-

The revised statute provides clarity on director travel, supervisory committees, conservatorship and more.

May 30 -

The industry is so worried that a proposed FCC rule could hamper communications with members that some trade groups are seeking help from an unlikely ally -- the Consumer Financial Protection Bureau.

May 30 -

Secretary of Housing and Urban Development Ben Carson appeared not to recognize a commonly known real estate term during a congressional hearing on Tuesday.

May 21 -

Although higher corporate debt could hurt the economy, Federal Reserve Chair Jerome Powell argued changes made since the last crisis will guard against a meltdown.

May 20 -

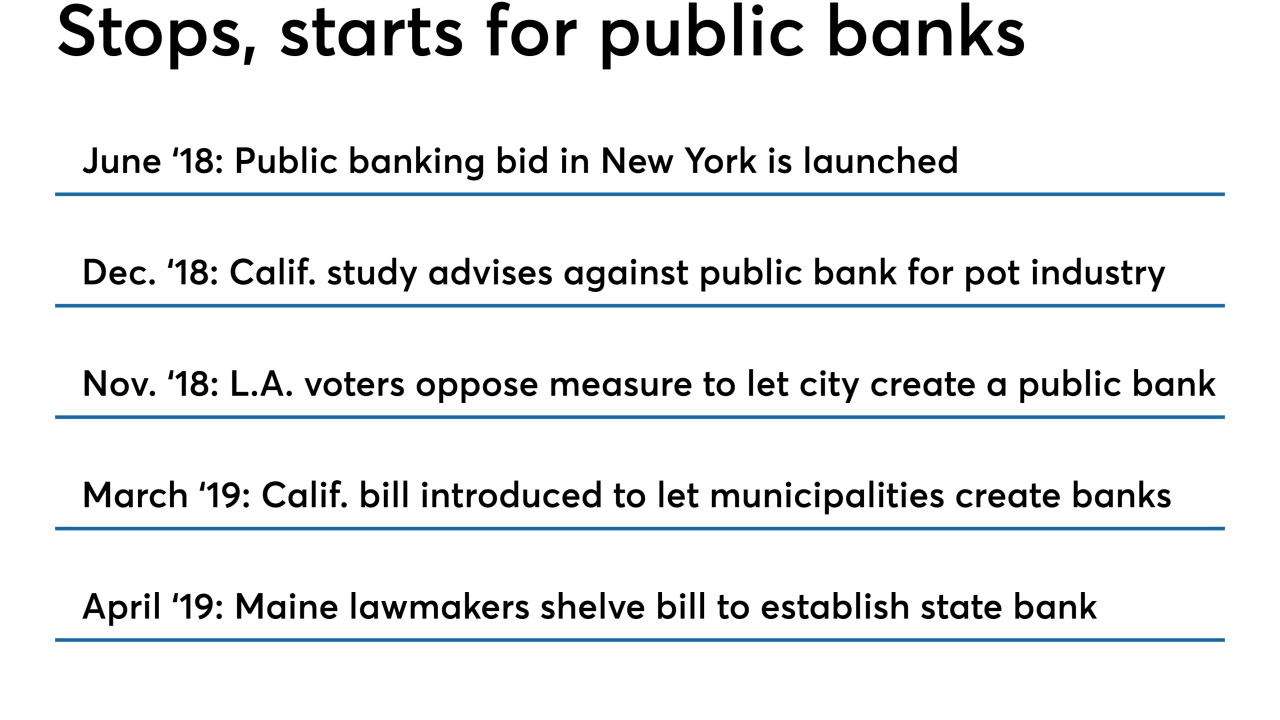

Undeterred by setbacks in other cities, a broad coalition of community groups is seizing on popular mistrust of traditional banks to press the case for a city-owned bank.

May 17 -

National Credit Union Administration Chairman Rodney Hood’s testimony Thursday was reportedly the first time in three years the agency has appeared before the House Financial Services Committee.

May 16 -

At a Senate Banking hearing focusing primarily on predatory lending practices, NCUA Chairman Rodney Hood offered insight into the agency's priorities under his leadership.

May 15 -

The legislation from Sen. Bernie Sanders and Rep. Alexandria Ocasio-Cortez is part of an effort to shift the range of what is thinkable in Washington to the left. It may also serve to highlight the vulnerabilities of Democrats with bank-friendly records.

May 13 American Banker

American Banker -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

Sens. Mike Crapo and Sherrod Brown are asking Facebook about its consumer financial data collection practices as they consider data privacy legislation.

May 10 -

A sharp disagreement between foreign and U.S. regulators is emerging on how far banking supervisors should go in asking financial institutions to stress test their loan and investment portfolios for any risks associated with climate change.

May 8 -

Lawmakers from both parties oppose a Small Business Administration proposal to raise guarantee fees. The clash could lead to a halt in operations this fall.

May 7 -

A proposal to give the Consumer Financial Protection Bureau jurisdiction over credit unions with $10 billion or more of assets has sparked a war of words between the longtime foes.

May 7 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

Sen. Sherrod Brown questioned Stephen Moore's ability to make decisions at the Fed to benefit all Americans after calling two Ohio cities the "armpit of America."

April 24 -

Sen. Sherrod Brown questioned Stephen Moore's ability to make decisions at the Fed to benefit all Americans after calling two Ohio cities the "armpit of America."

April 24 -

While NCUA lawyers fielded questions about the possibility of redlining, a three-judge appeals panel showed skepticism about other elements of the ABA's arguments against changes to credit union membership rules.

April 16 -

Credit unions in the Lone Star State have been working with lawmakers on a series of bills but the clock is ticking since the legislative session ends in May and won't restart until 2021.

April 16 -

A federal court this week will hear arguments in NCUA's appeal of a a judge's split decision on its 2016 field of membership rule while the new NCUA board meets later in the week.

April 15 -

From new legislation to mergers and more, here's a look at measures from across the country that could change how credit unions do business.

April 12