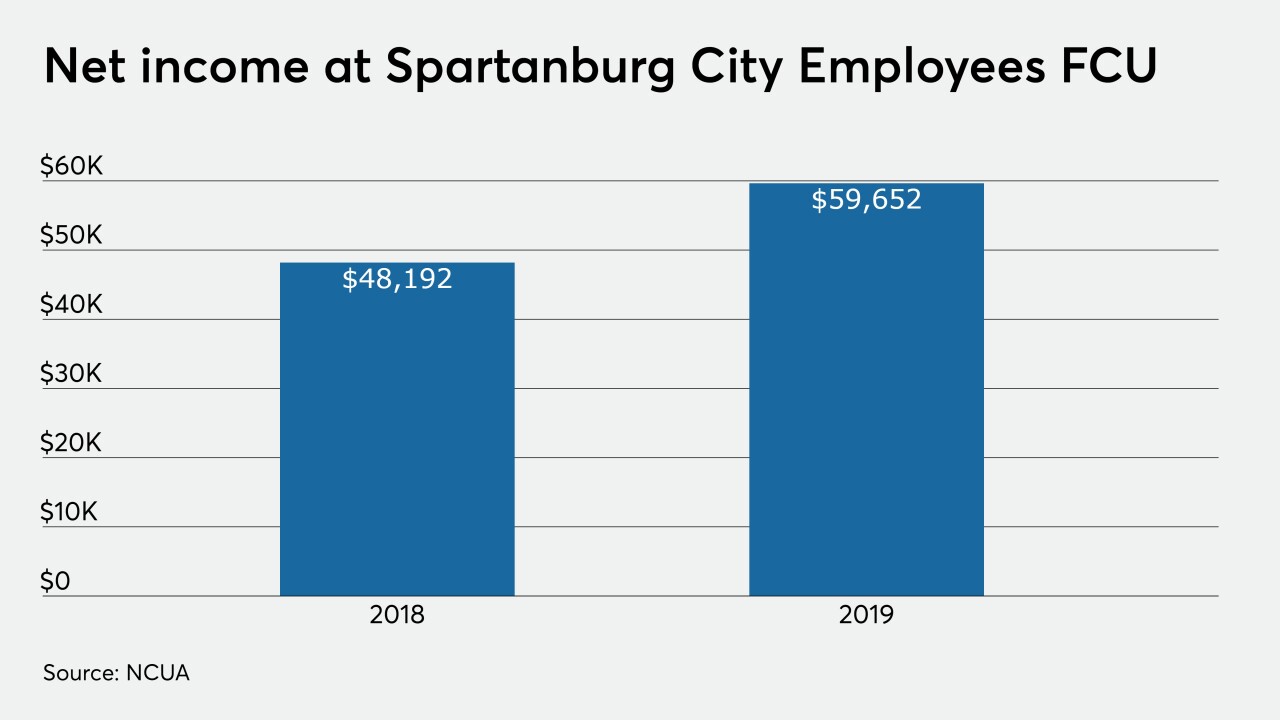

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15 -

The industry was already on a path toward increased digital services, but the global pandemic is showing why CUs need to speed up that process.

April 14 nCino

nCino -

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

Many states are offering additional flexibility as more consumers dip into their savings as a result of the pandemic’s economic fallout.

April 9 -

At just $3.7 million in assets, tiny Financial 1st Federal Credit Union has voted to merge into Horizon FCU.

April 9 -

Credit unions that take advantage of hedging could see better execution and increased profitability in their mortgage operations.

April 6 Vice Capital Markets

Vice Capital Markets -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

April 3 -

South Jersey Gas Employees Federal Credit Union will merge into Jersey Shore Federal Credit Union on June 1.

April 2 -

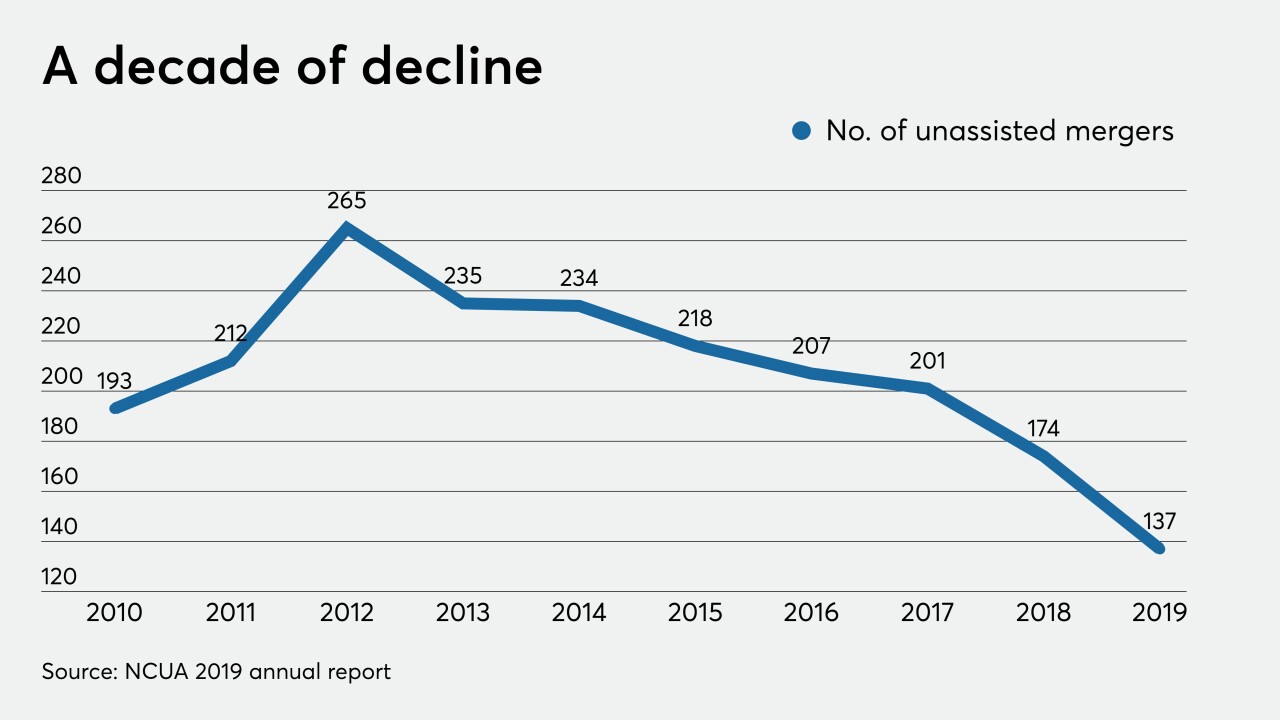

The number of deals per year was declining even before the pandemic, and it's unclear when things might pick up again.

April 2 -

Alabama Rural Electric Credit Union will merge into Alabama One later this year, creating a combined institution with a reach across 57 counties.

April 1 -

With branches closed and fewer opportunities for credit unions to have in-person interactions with members, the pandemic has reiterated the need for digital transformation in the industry.

March 31 Ignite Sales, Inc.

Ignite Sales, Inc.