-

Payday lenders have long used bank partnerships and similar means to circumvent state interest rate caps. Lawmakers should stop such practices now.

February 10 Colorado

Colorado -

The deal, expected to close later this year, will expand the Apple Valley, Minn.-based credit union's reach to 30 branches across the state.

February 10 -

From taboos to cost concerns, some say the industry hasn’t moved quickly enough to tackle a key risk area.

February 10 -

Point of sale credit can be an alluring option for consumers who are normally averse to taking on debt. The allure is also enough to draw support from one of Australia’s largest banks and the digital merchant acquiring giant Stripe.

February 10 -

Fraudsters are smarter and more devious than ever before. With that evolution comes an increase in successful fraud attempts, seen especially by companies that do not practice modern payment safety protocols.

February 10 Nvoicepay

Nvoicepay -

The agency's lawsuit against the Rhode Island company — the first involving a bank under Director Kathy Kraninger — has challenged assumptions about its approach to enforcement.

February 9 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 7 Nations Lending Corp.

Nations Lending Corp. -

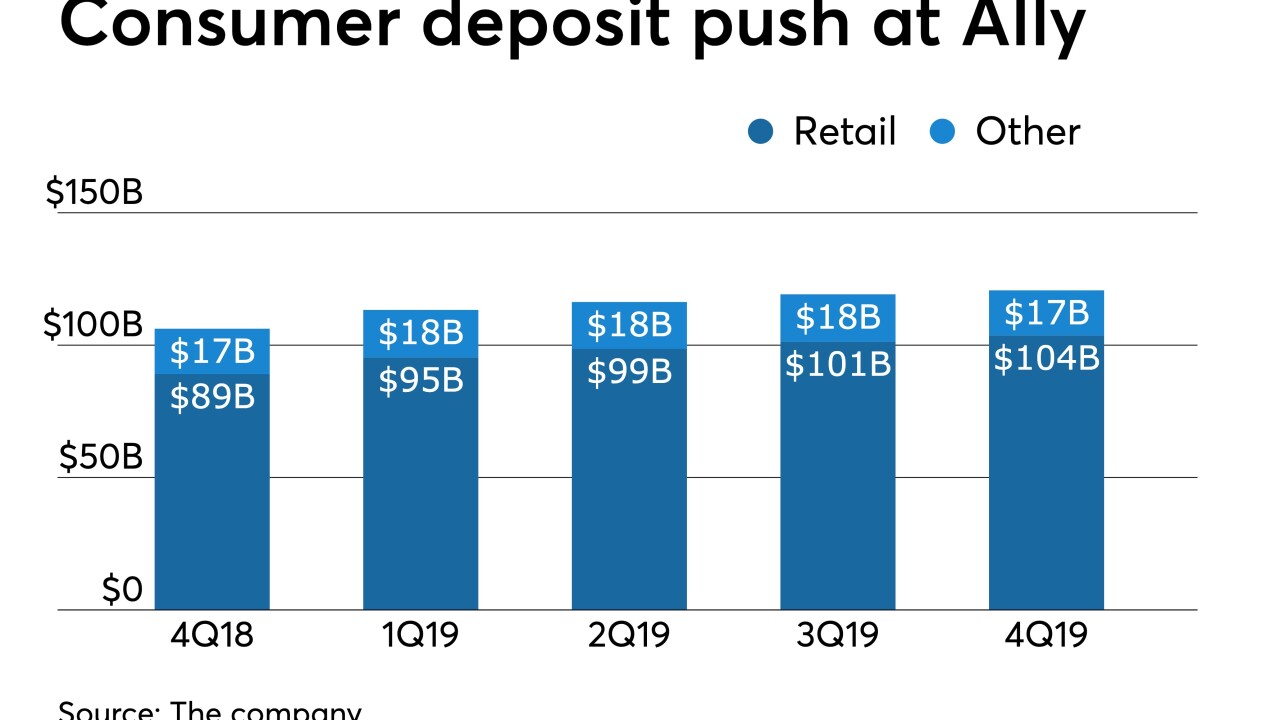

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

M&T hires Aarthi Murali away from JPMorgan Chase as its customer experience chief; when a small town loses its only bank; why more banks are ditching their legacy core vendors; and more from this week’s most-read stories.

February 7 -

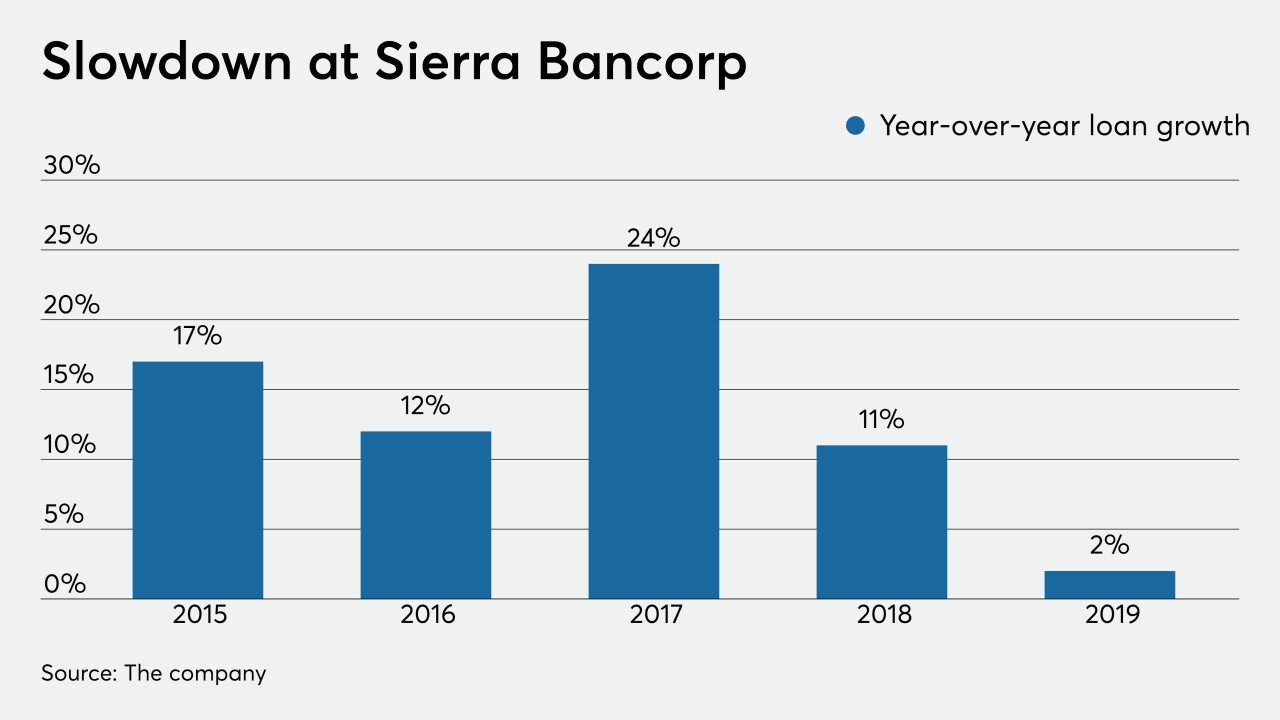

Sierra Bancorp in Porterville has formed dedicated lending teams in Sacramento and Greater Los Angeles in its bid to accelerate loan growth following a sluggish 2019.

February 7