-

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

April 22 -

Firms that create virtual assistants for financial institutions are training their bots to answer questions about the pandemic and relieve phone lines from a barrage of customer calls.

April 22 -

PayPal subsidiary iZettle is working with U.K. urban delivery platform Stuart to offer small businesses remote payment and delivery services during the coronavirus crisis.

April 22 -

The four-year project aims to track the ways consumers make and manage their money, which have been dramatically altered by the global pandemic.

April 22 -

Business payments gateway Cashfree has established new features for its insurance, web aggregator and broker clients in India to streamline policy premium collection, claim settlement and payouts to agents and hospitals.

April 22 -

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

Businesses have turned to workarounds to accommodate the coronavirus’ impact on brick-and-mortar stores, emergency measures that will likely become permanent in order for these businesses to survive into the future.

April 22 -

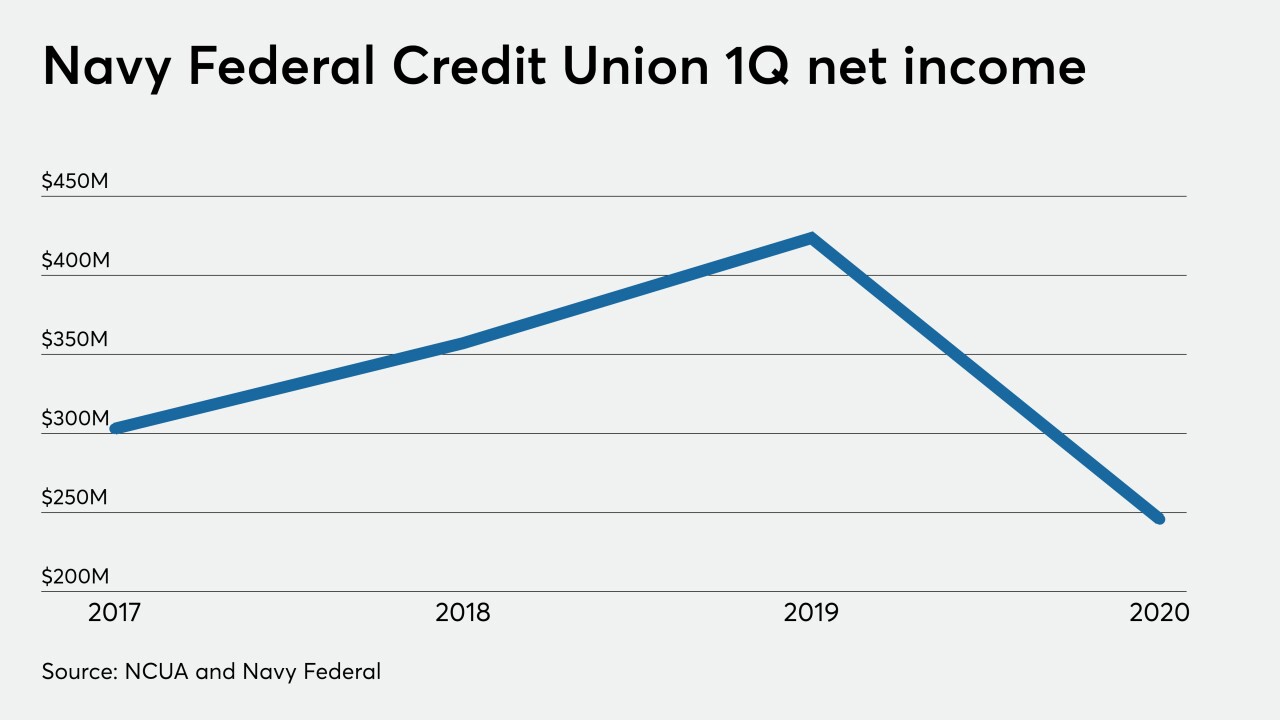

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22