-

Long after the pandemic is finally behind us, the many security and financial benefits owners, management companies and fans alike receive from having the technology in place will remain too invaluable to ignore, says Corsight's Rob Watts.

April 23Corsight -

Affirm's deal to buy Returnly emphasizes the need to simplify the process when a point-of-sale lender stands between the consumer and merchant.

April 23 -

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The company promoted Bob Fehlman to become its president and hired Jay Brogdon from Stephens Inc. to succeed Fehlman as chief financial officer.

April 22 -

Ken Meyer, who will speak at American Banker's Digital Banking AI & Automation conference next week, says banks should be able to quickly catch up with big technology companies and financial services upstarts in the adoption of artificial intelligence without alienating customers or running afoul of regulators.

April 22 -

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

The Portland, Ore., company has a simple growth plan: convert more Paycheck Protection Program borrowers into long-term customers.

April 22 -

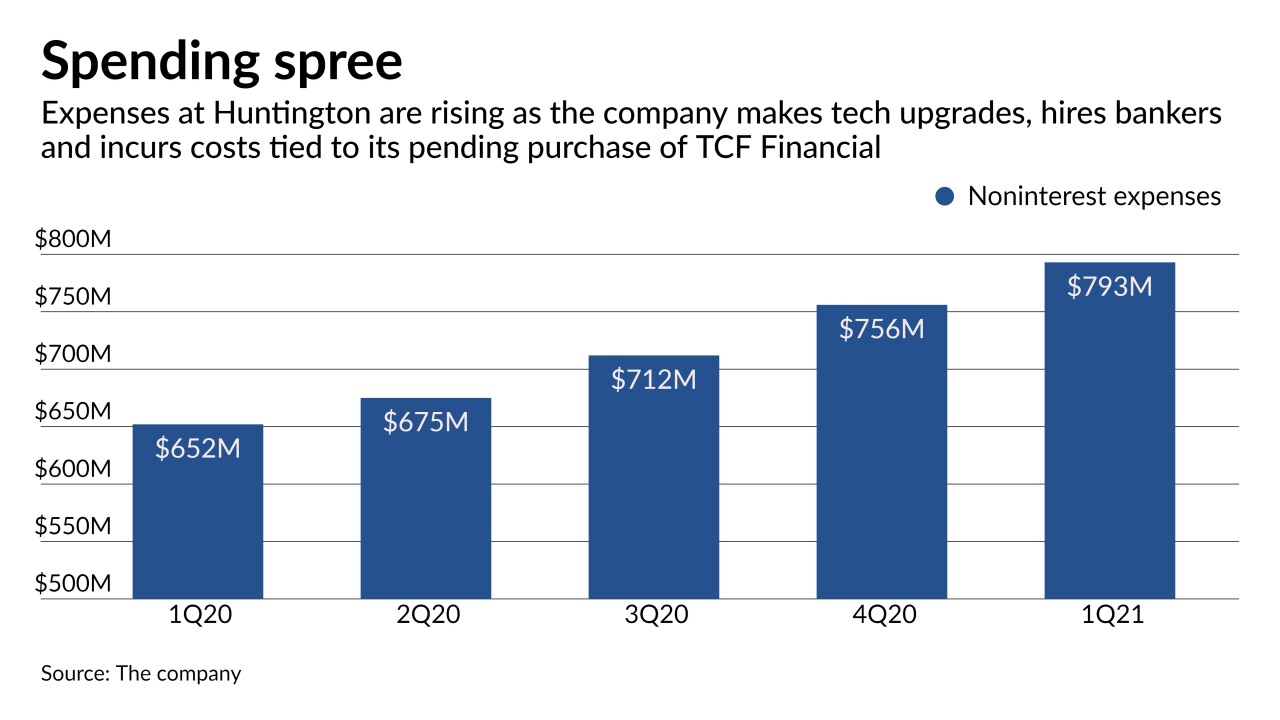

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

April 22 -

Amazon.com is poised to bring its automated checkout technology to full-size supermarkets, a significant milestone in the race to revolutionize how people buy their groceries.

April 22