-

To address immediate market demand but allow time for the project to be done right, the official leading implementation of FedNow says the central bank envisions an initial release in 2023 or 2024 followed by subsequent updates.

February 12 -

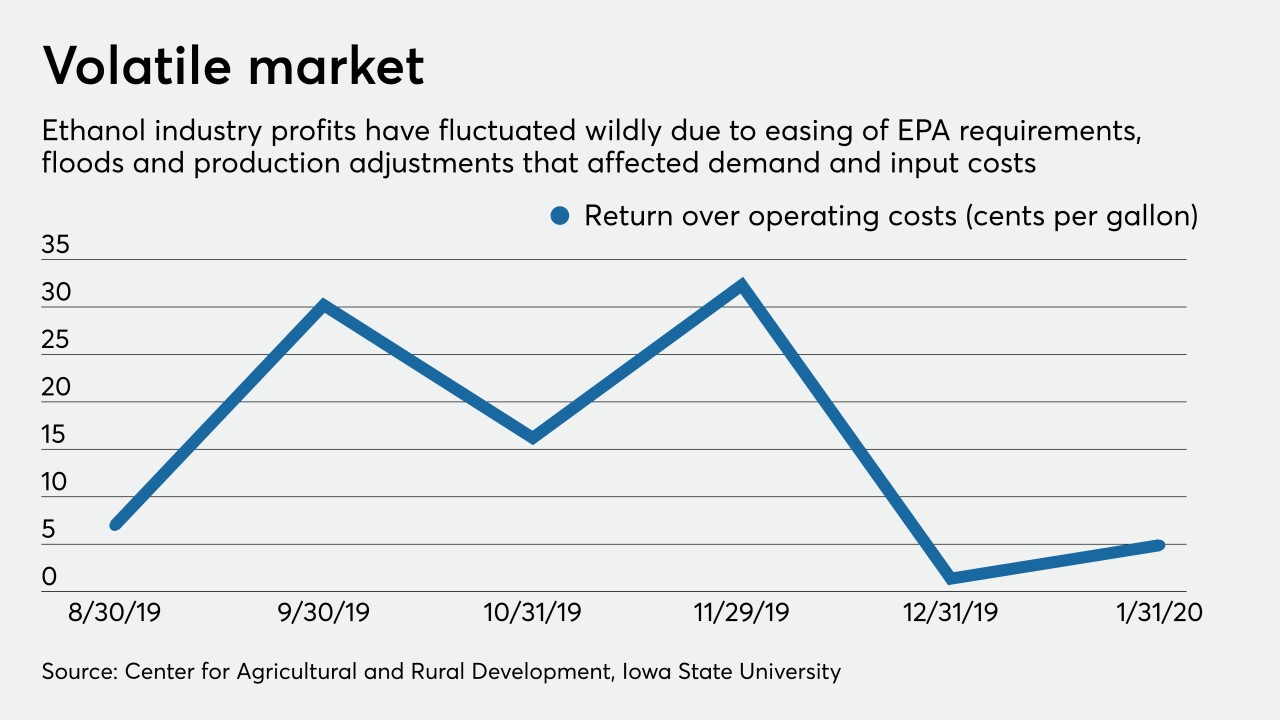

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

A study by the House Financial Services Committee on the industry’s efforts to hire and promote more women and minorities has sparked a dispute over whether banks should have to be more transparent about those efforts.

February 12 -

Wells is thought to be the first big U.S. bank to allow harassment victims to go to court instead of arbitration. An investment firm that advocates for progressive causes claimed credit for the policy change.

February 12 -

Activist investors say the lender's words on combating climate change have not matched its actions. But the company argues that requests to put climate resolutions to a shareholder vote amounts to micromanagement.

February 12 -

It could take a while to achieve those goals – more than half of credit union boards don’t have term limits for directors, the report showed.

February 12 -

The fintech, which translates foreign credit reports to help immigrants get loans, says it has raised millions from venture capital firms and celebrities like Alex Rodriguez and U2's The Edge because its product addresses important economic and social needs.

February 12 -

Square has buttressed its deep-learning with the purchase of Dessa, a Toronto-based machine learning startup that specializes in advanced risk management.

February 12 - LIBOR

Federal Reserve Chairman Jerome Powell told senators that the central bank is willing to explore a credit-sensitive interest benchmark in addition to the secured overnight financing rate, which some banks say could cause problems during economic stress.

February 12 -

Point of sale credit is a popular option, and Visa has followed its investment in Klarna by financially backing ChargeAfter.

February 12